New month – new July stocks to add!

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Over the last few months, I waited to the market to stop its descent and it has shown very positive signs in new July stocks. I have focused a lot of my new holdings in undervalued stocks and also in the British Exchange, to offset some of the volatility the American market is having lately – due to a certain leader tweeting about anyone that upsets him.

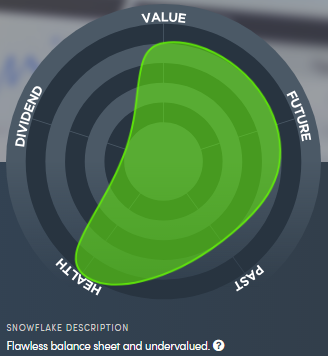

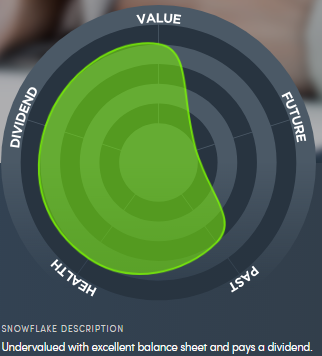

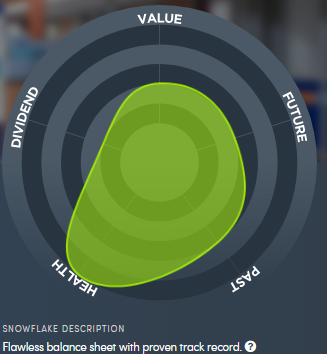

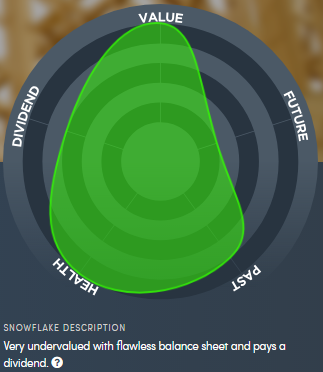

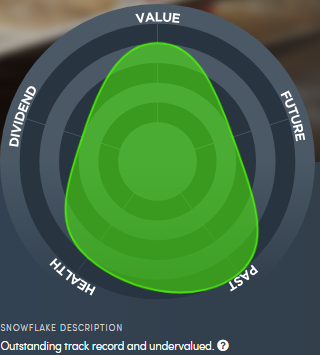

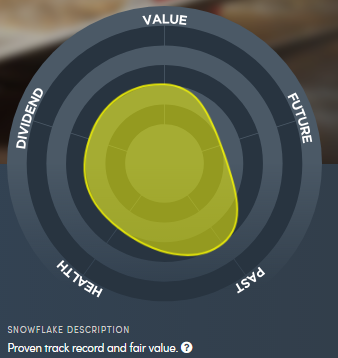

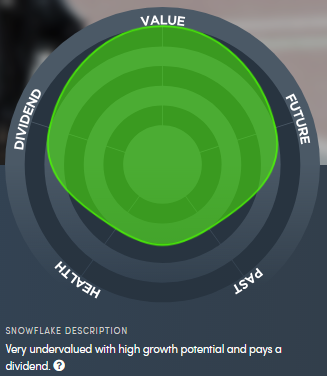

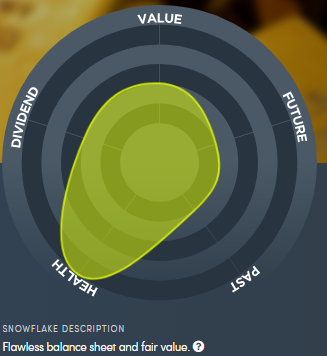

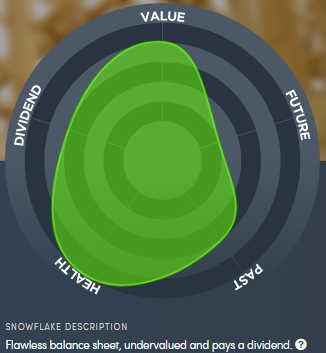

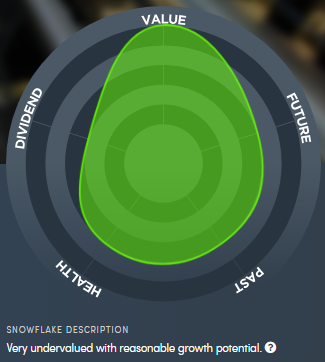

I’ve added the following stocks – the reason for choosing them are below. You’ll notice each stock has a graph – the closer to the edge, the higher score it has in a particular category. The greener the stock is, the higher it’s overall score is. All this information was created with Simply Wall St.

$QIWI

Qiwi plc, together with its subsidiaries, operates electronic online payment systems primarily in the Russian Federation, Kazakhstan, Moldova, Belarus, Romania, the United Arab Emirates, and internationally. It has a flawless balance sheet, strong future growth and excellent value. Expected to grow 20% this year

$UNM

Unum Group, together with its subsidiaries, provides financial protection benefit solutions in the United States, the United Kingdom, and internationally. They are undervalued, excellent balance sheet pays a dividend, and are a leader in their sector.

$SBNY

Signature Bank provides various business and personal banking products and services. A proven record of past results, a strong outlook for the future and an excellent balance – all you need from a bank! 17% expected annual growth in earnings this year.

$RDW.L

Redrow plc focuses on housebuilding activities in the United Kingdom. Flying low under the radar, Redrow is extremely undervalued, has a flawless balance sheet and pays a dividend. It has the holy trinity of goods with being undervalued, strong past, healthy balance whilst still having a dividend and strong outlook. Expected over 14% growth this year

$IAG.L

International Consolidated Airlines Group, S.A., together with its subsidiaries, engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, Ireland, the United States, and rest of the world. Has an outstanding track record and is really undervalued. A low volatility, coupled with an estimated 22% return on equity over the coming years will have us holding on to this stock!

$DAL

Delta Air Lines, Inc. provides scheduled air transportation for passengers and cargo in the United States and internationally. After having a bad year due to press and some ill choices by staff, Delta is ready to bounce back! They have a proven track record and is fairly valued. Over 12% growth predicted but I think with this value and future cash flows, it could grow more!

$CINE.L

Cineworld Group plc engages in the cinema business. A very undervalued asset with high growth potential and pays a dividend. After the fall of the stock price in Feb 2018, CINE has been waiting to bounce back and this is the time! Nearly 35% growth predicted for this year!

$CEY.L

Centamin plc engages in the exploration, mining, and development of precious metals in Egypt, Burkina Faso, Côte d’Ivoire, the United Kingdom, and Australia. Gold has lost its lustre more recently. However, exposure to the ultimate safe-haven asset is a sage move to protect your share portfolio once the next macroeconomic or geopolitical shock hits. And buying into a miner rather than buying gold itself is an easy way to play the gold investment story. 40% growth here we come!

$BWY.L

Bellway p.l.c., together with its subsidiaries, engages in the house building business in the United Kingdom. It shows a flawless balance sheet, undervalued and pays a dividend. Its history is a strong representation of the stock itself and has a very low volatility rating. 13% increase this year is on the horizon!

$BGEO.L

Bank of Georgia Group PLC provides various banking products and services in Georgia. A very undervalued company with reasonable growth. A lot of insiders bought shares in the company in the last 3 months so it could spell a great run!

You can check how these new stocks July are performing in my portfolio as well as checking out how to find the perfect person to copy on eToro.

I just could not leave your web site prior to suggesting that I actually enjoyed the standard information a person supply for your guests? Is gonna be again often in order to inspect new posts