Hi everyone – as I normally do each month, this is my eToro review for June. I

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

For the latest competition results – check it out here

Goal comparison

- Copiers = 27 (-4 Copiers YTD)

- Followers = 7.3% increase YTD

- Portfolio growth = 20.98% increase YTD

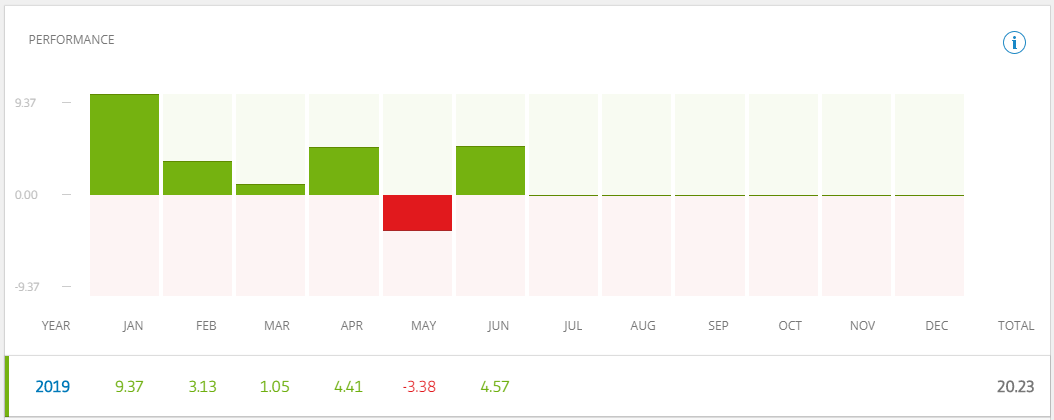

- S&P comparison = beat for YTD (20.23% vs 17.35% source: investing.com)

- Realised Profit = 0.06%

- AUM = 94% increase

- April Risk Level = 4 average (4 Max)

- Monthly updates = Complete

Looks like I’m hitting my goals in every category except for copiers. Our portfolio growth is still growing and beating the SP500. This is a great benchmark for portfolio success.

eToro Review – June Portfolio

My eToro portfolio had some highs and lows in June. Partly from the tariff wars, others were hit by poor earnings. I’ve begun focussing my stocks on strong US stocks that will provide great profits over the coming months/years. Below is a snapshot of what stocks I’ve opened and haven’t closed yet in 2019.

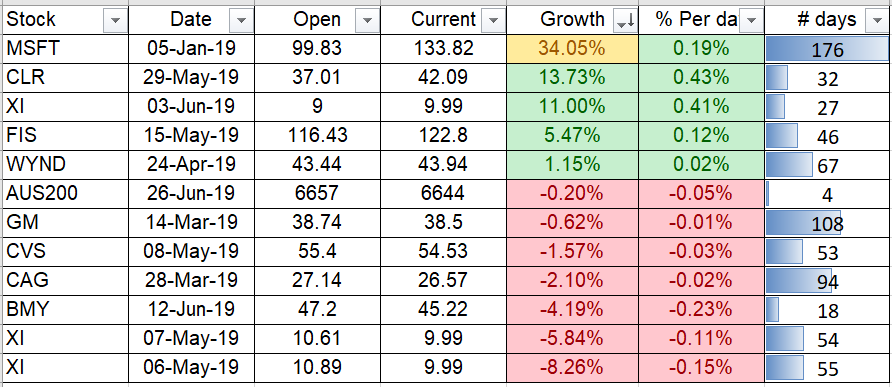

Current 2019 Open eToro stock positions

As you can see, there is some red and some green. Fortunately, a lot of the red traders are within 5% tolerance since being bought so there is not too much to worry about.

$MSFT is still out in the lead. There are still some very promising stocks within this portfolio, just itching to break out!

Portfolio Growth and dates

- 5% – Achieved January 8, 2019

- 10% – Achieved February 6, 2019

- 15% – Achieved March 22, 2019

- 20% – Achieved May 17, 2019

- 25% – Coming soon!

- 30% – Coming soon!

The 30% Sunshine Club

These stocks are laying on the beach in the sunshine. Since being bought, they have climbed to 30% or more, in profit. Hopefully, we’ll add more in the coming months.

- Microsoft – 34.05%

Closed Stocks in the Sunshine Club

None for the moment!

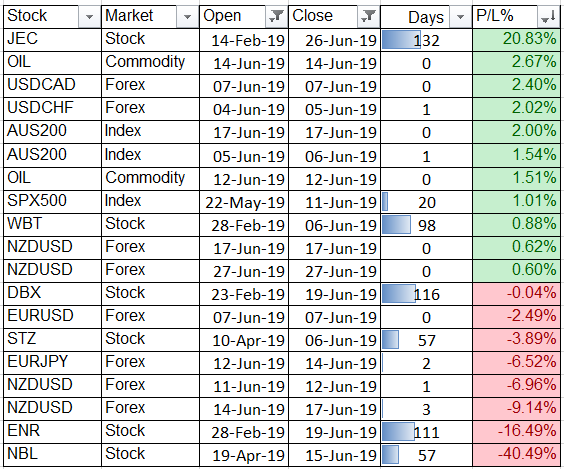

eToro June Review Closed positions

I have taken a different reporting approach for my 2019 closed positions. I realised, if I’m only showing stocks I’ve open in 2019, then I should only be reporting on those same stocks which I have closed in 2019. Each stock has been bought and sold in 2019 only.

June was an ok month – we rebalanced our portfolio and removed some dead weight. With stocks that are loosing I always ask myself the same question – would i reinvest in the stock right now? If i would, i leave it. If i wouldn’t, i’d close it and move on to the next.

Below are the different markets that I closed during June 2019, sorted by % Profit/loss

As you can see, I closed out my $PVH holdings with a decent profit. A good result considering that lost about 15% a week or two after due to the Tariff War with China and a poor earnings report. Positive territory for my eToro May Review.

New Stocks added to my eToro portfolio

With analysis help from @Tipranks for my eToro June Review.

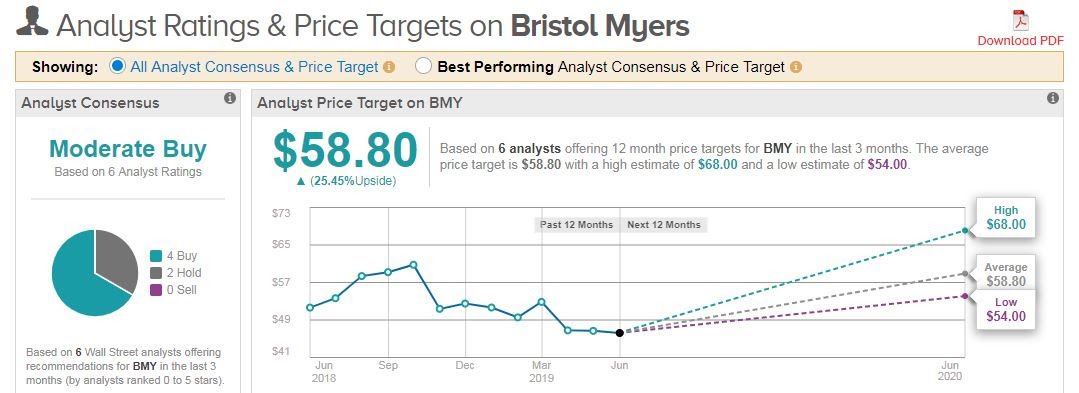

Bristol Myers (BMY)

Only one new stock to add this month – Bristol Myers.

Back in January, the company announced it was buying Celgene (CELG) for $90 billion, to bolster its long-term growth plans.

Celgene’s top drug is cancer treatment Revlimid. Investors approved the deal in April and the purchase is expected to add 40% to Bristol’s earnings in the first year. Further down the road, management is targeting $2.5 billion of annual cost synergies from the combination.

But what the company is really looking to acquire is potential future growth through Celgene’s clinical pipeline. The acquisition adds 5 new late-stage clinical products to Bristol’s pipeline and more than 20 other products in Phase 1 or 2 studies. Management believes these new products could drive growth throughout the better part of the next decade.

Quarterly Results

In the meantime, the underlying business has solid momentum of its own. Back in April, Bristol posted quarterly results that exceeded expectations. The company earned $1.10 a share in the first quarter, as revenue increased 14% from the previous year, to $5.92 billion.

The stock is currently valued at just 11x expected full-year earnings of $4.19 a share, which is a discount to the broader market and the average sector valuation of 13.8x.

Analysts and Hedge Funds Taking Notice

The analyst community is starting to take notice of the potential value that the combination between Bristol and Celgene could create. Goldman Sachs initiated coverage of the shares with a Buy rating on May 28. That came with a $54 price target (15% upside potential). The firm’s Terence Flynn says equity trades at a “significant discount” to peers noting NTM P/E compressed to 10.5 (from 12.8x) after Celgene purchase. He also expects Opdivo CM227 front-line lung cancer trial to yield positive data in the summer of 2019.

Earlier in the month, Barclays raised its rating on the stock from Equal-weight to Overweight, with analyst Geoff Meacham citing: “We are more bullish on Bristol shares given our increased confidence in the Celgene deal successfully closing (following the favorable shareholder vote last month). While we recognize the controversies surrounding the proposed deal (e.g. Revlimid erosion in 2023), we think the combined company looks attractive at current levels given the increased optionality from the Celgene pipeline and more importantly the differentiated growth profile/ earnings power in the next 2-3 years.”

In total, 4 of 6 active analysts rate Bristol and Buy and the average price target of $58.80 a share represents 25% upside potential from current levels.

Hedge funds Baupost Group and Elliott Management both announced new $100 million-plus positions in the stock. In addition, Bridgewater Associates added 78% to its stake.

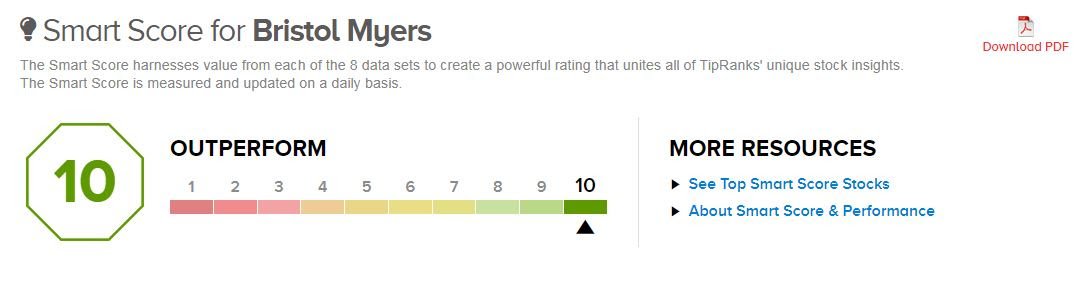

It’s also worth noting that the stock has a Smart Score of 10/10 on TipRanks. This new proprietary metric utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

In addition to the positive aspects mentioned already, Smart Score says the company has seen insider buying, as well as positive sentiment from financial bloggers and ‘Very Bullish’ recent news sentiment. For example, one recent article highlights BMY as a ‘great dividend stock right now.’ Currently paying a dividend of $0.41 per share, the company has a dividend yield of 3.5%.

Final thoughts on my eToro June Review

June 2019 saw a rebalancing of my portfolio, closing off some losing trades and bolstering my available equity to utilise in the coming months. Looking ahead, the easing trader war should benefit our portfolio and lead to some great growth in selected stocks – particularly Xiaomi, Ali Baba and Skyworks.

Remember to Stock Up with Joe

If you’re looking for people to copy, why not check out my latest list of people to keep an eye on in July 2019. If you need to figure out your investing technique, check out these books.

Thank you for taking the time to read my eToro June review.

Good article and straight to the point. I don’t know if this is really the best place to ask but do you folks have any ideea where to employ some professional writers? Thanks in advance 🙂