Welcome! On this page, I’ll break down my current portfolio and have a look at my trading style.

I’ve updated this section for 2019.

Trading Style

My trading style is medium-long term buy and hold. Meaning that when I buy into a stock, I’m not really looking at the price entry point, as I believe it’s value is going to go up regardless. I would hold onto the stock until I believe it has run its course – this could take a few months to a year or more. Very rarely do I hold stocks for only a few weeks.

I’m opportunistic in buying during low points of stocks I’ve already invested in so I will have several positions in just one stock, allowing me to slowly grow my portfolio over time. If I am able to, I split my purchase into two positions (e.g. instead of buying 1 x $1000 block of Google stock, I buy 2 x $500 blocks). Hedging allows you to sell one block if need be and keep the other, without having to drop the whole investment.

Looking at my profile, I ride out the dips and remove emotion from the equation. Some people panic sell but I see it as an opportunity to buy in the dips. As 2018 was a mostly bad year for stocks, I am looking for the right opportunity to buy some great stocks at low prices.

You can also check out my eToro profile as well.

Portfolio

Simply Wall St Has allowed me to produce these infographics below. Their product is easy to use and I really enjoy their product. Clean, simple and effective.

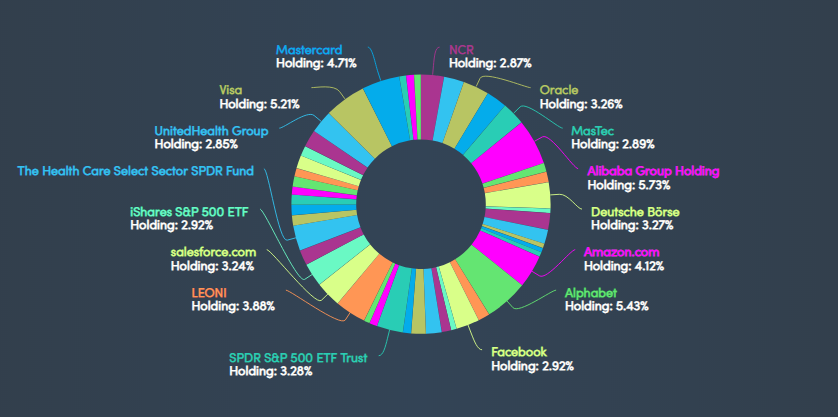

This is a breakdown of my portfolio

My top holdings are

- Ali Baba

- Visa

- Mastercard

- Amazon

I’m trying to not heavily favour one stock over another in terms of allocation – I believe I have a nice spread of stocks across a number of industries to help our portfolio grow. in 2018, I also began investing in ETFs to further spread our risk.

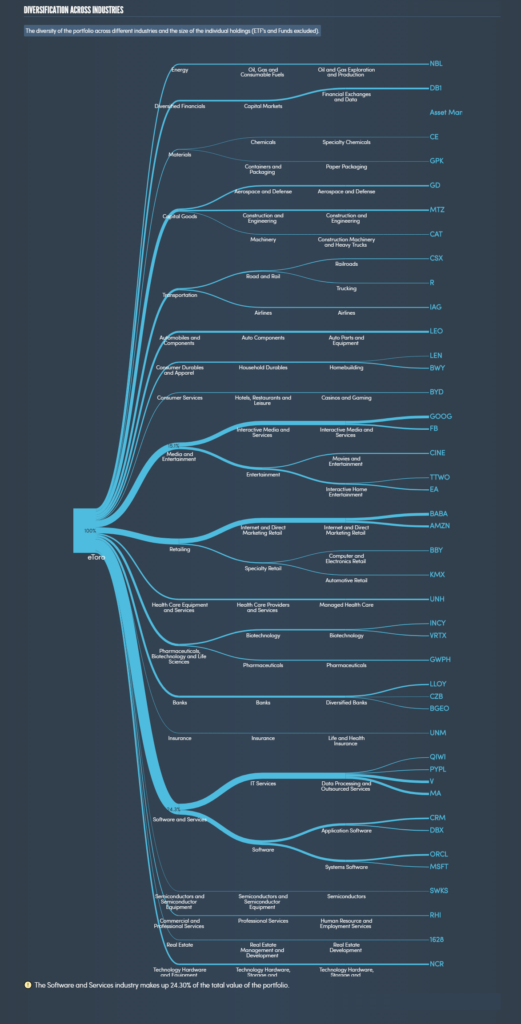

Below is an image of how I have diversified my portfolio.

Where is my portfolio headed?

As you can see from the above, I am heavily invested in the Software and Services sections in 2018. I’m trying to reduce that exposure to other areas to have a healthily balanced portfolio.

I believe the Health sector with have a breakout year and that it will also ride off the back of the pharmaceutical growth in 2019.

What I am looking at doing is reducing the current number of stocks to around 25-30. This will allow me to focus on stronger stocks that will provide a nice return.