Goal comparison

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Hi everyone – as I normally do each month,

- Copiers = 29 (-2 Copiers)

- Followers = 3.1% increase YTD

- Portfolio growth = 12.79% increase YTD

- S&P comparison = beat for YTD (13.98% vs 13.07% source: investing.com)

- Realised profit = -0.17% (small loss but still a loss)

- AUM = 80% increase – this is massive! One or more of my copiers decided that March was the time to invest and increased my AUM by 80%! THat is a significant increase.

- Risk = 4 (5 last month)

- Monthly updates = Complete

So my aim of keeping to my etoro trading goals is looking on track, particularly my Portfolio growth. I have a few stocks in positive territory that I can take some profits when the timing is right – this means we should start to see a more positive realised profit number over the coming months.

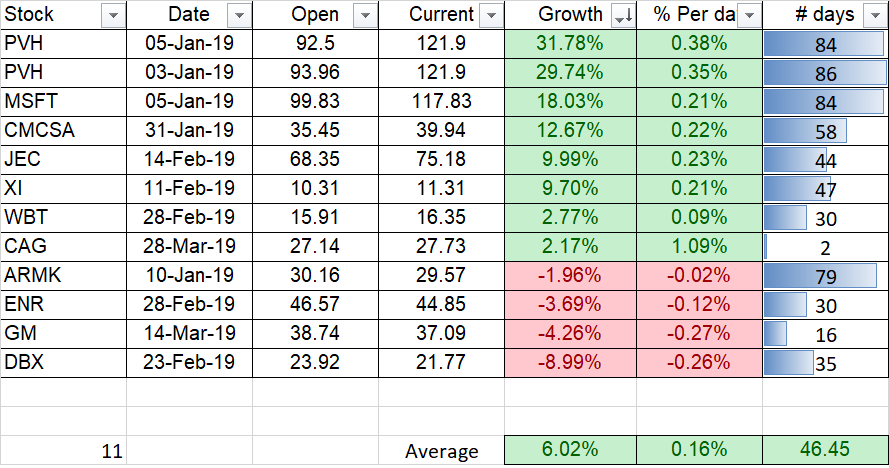

Portfolio overview

Overall, my eToro portfolio has had a great start to the year. The new positions I’ve opened this year have had a great start. As mentioned in the previous month, I’ve begun focussing my stocks on strong US stocks that will provide great profits over the coming months/years. Below is a snapshot of what stocks I’ve opened and haven’t closed yet in 2019.

Open eToro stock positions

As you can see, $PVH had a fantastic month thanks to a stellar earnings report. This allowed it to jump 15% in one day! I have set a nice S/L on these holdings so we’ll take some profit at the right time. $MSFT is once again chugging along nicely, climbing over the 18% profit margin –

$DBX is getting close to being taken out of the eToro portfolio – if it hits -10% then

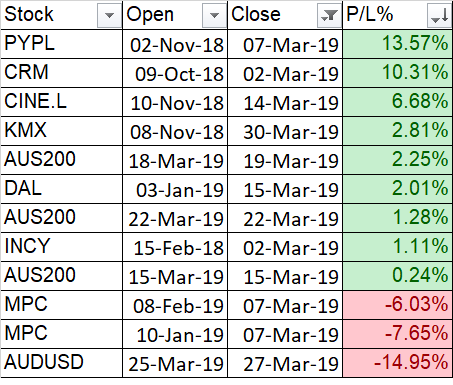

Closed eToro –positions

March has been a mixed bag of closed positions. Some really strong positive territories and a bad forex venture. I decided to go back to the eToro virtual account for my forex training and fine tune what I’ve learned. This will allow me to take small profits consistently, adding up over the course of a year to help boost our realised profit.

New Stocks in my eToro portfolio

With analysis help from @Tipranks

$CAG – Conagra Brands

Even if you aren’t too familiar with Conagra Brands, chances are you know its products. Here I screenshotted some of its most popular brands, including Pam oil cooking spray and Birds Eye vegetables:

Conagra combines solid execution in expandable categories (i.e. frozen food and global snacking) with a compelling valuation. Even accounting for the recent rally, the stock is still down 25% on a six-month basis. That’s due to unexpectedly sluggish growth over at Pinnacle Foods, CAG’s new $8 billion acquisition- which sent shares plunging in December. After an ‘intense diagnostic,’ the company concluded that Pinnacle’s underperformance was ‘clearly

Heading forward

Although these efforts will take a while to pay off, the company is moving in the right direction. In fact, shares spiked 18% on the company’s recent earnings report for Q3 of fiscal year 2019 thanks to Pinnacle progress and the strong performance of Conagra’s legacy businesses. According to the report, net sales grew 35.7%, driven primarily by the Pinnacle Foods acquisition. Meanwhile CAG realized approx. $12 million of cost synergies in the quarter (and reaffirmed its $215 million cost synergy target).

As CEO Sean Connolly stated, “The integration of Pinnacle Foods, and the reinvigoration of its innovation pipeline, remain squarely on-track. We are aggressively applying our proven ‘Conagra Way’ to address the executional challenges in the Birds Eye, Duncan Hines and Wish-Bone businesses. While it will take some time to return these Pinnacle businesses to growth, we are confident that we have identified the issues and have the right action plans in place to improve the performance of these terrific brands.”

Looking forward, further updates can be expected at the upcoming Investor Day on April 10- a potential positive catalyst for share prices.

What about the analysts?

Post-report multiple analysts chimed in with buy ratings on CAG while boosting their price targets. Here we have JP Morgan, Jefferies, Merrill Lynch and Goldman Sachs all reiterating their support for the stock within the last week.

As a result, this ‘Strong Buy’ stock still has plenty of

Crucially, Jagdale expects CAG to recover all of the near-term shortfall in sales through better execution, innovation & synergy capture. He explains the initial deterioration in Pinnacle performance as execution issues driven by sale process distractions- which I believe is a reassuring sign that there aren’t deeper fundamental problems at play. And in a promising sign, the analyst even sees cost synergies capable of beating initial guidance- again driving share prices higher.

“Management expects Pinnacle Foods results to stabilize by 2H20 driven by a pick-up in innovation and improving distribution trends. Meanwhile legacy CAG continues to perform solidly and is gaining momentum” writes the analyst.

Insider sentiment shifts

Notably, insider sentiment on CAG has done a 180 over the last few months. After a spate of insider selling, all the most recent insider transactions are now buying- another bullish signal for the stock. Most recently, director Richard Lenny (also a director of McDonald’s) supplemented his existing $1.4 million holding with a further $80,000 stock splurge. In fact, multiple TipRanks indicators skew positive on CAG. Check out the following: a Bullish blogger opinion; Strong Positive news sentiment; and Very Positive hedge fund activity.

$GM – General Motors

I highly recommend taking a closer look at General Motors. Why? Well, first off we have a cheap stock which comes with a hefty dividend attached. We are looking at a lucrative yield of 3.94% (which translates into an annualized $1.52 payout, paid quarterly).

Yet GM is still only trading at 7 times trailing earnings, and when you incorporate near-term expectations for modest bottom-line growth, GM’s forward multiple comes in at just 6. That’s despite a stellar earnings report, forecasting continued profit growth in 2019.

Confidence in downside protection

GM has previously struggled during times of economic slowdown. But the company is now much more streamlined and flexible, which should keep earnings and cash flows positive even if the going gets tough.

“While we aren’t forecasting a downturn, we have solid confidence that GM could hold up in a downturn” says RBC Capital’s Joseph Spak. Company commentary is that profit would be $6– 8bn lower in a 25% US downturn.

In the words of GM CEO Mary Barra (on the last earnings call): “We expect to improve 2019 earnings and cash flow as we move into the next phase of our transformation, linear, more agile and better position to win. Our favorable outlook is based on a continued robust mix of new products around the globe continue cost efficiency and our business transformation initiatives. We believe that we will continue to be macro uncertainty but we expect to manage through them based on current market conditions.”

Strong autonomous tech

General Motor’s self-driving subsidiary, Cruise received a whopping $2.25 billion investment from Japan’s SoftBank fund last year, followed by $2.75 billion from Honda. While it remains to be seen whether GM can win on the robo-taxi opportunity, the crucial point right now is that it has a seat at the table. As Barra said about Cruise: “GM Cruise is deeply resourced to succeed with more than 1,100 employees and 5 billion raise in external capital from Softbank and Honda in 2018.”

Overall Street consensus: 100% buy

Net-net, RBC’s Spak has a buy rating on GM with a $52 price target (up from $50 previously). That indicates 35% upside potential from current levels. He believes that the market continues to underappreciate GM’s ongoing transformation, which should lead to a ~$4.5bn savings run-rate in 2020. Simply put, Spak sees this restructuring as worth about ~$2.50 in EPS.

In fact, all 7 best-performing analysts rate GM stock a ‘buy’ right now. So no hold or sell ratings here 😊 Indeed, Citi analyst Itay Michaeli just raised his GM price target to a Street-high $67. He says GM’s “unique fundamental position” and the path to his prior $76-$134 per share long-term upside potential case “have probably never been as visible as they are today.”

Following the Smart Money

GM is a classic Warren Buffett stock pick. Buffett displayed a very bullish sentiment on the auto stock in Q4. In fact GM was one of the few stocks that his Berkshire fund ramped up- making it the fund’s second biggest stock increase by percentage change (after JP Morgan). And following this 37% increase, Berkshire now owns over 72 million General Motors shares, worth around $2.4 billion. Given his stock picking track record, I feel happy to follow the Oracle of Omaha’s lead when it comes to GM stock.

***

Overall, March 2019 has been a decent month for my eToro portfolio – a great month for stocks and focusing on the rest of 2019. We’re beating or on par for most of my 2019 eToro goals so I’ll be keeping a close eye on the remaining months.

Remember to Stock Up with Joe

Also, if you like the stats above, check out Simply Wall St – they provide some great analysis into thousands of stocks.

Other great articles to read are

Real wonderful information can be found on site.

You are my intake, I own few blogs and rarely run out from to post .