Goal comparison

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

At the start of 2019, I wrote down my trading goals for the year. I will now see how I am progressing against these goals in my eToro January Review.

Copiers = +50

Followers = +2,000

Portfolio growth = +15%

S&P comparison (beat the S&P500)

Realised profit = +10%

AUM = +$50,000

Risk = 4 or 5

Provide in-depth monthly updates

Let’s do a quick check up to see how I’m going against my goals.

- Copiers = no change

- Followers = 7 new followers

- Portfolio growth = 9.37% increase

- S&P comparison = beat for Jan (9.37% vs 7.87% source: investing.com)

- Realised profit = 0.09% (small gain but still a positive gain)

- AUM = 6% increase

- Risk = 5

- Monthly updates = Jan 2019 complete

So my aim of keeping to my trading goals is looking on track, particularly my Portfolio growth.

eToro January Portfolio overview

Overall, my portfolio has had a great start to the year – this has been consistent over the last 3 years I have been on eToro.I’ll be trying to minimise the number of holdings I have and start to focus more on US stocks, rather that include some of the Chinese, English and German stocks I have introduced into my portfolio. Reflected by the growth of my portfolio so far, there have been some outstanding gains by a handful of stocks

$GWPH = 41.3%

$FB = 27.16%

$INCY = 26.7%

$BABA = 22.92%

$LEN = 21.12%

$DBX = 20.95%

$R = 20.27%

$PVH = 17.39%

$EA = 16.89%

All of the above % are taken from investing.com portfolio view.

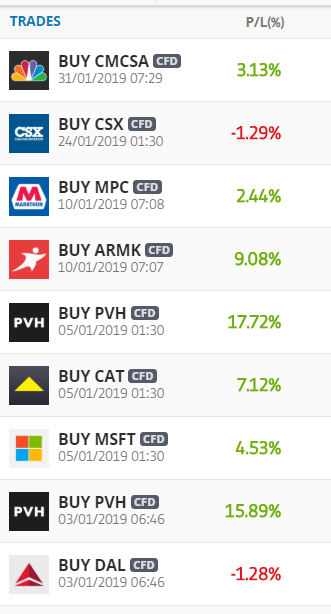

Let’s have a look at the stocks I’ve acquired in January 2019

As you can see, these stocks have had a very strong start to 2019 – particularly $PVH. Hopefully, my change in trading strategy continues to produce great results over the next 11 months.

Stocks to watch

I think there are two stocks to keep an eye on.

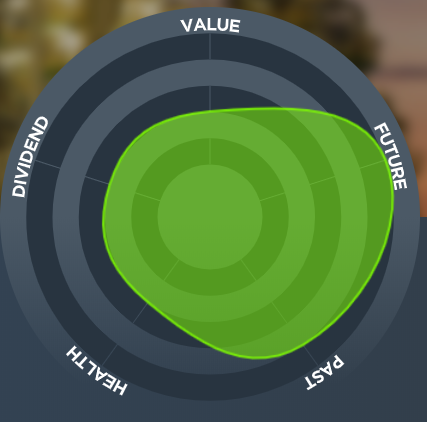

$MPC – Marathon Petrol Corporation, together with its subsidiaries, engages in refining, marketing, retailing, and transporting petroleum products primarily in the United States. It’s showing an exceptional growth potential and a solid track record. MPC hit around the $86 mark in October then tumbled with most of the market. Sitting at around $66 at the time of writing, there’s a good amount of growth to come!

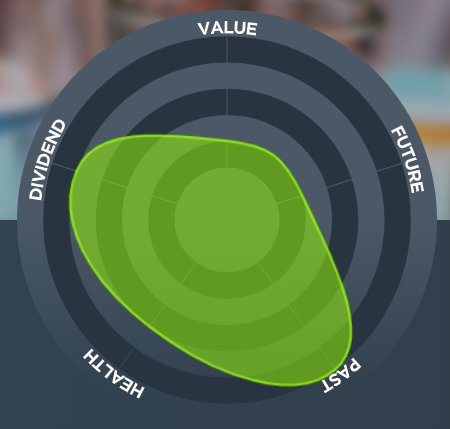

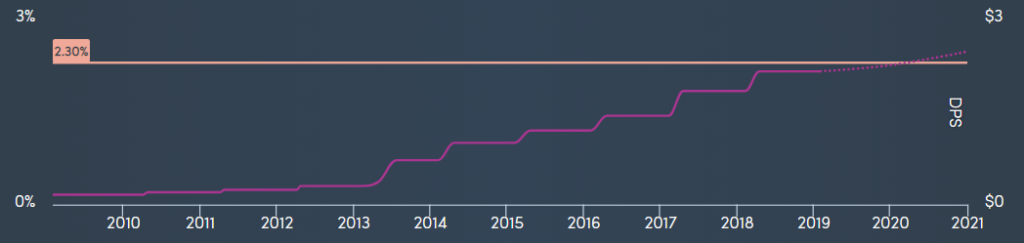

$CE – Celanese Corporation, a technology and specialty materials company, manufactures and sells value-added chemicals, thermoplastic polymers, and other chemical-based products worldwide. Two reasons why $CE should be part of your portfolio – their dividends have increased consistently over the last 10yrs and they’ve also been stable over this timeframe. A rare feat and something that solid should be part of your portfolio.

eToro January Review – Crypto outlook

After the decimation of the cryptocurrency value in 2018, many people are sceptical of what is in store for 2019. Some investors believe that the crypto/BTC ETF is going to save the coins, dragging the alt-coins along with it. Fortunately, I am unfazed about the future price of the cryptocurrency. I do believe that cryptos have a massive part in our future and the technology behind it is going to be game-changing. My current holdings in crypto are not anything special or in large quantities. Using profits from previous trades to purchase these so if they dwindle, there’s no emotion attached to them. I will probably move the crypto I have from my account to my other trading account which focuses solely on cryptocurrency and copying other traders.

BTC is going to continue to dominate for a very long time – there’s too much money involved for it not to influence the rest. As an example, take the big 4 of the stock world – AAPL, MSFT, AMZN and GOOG – what happens when one of these stocks fall? It takes the rest of the market down with it, particularly in the ETF and indices. If there is going to be a BTC ETF, one would have to assume it would be doing the same if a similar event happened.

Well, that’s it for my eToro January review – a successful month – let’s see what the rest of the year brings.

Remember to Stock Up with Joe

Also, if you like the images above, check out Simply Wall St – they provide some great analysis into thousands of stocks.

Hmm is anyone else encountering problems with the images on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

Yep – some of the images were removed but i’ve updated it. Thanks for the heads up!