At the start of 2019, I wrote down my trading goals for the year. I will now see how I am progressing against these goals in my eToro February review.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Goal comparison

- Copiers = 31 (-1 Copier)

- Followers = 1.1% increase YTD

- Portfolio growth = 12.79% increase YTD

- S&P comparison = beat for YTD (12.79% vs 11.50% source: investing.com)

- Realised profit = -0.07% (small loss but still a loss)

- AUM = 13% increase (this is important as it more money is coming in with the same amount of copiers)

- Risk = 5

- Monthly updates = Jan – Feb 2019 complete

So my aim of keeping to my trading goals is looking on track, particularly my Portfolio growth.

Portfolio overview

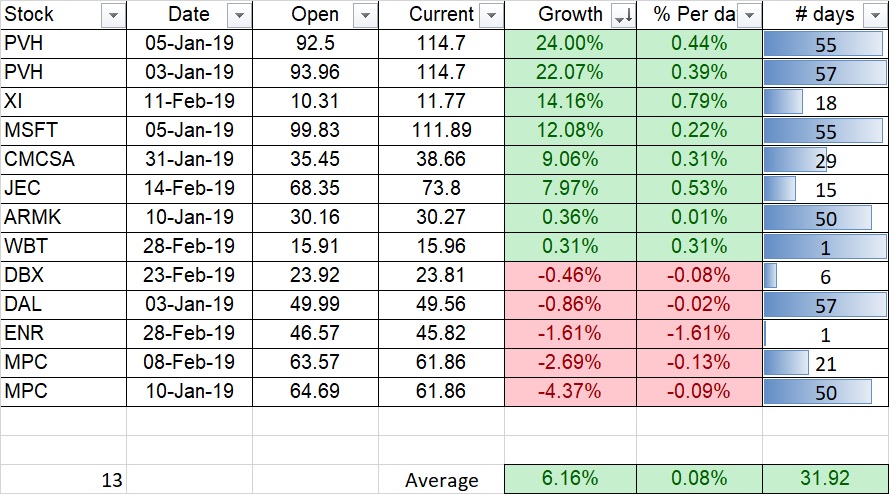

Overall, my portfolio has had a great start to the year. The new positions I’ve opened this year have had a great start. As mentioned in the previous month, I’ve begun focussing my stocks on strong US stocks that will provide great profits over the coming months/years. Below is a snapshot of what stocks I’ve opened and haven’t closed yet in 2019.

As you can see, $PVH and $XI are the standout performers. One of my consistent performers has been $MSFT and would highly recommend this to anyone long term. $MPC is a fairly new addition so I still have high hopes for this stock in the long run.

I have As you can see, these stocks have had a very strong start to 2019 – particularly $PVH. Hopefully, my change in trading strategy continues to produce great results over the next 10 months.

eToro February Review – New Stocks

With analysis help from @Tipranks

$XI – Xiaomi

Why I like $XI as a short-medium hold stock – $XI is an exciting stock to keep an eye on. I think that when it initially went live on the stock market, there was a lot of excitement and that drove the price up too quickly too soon.

I found a nice entry price around the 10.31 mark and bought into the stock. What finally made me purchase the stock was when I bought my first $XI product – a robot vacuum. I like the breadth and depth of products they have and they’re damn good at what they produce. They are massive in Asia and they are fast becoming one of the bigger phone companies in Europe. Their intrinsic value based on current share prices vs future cash flow still has an estimated 38% growth (current stock value to approx. 19.5 stock price).

Keep an eye on future earnings

It is expected that they will have shaken off their debt and really start to accumulate some revenue over the coming years – at nearly 15% yearly for the next few years. This is evident by the spread of the products and how they’ve become a household name in the world full of $SAMSUNG and $AAPL.

Their historical debt has flipped in 2018, so expect big things in 2019 and beyond. Another thing is that they don’t overproduce and oversupply their products. They have a relatively low level of unsold assets and they seem to have a sufficient cash runaway stored to cover themselves for more than 3 years based on their current cash flow.

I think there is a great opportunity to buy $XI whilst it’s still under $15. I expect I’ll hold around the $20 mark then set a tight SL.

$JEC – Jacobs Engineering

One of the most important themes coming out of the President’s recent State of the Union address was the need to improve the nation’s infrastructure. This is an area of spending with bi-partisan support given clear signs of the need for investment in better roads, bridges, airports, energy grid, telecom and more. This is where JEC comes in.

JEC had a strong earnings report earlier this month showing that the trends for the group are quite favourable. Not only did they beat estimates, but they also raised guidance for the future. The reason that was possible was an 8% increase in their already impressive backlog of projects. In the construction industry, this backlog of business is the key to understanding future growth given that many of these contracts are multi-year projects. The healthier that backlog looks…the more likely they are to produce attractive profits going forward.

Analysts were certainly pleased with a fresh round of Buy ratings with an average target price of $80.75. But if we only focus on the Best Analysts covering JEC we see an even healthier $85.50 average target.

The most intriguing though is that both Insiders and Hedge Funds are moving in their direction. This smart money flow is quite encouraging that ample upside lays ahead for these shares. So it makes sense to construct some of these shares into our portfolio.

$ENR – Energizer Holdings

The market has bounced mightily from the Christmas Eve low. Now we are only about 5% away from the all-time highs. The reason we point this out is to say that many of the great values have evaporated. If you look hard enough, you can still find them in companies like $ENR, which is still 27% away from its fair target price.

But value is not the only part of this story. This leading battery and consumer brand company has a long history of growth. However, that hit a short-term snag with some currency-related issues. Those are typically temporary problems which is why analysts still expect 16% growth going into next year.

Then what will happen?

So far this is shaping up to be a nice growth and value story. We see there is, even more, to love about these shares as we inspect them from the Best Individual Investors on @TipRanks have a Positive view. So too do Bloggers. Hedge Fund Managers have not been shy with nearly 1 million fresh shares purchased recently.

The best of these indicators come from insiders. There we see 4 different key insiders making over $1 million in Informative Buys of shares. The more telling of these items is that it is 4 different insiders making this move which tells you that there is a wide-spread belief amongst management that more good times lie ahead.

These shares look charged up and ready to go run higher in the year ahead. Plus they recently caught headlines with a phone that has a 50 DAY BATTERY!!!

$WBT – Wilbilt Inc

In looking at our portfolio, we see a shortage of industrial selections. Finally, one hit the screen that we couldn’t resist in Welbilt. The beauty is that they are not in an overly cyclical industry (like $CAT). Instead, it is the more stable sector of providing equipment to restaurants and industrial kitchens. No matter the economy… people have to eat 😉

The 2 most attractive parts of this story are the @TipRanks indicators of Hedge Fund Managers and Insiders. The former group is pouring money in with an impressive 4 million shares added recently. On top of that, it was reported just a few days ago that 5 different insiders reached into their pockets to add more shares. These are two resounding clues that the smart money sees brighter days ahead.

Analysts are also applauding the firm with a fresh round of reiterated Buys. In fact, the analyst with the best track record following the stock, Jeffrey Hammond of KeyBanc, also has the highest target price at $20, which is ample upside from the current price. His main point is that management guidance may prove quite conservative, which provides a nice upside for shares.

We believe Hammond’s perspective is correct. So let’s follow his lead by spooning a healthy serving of these shares into our portfolio.

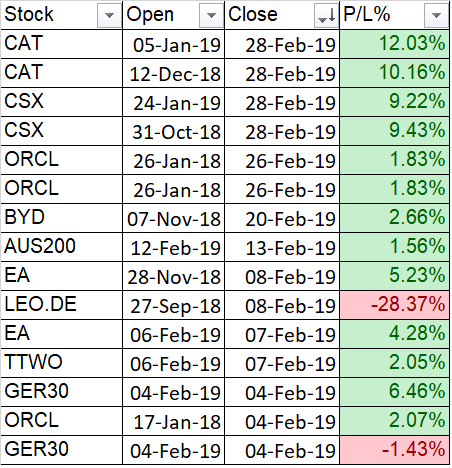

eToro February Review – Closed stocks

$CAT – Caterpillar: Recently, UBS downgraded Caterpillar all the way from Buy to Sell. The reason is that this near 10-year global expansion is showing signs of age with lower growth expected ahead. And yes, likely a recession somewhere in the near distance (1-2 years out). CAT is as cyclical of stock as you can find. Thus, every time there is a whiff of global economic concern, it will take it on the chin thus lowering the odds of success at this stage of the game. It outperformed the market by a nice margin in the 2.5 months we owned shares. Just think best to take our profits off the table and move the money elsewhere.

$CSX – CSX Corp: We held on after their lukewarm earnings report in mid-January. Since then, shares have been impressive outperformers rising over 15%. The problem at this point is that there is barely any upside left on the average target price of $74.64. Thus, the appeal to hold on longer is gone and we should just pack up our profits.

Crypto outlook

The main news in the crypto world is the Ethereum Hard Fork. Below is an update from Coindesk – link here

Two long-anticipated upgrades appear to have officially activated on the ethereum blockchain, the world’s second-largest by market value, without incident.

At 19:57 (UTC), the sixth and seventh system-wide upgrades to the software, dubbed Constantinople and St. Petersburg, respectively, rolled out on the main network at block number 7,280,000. As seen on blockchain monitoring website Fork Monitor, there is so far no evidence of a chain split that would suggest a portion of ethereum users are still running an older ethereum software.

Past hard forks of the ethereum blockchain have encountered such setbacks, most notably in 2016 with ethereum classic, a group that continued running an older software instance when a controversial upgrade was introduced.

What does that mean?

As background, before any system-wide upgrade, or hard fork, miners and node operators are required to install new client software that automatically updates at the exact same block number. This prevents two concurrent and incompatible versions of the same blockchain from splitting the wider network.

With the apparent activation, the St. Petersburg code has also disabled part of the Constantinople code deemed back in January to host security vulnerabilities that could be used by attackers to steal funds.

“With the blockchain, everyone has to upgrade in order for everyone to be able to use [the new] features,” explained Taylor Monahan – CEO of blockchain wallet tool MyCrypto.

“About two weeks before the fork, everyone upgrades the software but none of the new features is enabled,” said Monahan to CoinDesk. “Then, on that block number, everyone at the exact same time starts using the new features. So, that’s how we prevent differing states from existing simultaneously. It’s [also] called a consensus issue or a consensus bug.”

MyCrypto presently runs 10 to 15 computer servers also called nodes all running on the most updated version of the Parity ethereum client.

With today’s release of Constantinople and St. Petersberg, four different ethereum improvement proposals (EIPs) have been officially activated on the ethereum network – one of which does introduce a new “corner case” affecting smart contract immutability.

As of press time, the market price for ether – the main cryptocurrency of the network – has seen a small jump from $135.14 shortly prior to release. It presently sits at $136.99, according to CoinDesk data.

***

Overall, Feb 2019 has been a great month for stocks and focusing on the rest of 2019. We’re beating or on par for most of my 2019 goals so I’ll be keeping a close eye on the remaining months.

Remember to Stock Up with Joe

Also, if you like the stats above, check out Simply Wall St – they provide some great analysis into thousands of stocks.