Hi everyone – as I normally do for each month, this is my eToro review for November. I

** If you don’t have an eToro account – you can set one up ! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Goal comparison

- Copiers = 24 (-8 Copiers YTD)

- Followers = 1791 = 10.6% increase YTD

- Portfolio growth = 25.55% increase YTD

- S&P comparison = beat for YTD (25.55% vs 25.30% source: investing.com)

- Realised Profit = 1.53%

- AUM = $45,010 assets under management = 96% increase

- Risk Level = 4 average (4 Max)

- Monthly updates = Complete

Looks like I’m hitting my goals overall, with the exception of Copiers. I am not worried about the decrease in copiers as the number of copiers shouldn’t dictate how I trade. Also, my Assets Under Management (AUM) has continued to grow, showing that the traders that are copying me, have increased their copying amount. We are beating to the SP500 benchmark, which is a good sign. As our portfolio doesn’t copy the SP500 (my portfolio includes trades in indices, forex, cryptocurrencies, foreign exchanges et cetera), it was going to be a challenge to continue beating this benchmark.

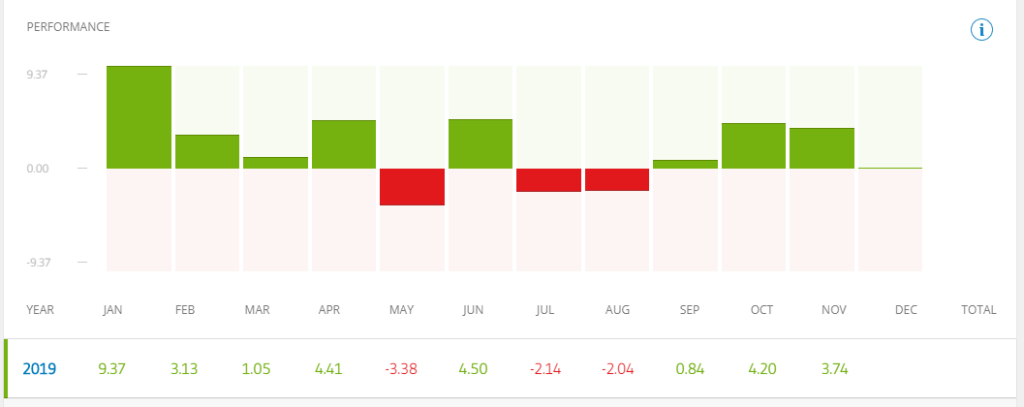

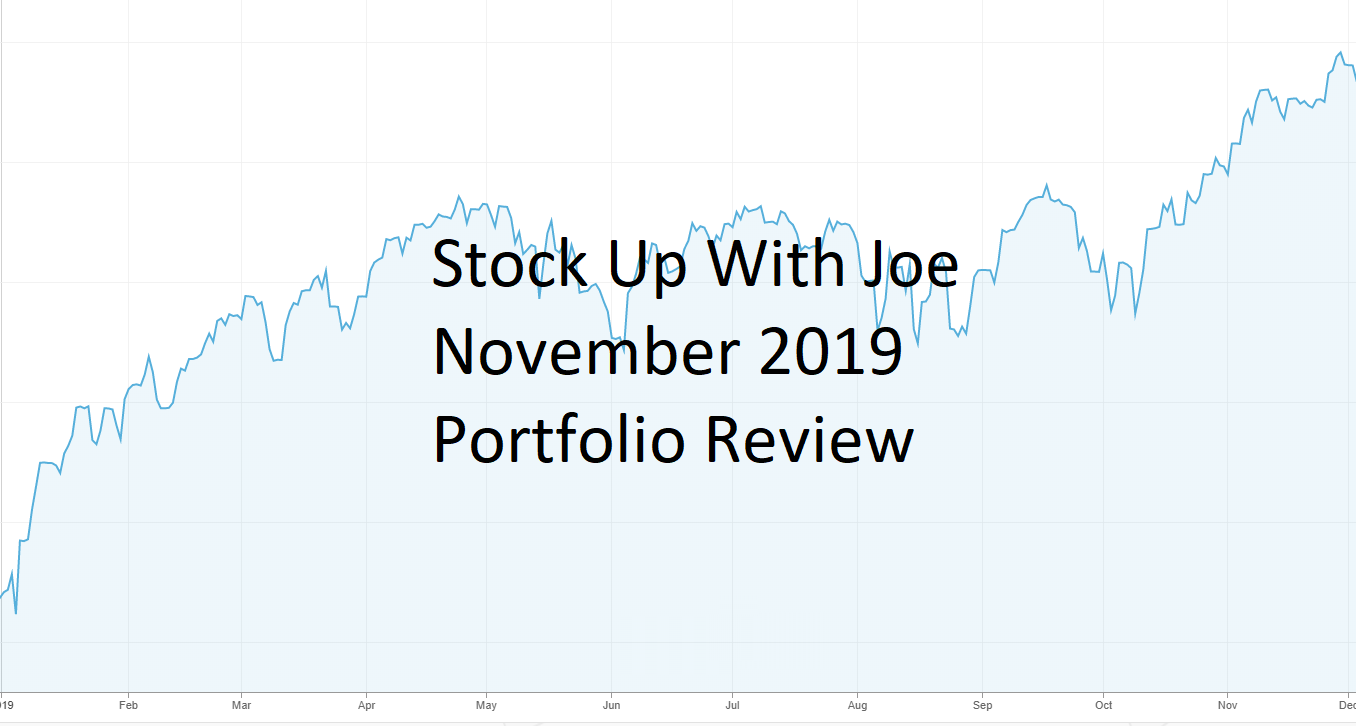

eToro Review – November Portfolio

My eToro portfolio has had a good month in November – with my overall portfolio growing by 3.74% – translating to approximately 25.55% year to date.

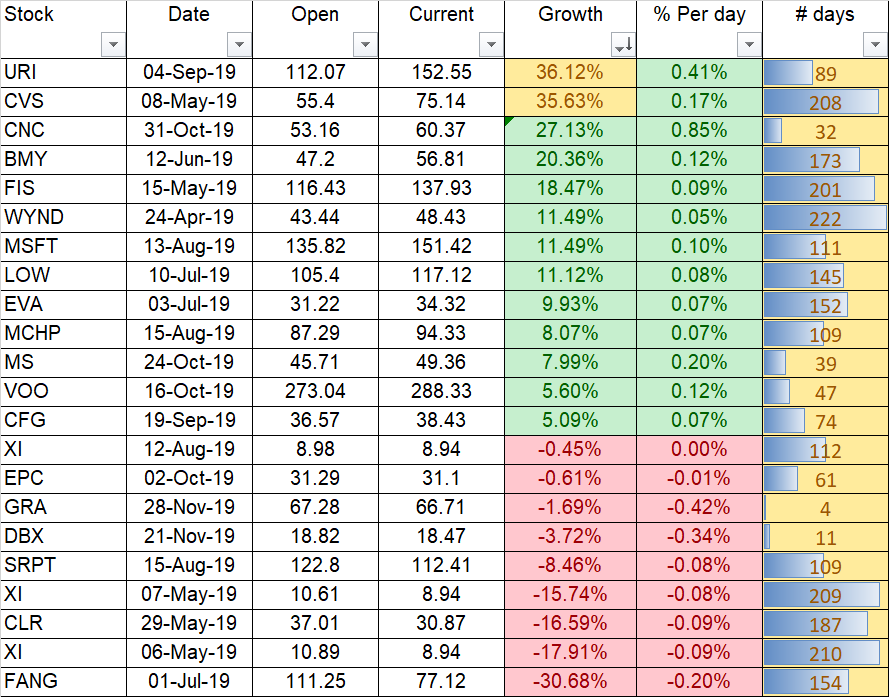

My stock choices for the year have started to come into their own and hopefully continue to provide some great growth over the coming months and years. Below is a snapshot of what stocks I’ve opened and haven’t closed yet in 2019.

Current 2019 Open eToro stock positions

As you can see, there is some red and some green. Fortunately, we’ve closed a lot of positive trades so the sea of red wasn’t as visually significant.

URI and CVS are crushing it at the moment, with over 35% growth since buying them.

Portfolio Growth and dates

- 5% – Achieved January 8, 2019

- 10% – Achieved February 6, 2019

- 15% – Achieved March 22, 2019

- 20% – Achieved May 17, 2019

- 25% – Achieved November 10, 2019

- 30% – Coming soon!

The Above and Beyond Club

These stocks are going above and beyond – crushing their returns and setting up our portfolio nicely. Aligning with the etoro Club tiers, we have

- Bronze: 20 – 24.99%

- Silver: 25 – 29.99%

- Gold: 30 – 34.99%

- Platinum: 35 – 39.99%

- Diamond: over 40%

Our current open positions include

Platinum

URI 36.12%

CVS = 35.63%

Silver

CNC = 27.13%

Bronze

BMY = 20.36%

Closed Stocks in the Above and Beyond Club

We’ve been fortunate to have a couple of stocks in 2019 closed in significant profit

$MSFT = 35.77% (Platinum)

$PVH = 25.92% (Silver)

$JEC= 20.83% (Bronze)

Let’s hope we add a few more over the coming months!

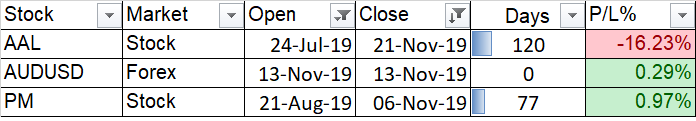

eToro November 2019 Review Closed positions

I have taken a different reporting approach for my 2019 closed positions. I realised, if I’m only showing stocks I’ve open in 2019, then I should only be reporting on those same stocks which I have closed in 2019. Each stock has been bought and sold in 2019 only.

November was a slow month, with stocks growing significantly. I didn’t close many trades – only 3 overall. AAL started to perform badly so I took my losses and moved on to the next stock. I removed PM as more of an ethical decision – although they were primed as a great growth stock and giving a nice return, I couldn’t continue with them. As always, I’ll look at rebalancing our portfolio and removing some dead weight. With stocks that are loosing I always ask myself the same question – would I reinvest in the stock right now? If I would, I leave it. If I wouldn’t, I’d close it and move on to the next.

Below are the different markets that I closed during November, sorted by % Profit/loss

New Stocks added to my eToro portfolio

Below are the latest stocks added to our portfolio

$GRA – Grace

$DBX – Dropbox

Hopefully, these stocks provide a great return for months to come!

Final thoughts on my eToro November 2019 Review

November saw a low trading month but excellent in portfolio growth. Looking ahead, the easing trader war and Brexit could really swing some of our trades but should benefit our portfolio and lead to some great growth in selected stocks – particularly Xiaomi and Lloyds.

Remember to Stock Up with Joe

If you’re looking for people to copy, why not check out my latest list of people from my Top Copy Traders Competition. If you need to figure out your investing technique, check out these books.

Thank you for taking the time to read my eToro review.

Disclaimer: Please note that some of the above links are affiliate links. They don’t cost you anything but I may receive an incentive if you click on it.

Please note that none of the above is financial advice. I have not taken into consideration any of your financial situation(s). Please do your own research when looking at the stock market and seek a licensed professional’s advice before committing.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

he blog was how do i say it… relevant, finally something that helped me. Thanks