Alex and Ellie are an Australian couple in their mid-30s who blog at HisHerMoneyGuide.com, and who are looking to retire early on a large passive income (known as ‘FatFIRE’ in the online vernacular).

What particularly interests me about them is that their key investment goal is to retire without drawing down on their investment capital. They’re looking to do that by purely using dividend income, rather than eating into their capital and selling shares. I was interested to hear how that would work, so I’m thrilled Alex was able to provide me with the following guest post.

How we plan to retire early off dividends (mostly)

I recently told someone that I wanted to retire early. I got the usual aren’t you too young to retire? spiel, but they also asked another question that is worth exploring: Won’t you have enough money?

It reminded me realise that a lot of people don’t understand investing, because the alternative is sitting on money in the bank with a 2% return (yes, you would need a lot of money to retire early that way!). While they might understand the concept of passive income (gaining money from minimal to no effort), they really don’t know how to go about it.

The two most common ways are through shares and property. However, only around 9% of Australians have an investment property, while only 31% own shares outside of superannuation (and I dare say a decent chunk of those would be people who receive shares in a company they worked for).

So given that we’re looking to retire early by the age of 45 with a pre-tax passive income of $150,000 a year, it’s likely that if I’d told that person our exact plans, their head would spin.

Given the vast bulk of our passive retirement income – around 70% – will come from dividends (the remainder will mainly be from a pair of investment properties), it’s worth looking into how that will actually work.

Moreover, unlike most people looking to reach FIRE (financial independence, retire early), we’re not aiming to draw down on our retirement savings (ie: sell them). We’re ideally looking to create a self-sustaining income base that could exist in perpetuity … or at least the rest of our lives.

So how will we retire early and effectively live off dividend income from our investments?

Let’s start with the real basics for those who don’t know much or anything about investing, shares and dividends.

As shareholders, we’re actually business owners. As such, we’re entitled to the profits the company makes. These profits get distributed as dividends.

But we don’t own the whole company. Most companies listed on stock exchanges have hundreds of millions, if not billions of shares on their register. So that’s really high dilution. Owning one share in any publicly listed company really isn’t going to set you up for life. If you’re going to have your retirement funded through dividends, you’re going to have to buy a fair few shares.

Take, for example, Commonwealth Bank of Australia (ASX:CBA), which is Australia’s most valuable company – worth some $140 billion. (And we’ll use CBA has an example throughout this article.)

The company has 1.77 billion shares in circulation. Each share in the past year entitled you to a total gross dividend of $6.15. Of that, $4.31 was cash, and $1.84 was pre-paid tax in the form of franking credits. That gives you a total gross yield (or return) of about 7.6% (clearly cash invested in the bank is better than cash in the bank!).

So to get $1,000 of gross dividends in CBA shares per annum, you’re going to need about 162 shares.

Given that CBA shares are currently trading at about $80 (eg: that’s how much it costs to buy one share), that means you need to invest a just under $13,000 to get $1,000 back each year.

If you’re like us and want to get a gross income of $150,000 a year – and if you hypothetically only invested in CBA (which you’d never do because you need diversification!) – you’d need approximately 24,390 CBA shares, worth $1,951,200.

So clearly you need to save and invest a lot of money – over a long time (unless you’re a trust fund baby!) – before you can make a dividend-funded retirement happen – regardless of whether you buy CBA or any other stocks.

For us, this will be a 20-year journey to save and invest enough money to make our investments self-sufficient and to fund our desired lifestyle.

Our investment philosophy

In the near future we’ll make a post on how we’re aiming to structure our investment portfolio in more detail. It’ll go into what types of assets and investments we’re looking to have.

However, for the sake of nice round numbers in this article, we’re looking to have $2 million in various shares, returning about $110,000 gross in dividends – a yield of around 5.5%.

Unlike many others who plan to retire early, we don’t plan to sell any of those shares. Our theory is that our dividends will grow over time and match – if not beat – inflation. Inflation is when the cost of goods and services rises over time.

If the returns from our dividends don’t rise to match inflation, the risk is that our quality of life will be slowly compromised over time. If it happens to beat inflation, we’ll actually net more money over time – but it’s not something we’re counting on.

Our strategy isn’t perfect (there are assumptions like the above), but it’s safer than most. It means we need to work a bit longer in order to have more up-front capital before we hand in our resignation letters and never work again.

Unlike others who aim to draw down on their shares over time, we’re not relying on a level of capital growth in the value of our shares. That’s a plus in our books, even if we need to work a bit longer.

This interesting Reserve Bank of Australia research paper states that capital growth average over the last 100 years has in listed Australian companies has been 2% per annum after inflation. So investors need to be wary of the highs and lows that come with the markets. You need to be willing to play the long game.

On the other hand though, the shares in our portfolio are ‘dividend stocks’, which traditionally suffer from lower capital growth. So it’s a good thing we’re not relying on capital growth, because we’re probably not going to get too much of it.

So instead, our biggest risk in retirement comes from inflation eroding the value of our stocks.

But how big a risk is that?

Inflation: how big a risk is it?

Let’s go back to our CBA stock as an example.

If we look at its dividend history over the last 22 years, we’ll see that its dividend has increased:

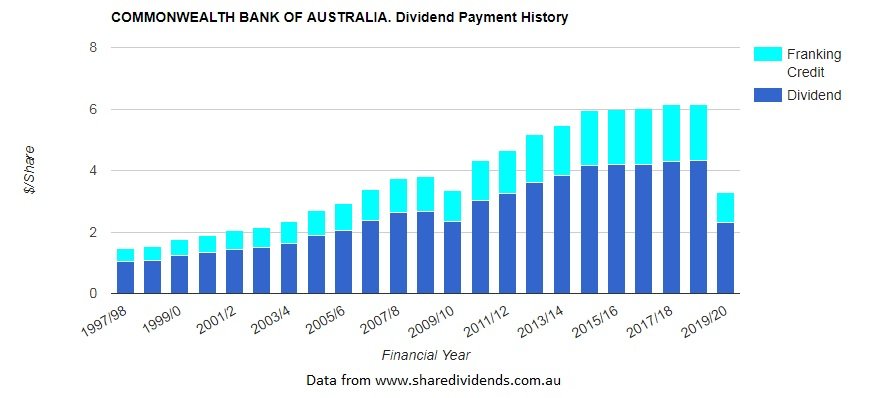

22 years of dividend history for ASX:CBA, via www.sharedividends.com.au

It has increased from $1.47 in 1997/98 to $6.15 in 2018/19. That’s a rise of 418.5% – or 19.0% per annum, which is extraordinary.

However, the old maxim of “past performance is no guarantee of future returns” plays true here. It has stayed almost flat the last two years, and only gone up by 2.6% in the last four full financial years, or 0.65% per annum.

If it had maintained its meteoric rise, it would probably now be grossing around $8 per share per year, but that’s not how life works.

Thankfully, while we do hold CBA shares – and are generally heavy in bank stocks – we’re diversifying away from them into other stocks that have solid dividend histories – and dividend histories that have increased over time.

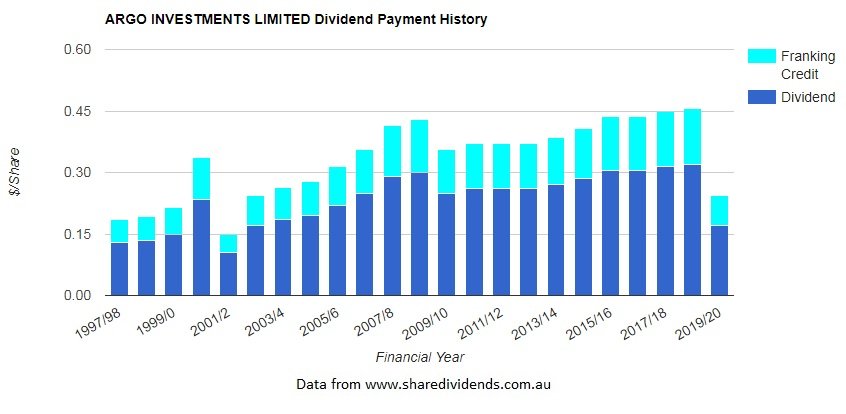

Here’s another example:

For instance, this Listed Investment Company has increased its dividend from $0.18 in 1997/98 to $0.45 in 2018/19. Compared to CBA, that’s a less extraordinary rise of 250% over 22 years – but it’s still an increase of 11.3% per annum. Over the last four full financial years it’s gone up 2.4%, which is just about bang on average for inflation in Australia over the last decade.

What this shows is that it certainly is possible for dividends match inflation. And it also shows that you shouldn’t put all of your eggs in one basket either – you need diversification in your investments.

Flexibility if we need it

We’re currently living in strange times, and the share market is behaving in odd ways. What does the future hold?

Will we see a decoupling of dividend payouts and company profits like the United States saw in the 1990s? Currently Australian companies tend to have high payout ratios (eg: dividend distributions), but what if that changed?

Well, the presumption is that it would shift towards capital growth instead. That means we would largely be forced to shift our strategy towards drawing down our capital, as many others plan to do so. If that were to happen, it would complicate our lives a little bit more (eg: needing to be more active traders and sell some shares each year), but ultimately we’d have a higher capital starting base, so it wouldn’t strictly be a concern.

Unless there was also a sudden – but then lasting – negative shift in share market valuations, we also have our superannuation to provide us with a bit of a safety net. We’re hoping to have around $700,000 in our share portfolios when we retire early, and would be able to access that (under current rules) at age 60.

With the legislated 4% draw down (and let’s assume the portfolio only goes up at the rate of inflation to be very conservative), that would give us an extra $28,000 a year in today’s money. That’s a fair bit of leeway.

In fact, it’s basically a quarter of our original $110,000 net (after tax) passive income target (superannuation accessed after the age of 60 is tax-free).

So inflation and dividends could drop by that much over 10-15 years, and superannuation could entirely plug the gap.

However, if dividends more or less match inflation as planned, then come age 60 we’ll actually have a lot more money to play with.

Otherwise, assuming that things also according go to plan, our dividend strategy also gives us the option to start drawing down later in life as well. This money could go towards funding a more comfortable lifestyle, or other things like healthcare costs as we age.

How’s that for flexibility?

Dividend approach provides safety

We’ve got a plan to retire early before the age of 45. We realise that we could retire sooner if we wanted to. However, our dividend investment approach provides an extra level of safety that a regular draw-down strategy does not.

Put simply, if we retired sooner, with less money to draw on, we wouldn’t have those additional options available to us that I just outlined above.

If you’re looking to achieve early retirement, your biggest decisions are working out what your retirement budget will be, and how much of a safety net you want to put around it.

My wife Ellie and I are confident with our dividend-centred strategy as a way to comfortably provide us with a long-term, self-sustaining passive income for the rest of our lives after we finally cut the work cord, with sufficient options to provide us with alternative strategies should the worst occur.

So if you heard about us wanting to retire early at the start of this article and were asking yourself “Won’t you have enough money?” – never fear, the dividend income strategy is here.

Cheers,

Alex from https://hishermoneyguide.com