Stake vs eToro – Australian’s (and soon NZ and the UK) looking to find a cheaper option when trading overseas stocks have two new players – eToro and Stake. This article provides both positives and negatives of each platform for Australians but is relevant to other customers. So, it is not meant to recommend one over the other. The decision is based on trading style and what you are trying to get out of the platforms.

If you don’t have a Stake account, you can create one here.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Quick Comparison – eToro vs Stake

- Both platforms

- allow fractional share purchases (i.e. buy $100USD of Amazon instead of the full share price)

- regulated within Australia

- you can buy the underlying asset for US Stocks

- deal in USD as their base currency

- offer commission-free trading

- provide dividends but no Dividend Reinvestment Program (DRIP). Both use the W-8Ben tax form.

- eToro

- allows CFD trading (leveraging and short selling)

- has a demo account where you can practice

- offers more markets to trade (indices, cryptocurrencies, forex, commodities)

- better social trading features (think Twitter meets a broker – news feed, CopyTrading, Popular Investors)

- Stake

- you can transfer stock holdings in and out to other platforms (within reason)

- enforces a T+2 Trade Settlement – This means the cash for executed sell orders takes 2 days to clear back into your trading account.

- has a better search function (you can search for subjects like ‘shoes’)

- more US stocks available to trade

eToro background

Brothers Yoni Assia and Ronen Assia, together with David Ring, founded eToro in 2007. So, one good thing – it has history and has survived the 2008 GFC.

eToro is a social trading and multi-asset brokerage company that focuses on providing financial and copy trading services. It has registered offices in Cyprus, Israel, the United Kingdom, the United States, and Australia. For Australians, it currently offers underlying asset stock purchases for non-leveraged US stocks, and CFD trading for stocks, ETFs, Cryptos, Indices, Commodities and Currencies (forex).

At the end of 2019, eToro had over 12 million registered users – with about 25,000 of them from Australia.

Stake background

Australian digital brokerage company Stake launched in 2017, designed to give Aussies access to Wall Street — home to some of the biggest financial markets in the world such as the New York Stock Exchange.

Matthew Leibowitz founded the company. He was a lawyer by trade who switched to the world of trading because of his interest in the “dynamic nature of the stock market”. After noticing how big the US market was, Leibowitz realised how complicated it was for people outside of the US to access it unless they were wealthy. And thus, Stake was born. Stake – which has an app and a website – allows you to trade more than 3,500 stocks on the US market.

So, at the end of 2019, Stake has around 30,000 Australian customers.

Getting Started

eToro

Signing up to eToro is easy. Go to the homepage, click the sign-up button and away you go. It follows the usual process of identification/verification and the list of usual questions. When signing up to eToro Australia, they will ask you a series of questions that will help determine your trading experience and risk tolerance. This can help limit some of your exposure to the market, so you do not blow your account in the first hour. The overall process was painless and simple

You can create your account here !

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Stake

Signing up to Stake is pretty much the same. It has the usual identification/verification questions with the added step of taking a selfie with the submitted identification. It was quick and efficient.

You can create your Stake account here – if you sign up using this link, you get a free stock (now it is either Dropbox, Nike or GoPro)

So whether you’re Stake vs eToro – they both have simple and easy sign up methods.

etoro vs Stake – Platform

eToro

When comparing eToro vs Stake, I believe that the eToro platform has more features than Stake. Here you have several menus to utilise and get that extra bit of information you are after.

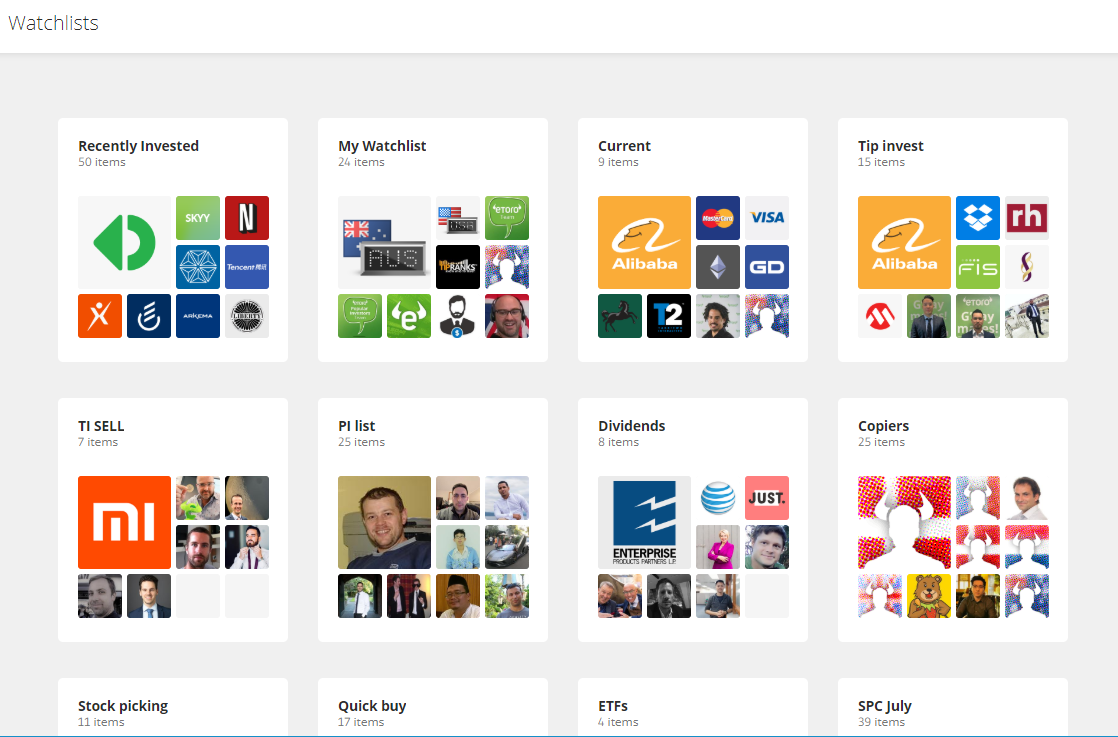

Watchlists

In the watchlists section, you add different markets to a watchlist and see how they are performing. Here you can have different watchlists for different sectors, locations or even mix and match them. This feature is handy if you want to create different watchlists for dividend stocks or undervalued. So, if you see a market you like, you can add it to whatever watchlist you like. You can even add traders to your watchlist and follow along on their trades or updates.

Portfolio

This section breaks down your current portfolio so you can see how individual holdings are performing and what their profit/losses are now. You can also alter the SL and TP triggers here.

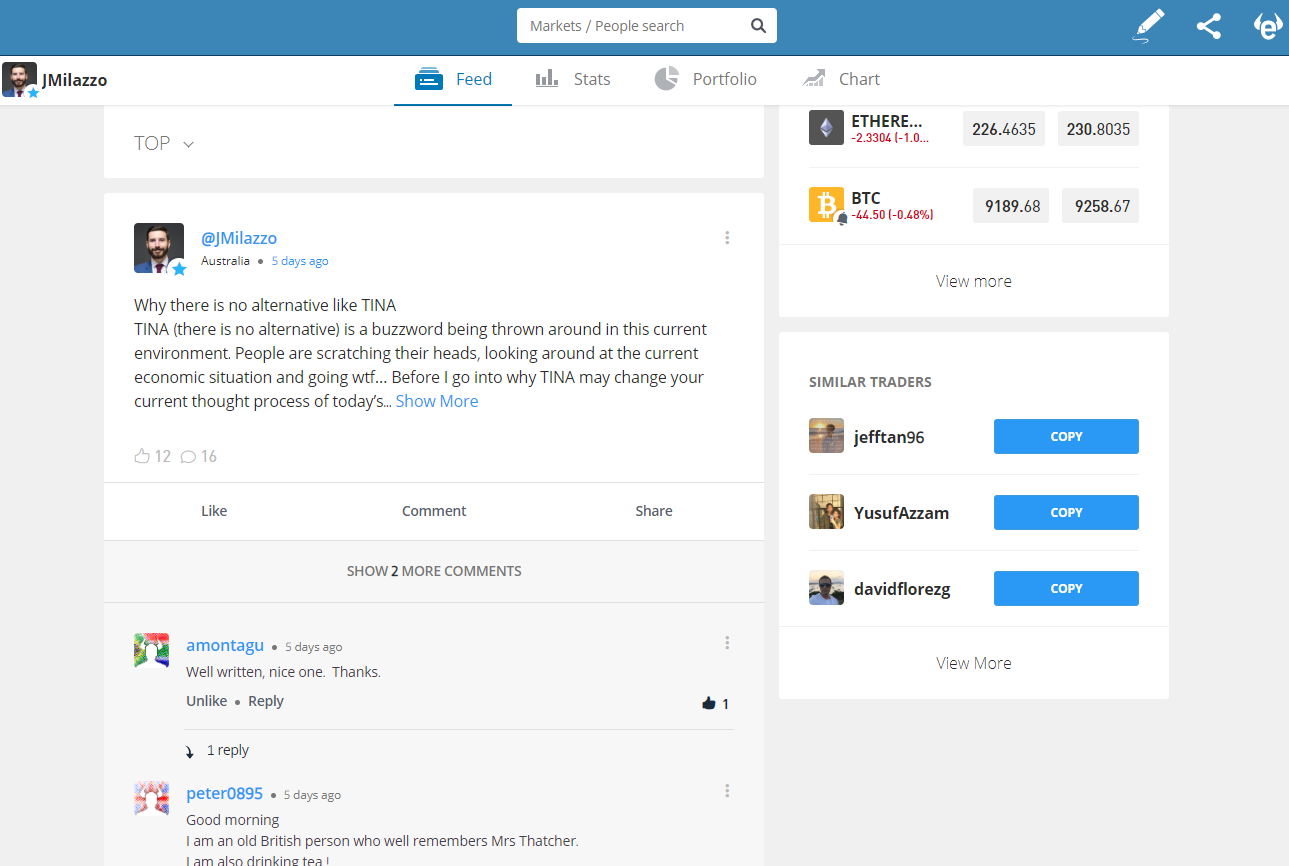

Newsfeed

This is a key feature that many traders enjoy but is not one that Stake has. The news feed is based on what you have in your watchlists or what you have invested in. This source can be overwhelming at times especially if you are following a market that has a lot of investors or followers (say BTC or AMZN for example). This feature is like twitter where people can tag different markets or people, ask questions, or provide an update on their portfolio analysis. It can be a great course of information to talk to likeminded investors about what they think is going to happen in the market. But like Twitter, you must wade through some bad posts to get to the good ones.

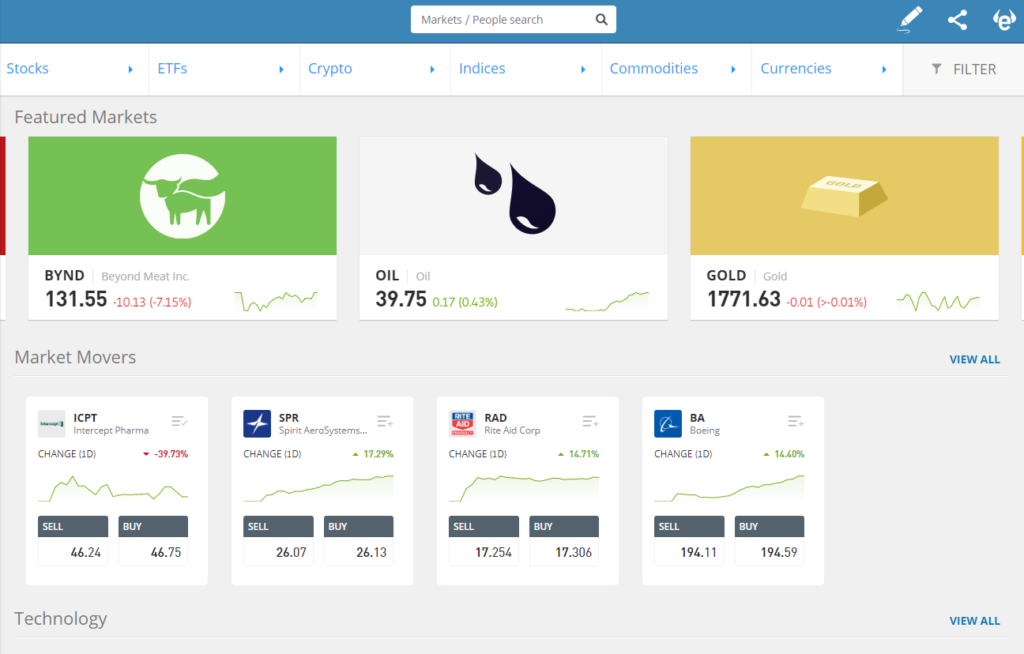

Trade markets

This is where you can explore all the markets, segmented by their grouping (Forex, indices, stocks etc). Whilst it is great that eToro segments the holdings like this, it can be difficult to search for something that you want to invest in but do not know where to start. Stake allows you to search by topic but eToro is by name. if you do not know the name of the stock, but know the industry, it can be difficult to find the right stock. Stake allows you to search by subject which I find is significantly easier to locate and research.

Copy people

eToro provides a list of traders that are performing well and that you may consider copying via their CopyTrader program. Many of these investors are Popular Investors and have a solid track record of trading. This is a useful section for those inexperienced traders that do not quite know where to start but are happy to allocate some of their equity to a trader and let them trade on their behalf. You can find a complete CopyTrader walkthrough here.

CopyPortfolios

Investing in a common theme of stocks or holdings is a CopyPortfolio. Things like online shopping or the crypto market or high performing traders. These CopyPortfolios act like a fund manager for you. You allocate an amount to the CopyPortfolio and they handle all the trades just for you. You can sit back and relax and let eToro manage the trades.

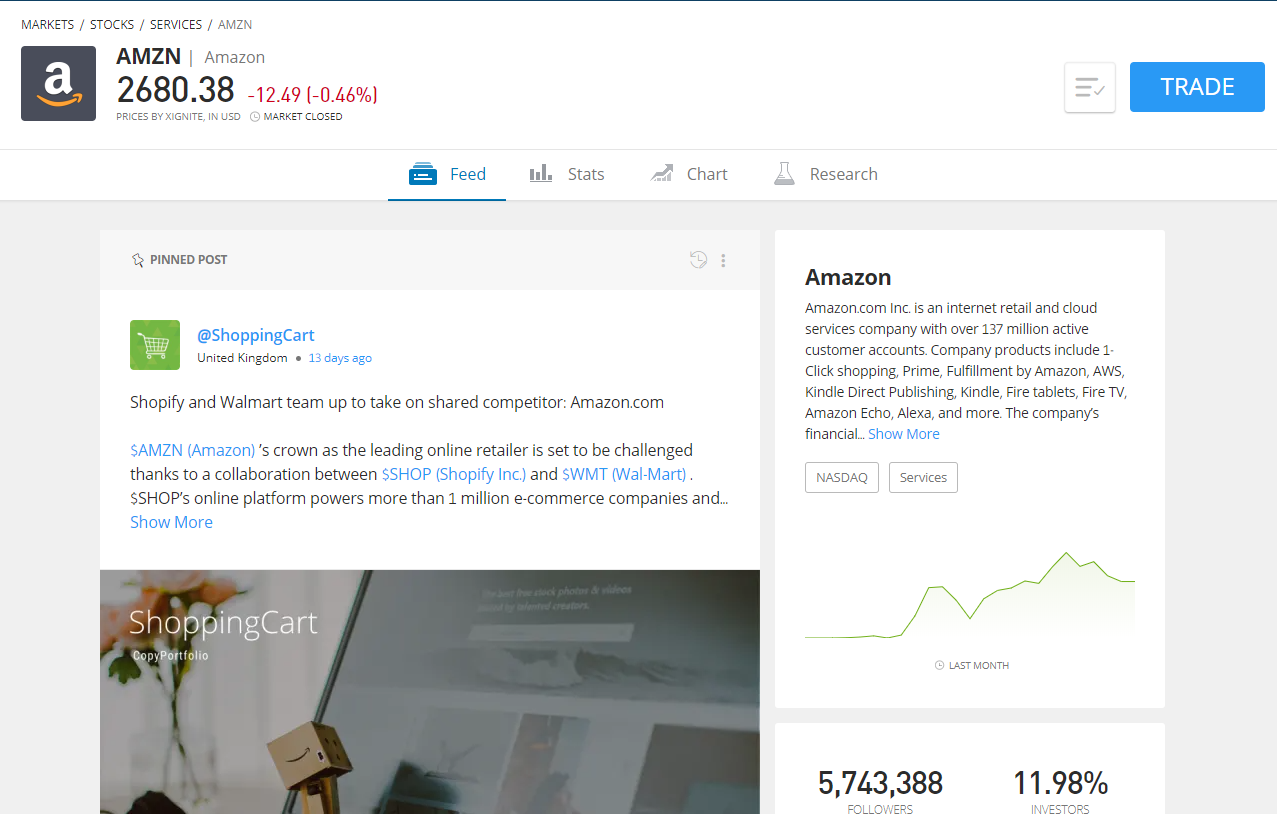

Market information page

Here you can focus on individual markets and they provide great insight into the holding. Things like charts where you can leverage the research tools for further analysis, the news feed so you can see what other traders are saying about the stock and the research tab. The research tab leverages TipRanks information to provide professional analysis of stocks, what fund managers are doing with their holdings of the stock, buy/sell analysis, and potential growth over the next 12 months. This section is useful as it allows you to get all your information from one page, rather than having to visit various webpages for your information.

eToro Demo Account

A great feature for traders using the eToro platform is the demo (or virtual) account. Once you sign up with eToro, you get a virtual account where you can play around with fake money and test out your trades or copy another trader before allocating real money in your real account. This feature is great for traders who are just starting and want to learn through experience. I would highly recommend using this feature to get comfortable with your trading. eToro gives you $100,000 to play with – more than enough to test several trading strategies.

Overall, the platform is easy to navigate and use. There are several great tools here for you to use to locate the best market that suits your trading style. Some people like a more streamlined service but I find that this suits my style perfectly.

Stake

The platform is minimalistic and there is something very appealing about it. There are no fancy features or too many options – it is simple and straight to the point. One of the main reasons that it is so simple is because you do not see what other traders are doing. The focus is on yourself and your trades. If all you need is to buy/sell trades, then this could be the perfect setup for you. The platform is broken down into 3 sections.

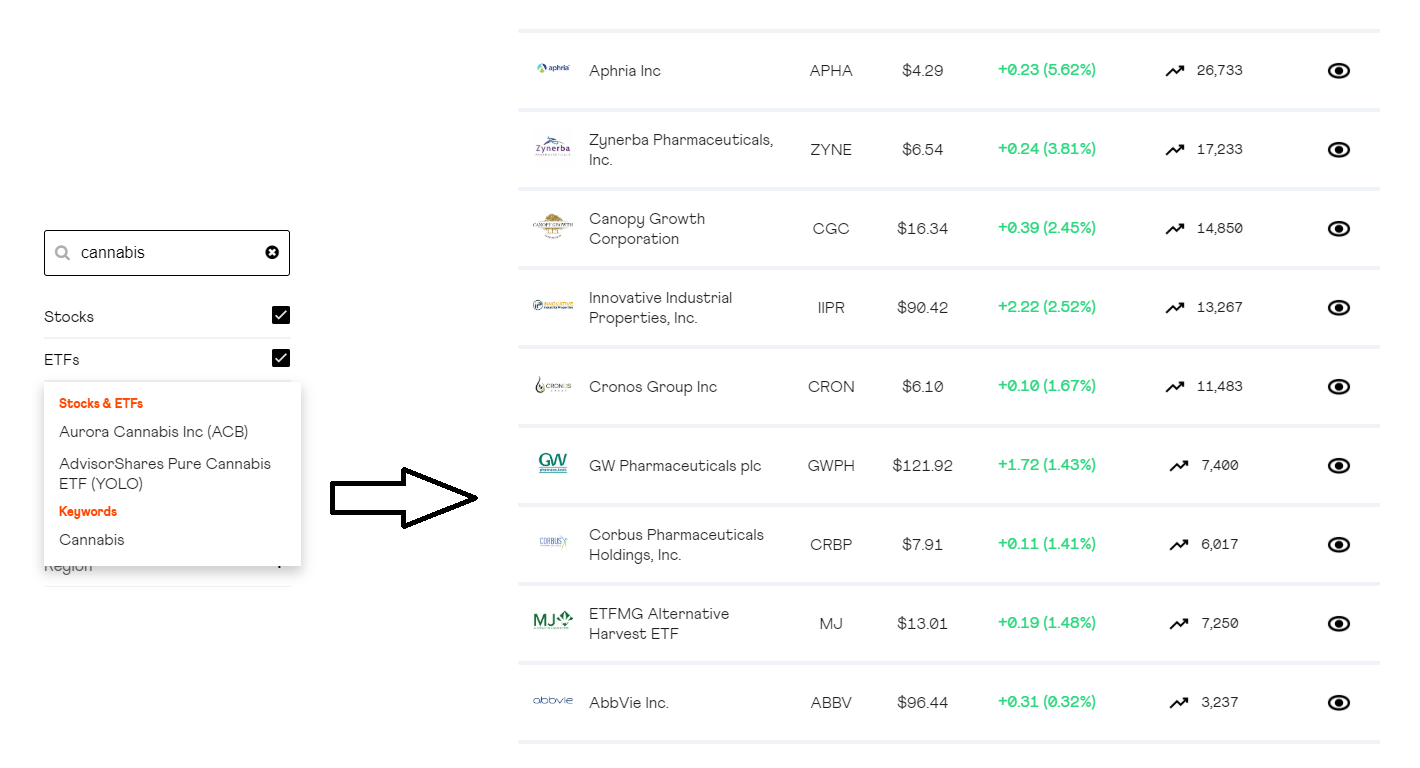

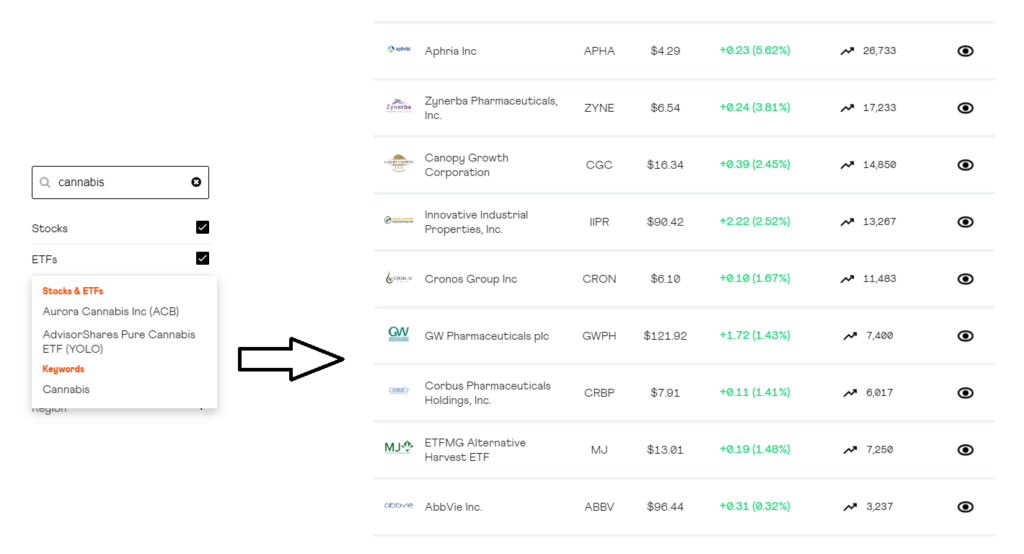

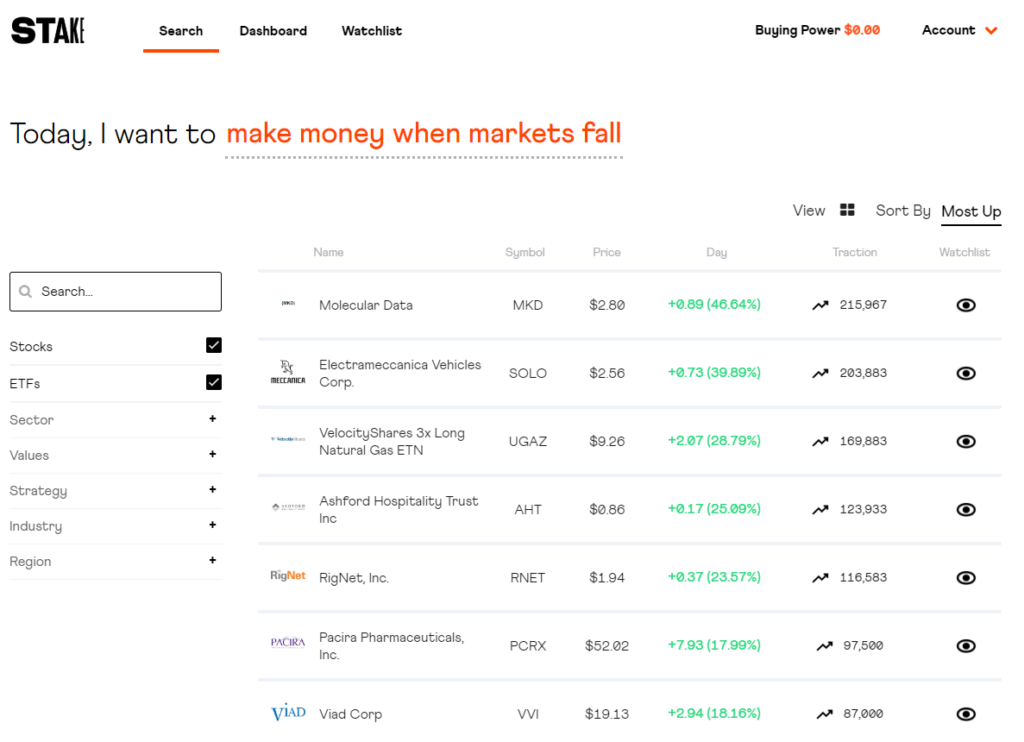

Search

The search function is steps ahead of the eToro search. The best thing I love about their search function is the ability to easily filter to what you need. You can apply different filters until you find what you need, something that eToro does not offer. That also suggest different search topics via a snazzy subject line at the top, which rotates through several choices that could spark interest. To me, the best feature is being able to search via subjects, rather than just by name. If I searched for cannabis, it would show me the stocks with cannabis in their name but also the keyword cannabis. By selecting the keyword, I am presented with all the related stocks in the cannabis industry. Very useful if I cannot quite remember the stocks name but I know the industry.

One thing that does bother me is the ability to sort by columns the way I like it. For example, I cannot sort by name. Whilst it is not the end of the world, simple features like this do make life a lot easier. When you dive into a stock you like, you are present with a clean outlay and easy to understand information. Stake offers a chart, recent data, news on the stocks and related stocks. Do you need more than that? If you do require more analysis, you will need to seek it elsewhere. If not, then this is a great setup to get information cleanly and quickly.

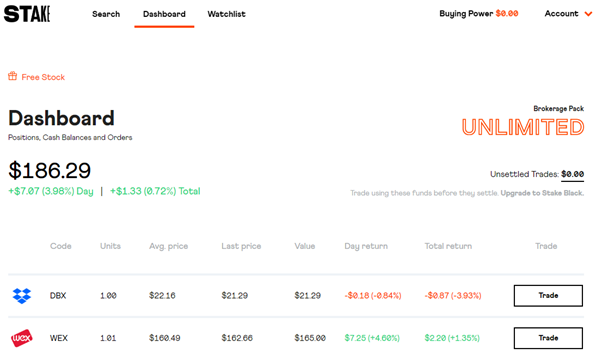

Dashboard

The minimalistic layout continues into the dashboard. Here you get no-nonsense and straight forward details. What you have invested in, units, value and returns. If you are after only those analytics, then this is perfect for you. For certain trades, I know what I am investing in, so I do not need all the bloatware that comes with other platforms. I just need to know how it has performed day by day and my overall return. For this, Stake is ideal in presenting this information.

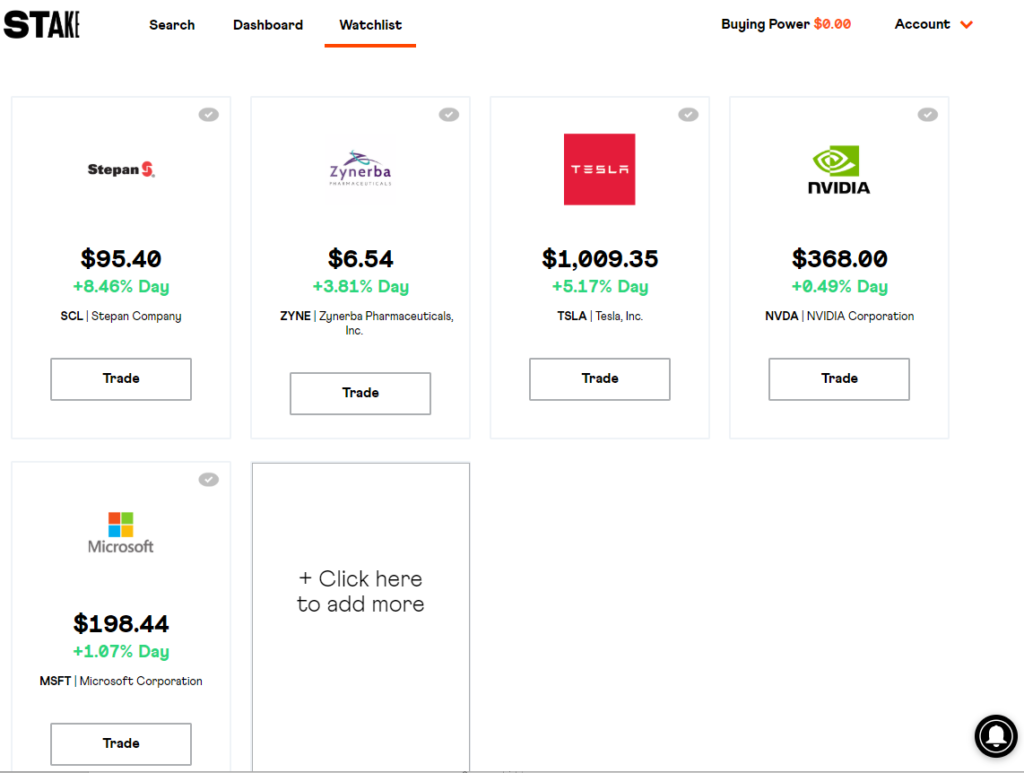

Watchlist

When searching for various stocks, you can add them to your watchlist by clicking on the ‘eye’ symbol on each row. A key difference between eToro and Stake is the ability to have several different watchlists. In Stake, it is all in one list when compared to eToro. If you like to segment the different stocks you are following, then eToro may be better suited. If you only have a handful of stocks you are following, then Stake is suitable.

eToro vs Stake – Platform Overview

If you like social trading, deeper analysis and more adaptable watchlists, then eToro would be more suited to your style. But if you like clean, no fuss, minimalistic platforms then you cannot argue with Stake being the superior platform. The demo account in eToro should not be underestimated as it can provide a safe place for beginner traders to play around without risking real money. Both platforms have their positives and negatives and will just come down to personal choice. As both platforms continue to roll out potential features, you may find yourself swinging one way or the other with Stake vs eToro. Who has the upper hand in this Stake vs eToro duel?

One thing I forgot to add was that both offer mobile apps. The mobile version of eToro is definitely cleaner than its website version. Stake is similar to its website in a good clean, easy to navigate formula.

Stake vs eToro – What can you trade?

Whilst Stake vs eToro both offer stocks and ETFs to trade, there are significant differences. eToro has a greater range of tradeable markets but Stake has better depth.

eToro

eToro provides a great breadth of available markets to trade. So, whilst there is a range of markets, it is not a deep as Stakes offerings, in the stocks and ETFs markets.

Do note that Australians, all non-leveraged buy positions for US stocks and ETFs are traded as real assets. This means that when you buy stocks, ETFs or cryptos without any leverage (i.e. leverage is set to one), you will buy real stocks or ETFs, not CFDs. This means that if you trade on a foreign exchange (non-US) you will be trading a CFD. They are rolling out the same real asset feature for Cryptos, but that feature has not arrived yet.

What is available on eToro?

On eToro you can trade

- Stocks

- By exchange (NYSE, London, HKSE – 17 exchanges)

- By Industry (Tech, Services, Consumables etc)

- ETFs

- Cryptocurrency

- Coins (BTC, ETH, XRP etc)

- Currency crosses (AUD/BTC)

- Crypto crosses (BTC/ETH)

- Commodity crosses (GOLD/BTC)

- Indices

- Commodities

- Currencies (Forex)

So, you can see that there is a significant difference in offerings on the eToro platform. There are noticeably fewer offerings if you are after stocks or ETFs when compared to Stake.

Leveraging and short selling

Aside from real assets, you can trade in CFDs on the eToro platform. This gives you the ability to leverage a trade or short a trade. This is something that the Stake platform does not offer now. Shorting stocks is a great way to make gains when the market drops. Please note that these are different from inversed ETFs like SQQQ or FAZ which acts the same if the market drops but are inversed of real ETFs.

eToro CopyTrader and CopyPortfolios

Key features that make eToro stand out is the CopyTrader and CopyPortfolio offerings. This is when you can invest in a trader or a portfolio and let them do the trading for you. You find a trader that specializes in Cryptos or Forex and let them do the trading for you. You copy their account with your money, and you mimic their trades, based on a ratio of your allocation to their equity. Say, for example, the trader uses 5% of their equity for an AUD/USD trade, then 5% of your allocation would also be made for that trade and it would open/close at the same time the CopyTrader would execute it. There are a few more details about this, which you can find here in the walkthrough.

Stake

For what Stake lacks in the breadth of offerings, it more than makes up for it in depth when compared to eToro. What you see is what you can invest in. eToro sometimes adds stocks to their list but it greyed out so you cannot trade in that stock until their exchange makes it available. A good example of this was Zoom that was added to the list but was not tradable for a few weeks, frustrating some investors who wanted to take advantage of its growth.

US Stocks & ETFs

When it comes to investment opportunities, the US stock market is where it is at. Access the world’s biggest companies, the next generation of game-changers or get involved in the most active ETF market on offer, including access to inverse and leveraged ETFs.

On Stake, you can invest directly in over 3,700 US-listed stocks and ETFs. All these shares are listed on US exchanges such as the NYSE and NASDAQ etc.

There are also more than 200 ADRs (American Depository Receipts) of global companies that trade in the US market that you can access on Stake. American Depository Receipts (ADRs) offer investors a means to gain investment exposure to non-US stocks without the complexities of dealing in foreign stock markets. They represent some of the most familiar companies in global business, including household names such as Nokia, Royal Dutch Petroleum (maker of Shell gasoline), and Unilever. These and many other companies based outside the US list their shares on US exchanges through ADRs.

One thing I love about Stake is that they list all of their stocks/ETFs – this information is publicly available and you can check them out – click here. This is something that eToro doesn’t offer and can make it frustrating to find that particular stock you’re after.

IPOs

On Stake, you can trade a new listing on the day of its IPO. So, when a company announces its IPO, you know that you will be able to access it on day 1 on Stake. eToro does add stocks now and then once they have IPO’d but it is up eToro so there could be a delay in offerings.

What they don’t offer

- Margin Trading

- Short selling (different to short exposure ETFs like SQQQ or FAZ)

- Options

Stake vs eToro – Trading offerings overview

Stake vs eToro both platforms have their respective features that will entice traders one way or another. They offer commission-free trading, which is an excellent way to entice traders. If you want more exposure outside of the US markets, the ability to mimic traders’ orders, leverage trades or short markets, then eToro is the platform for you.

If you want depth and no-nonsense trading, then Stake is more suitable. One thing that Stake vs eToro has in common is that neither offers Australian shares to trade.

Stake vs eToro – Types of trading orders

eToro

eToro has a great range of trading offers for its traders.

Buy or Sell at market price

Here you can buy x units or for X amount at the market value. If the market is currently closed, it will execute when the market is next open. So, you can order $200 worth of AMZN stock and then it will calculate what you get for $200 upon execution.

Do note that with sell positions, there are fees involved. This is outlined in the fees section below.

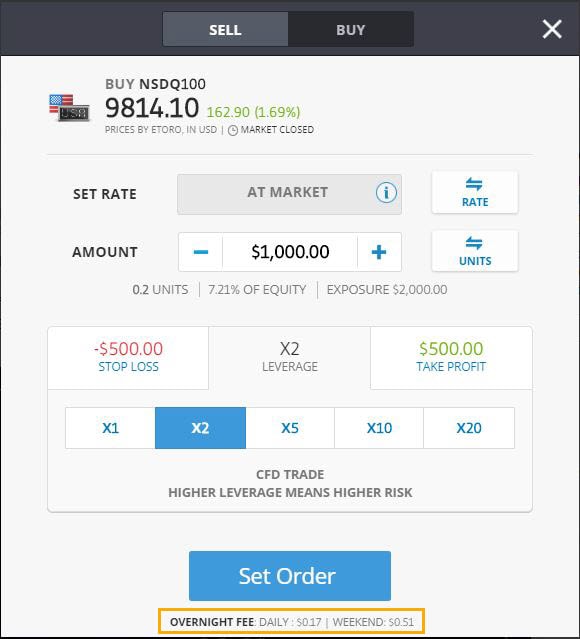

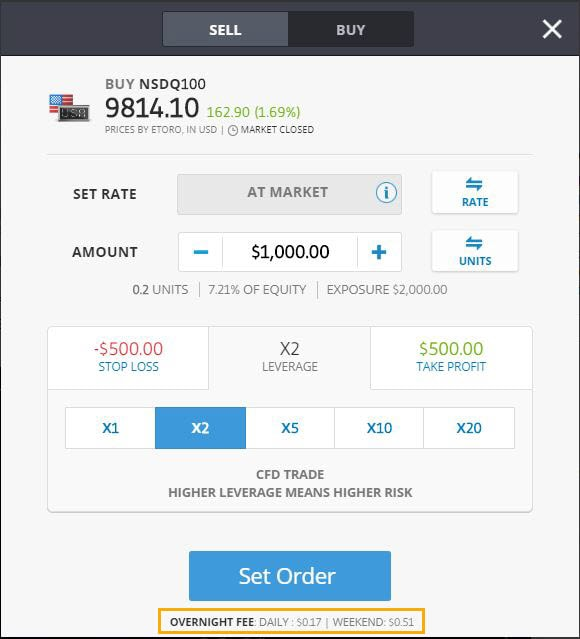

Use leverage

Feeling confident? You can set leverage for your trades. This means that whatever your leverage you set; the profit/loss will be multiplied.

Say you buy AMZN with x5 leverage, if AMZN moves 1% in the trading, your position moves 5%. Be warned, whilst the incentive that massive gains could be had, the same is for the losses. You can quickly wipe out your account in the market does not move favourably.

Do note that with leveraged positions, there are fees involved. This is outlined in the fees section below.

Set amount of units

Like round numbers like 1 unit of AMZN? Then this is where you can set it for your next trade. This feature is more commonly used for Indices or Forex trading but some traders like to know that they have a round number of shares in a stock.

Set rate

You have found a market, but you do not want to pay that rate for it. Here you can set your rate. Say AMZN is trading at 2500 but you want to set an order for 2300. You change it from Market to Rate and select 2300. Then add your value and leverage (if needed) and this will create an order for you. Once the AMZN price hits 2300, your order will execute. I have not tested the longevity of this function, but I have had orders sitting there for months.

Set $ amount

This is where you can limit how much you spend – want to spend $50 on a stock, yep, eToro can do that. Want to spend $5,000? You can also do that.

Set your Stop Loss (and trailing stop loss)

Whilst setting up your trade, you can amend the stop loss or initiate a trailing stop loss. Stop-loss is a tool to help reduce your potential losses if the market dips. Say you purchase AMZN, you can set the SL for -20%. This means if the value of your trade hits -20% then eToro will close that trade. This is useful for those who have good entry and exit strategies for their trading. Trailing stop loss is like Stop Loss, but the SL level increases as the share price increases. If your TSL is at -20% and the share jumps 10%, your TSL is now -10%. Then in the share price drops 10%, it will hit your TSL. So, an SL is a static setting, whilst a TSL increases with the share price but never goes backwards.

Set Take Profit margins

Take Profit is where you can set a limit for your profit. This is more for traders who trade frequently and have set entry-exit prices. It is very useful as you can set and forget it and not have to watch the platform 24/7.

Fractional investing

As mentioned above, you can buy/short a fraction of the share, instead of a whole unit. This is great for those stocks are sometimes thousands of dollars.

All non-US, or leveraged, or short trades are CFDs and may incur a fee.

Does eToro Have a Minimum Trade Size?

The question is not as simple as several factors come into play when determining the minimum trade size.

Trade size if you opened an account after April 2017

The minimum trade size for customers who registered their accounts on or after 2 April 2017 (excluding residents of Russia, China, India, and South East Asia) is based on the trade’s exposure (leverage* x invested amount):

- Currencies: $4,000

- Stocks and ETFs: $500

- Commission-free stocks (non-leveraged BUY positions opened by clients under CySEC and FCA regulation): $50

- Cryptocurrencies: $25

- Commodities and indices: $2,000

The minimum size for customers residing in Russia, China, India, and South-East Asia who registered their accounts on or after 2 April 2017 is based on the trade’s exposure (leverage* x invested amount):

- Currencies, commodities, and indices: $1,000

- ETFs: $500

- Stocks: $50

- Cryptocurrencies: $25

* Use of leverage may be subject to limits by European Securities and Markets Authority (ESMA) measures.

If you opened an account before April 2017

The minimum trade size for customers who registered their accounts before 2 April 2017 is based on the invested amount:

- Currencies, cryptocurrencies, and commodities: $25

- Stocks: $50

- Indices and ETFs: $200

The minimum amount required to copy another trader is $200.

Stake

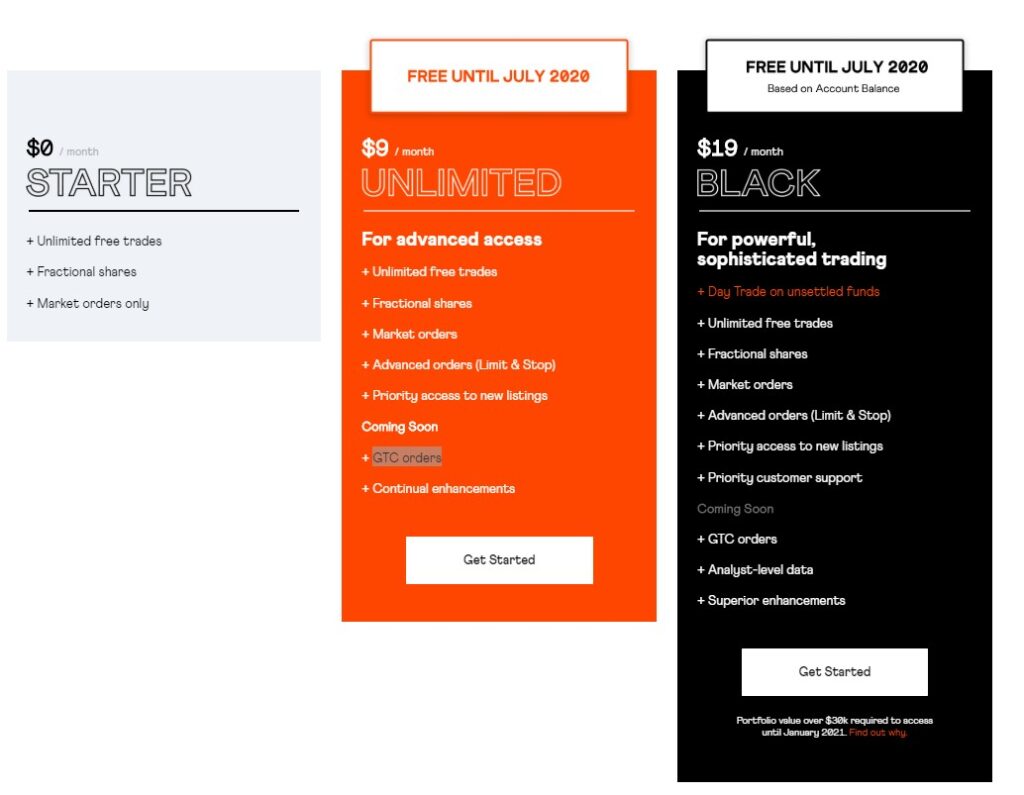

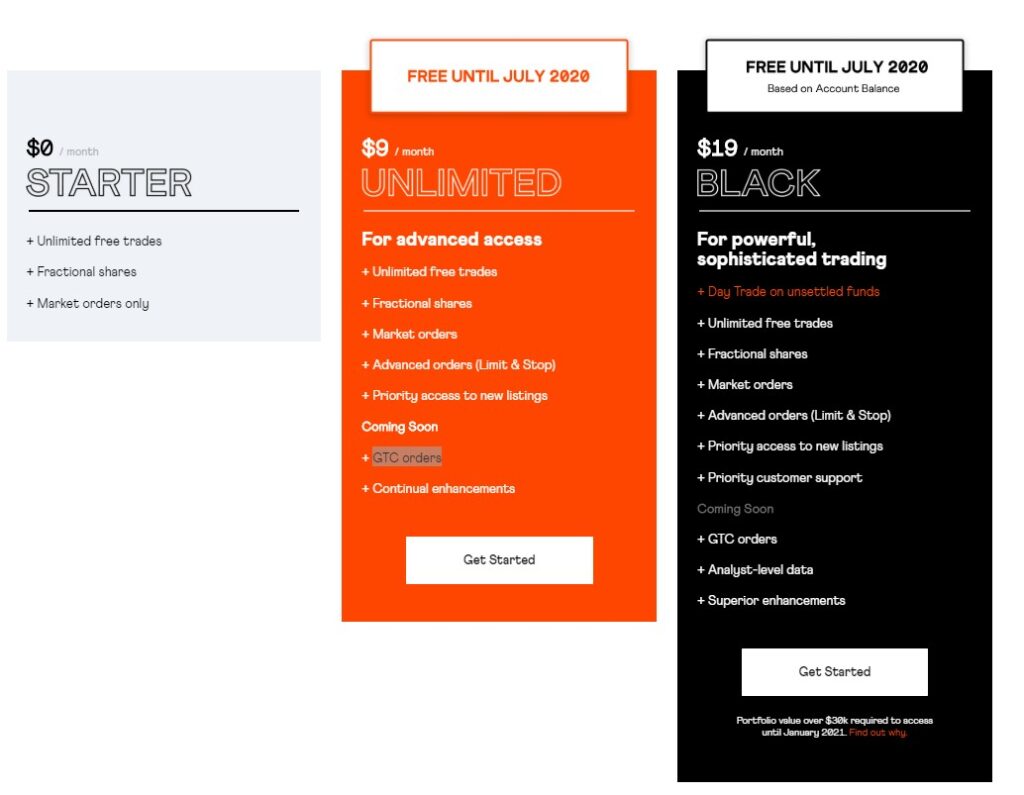

The platform offers straight forward trading options but a fair warning. Stake has three levels of brokerage packs. Now (until July 2020), you can utilise all 3 for free. This is Stake taking advantage of more traders jumping online and is a smart business idea. Show the traders what they can get, then take it away. Leaving them wanting more.

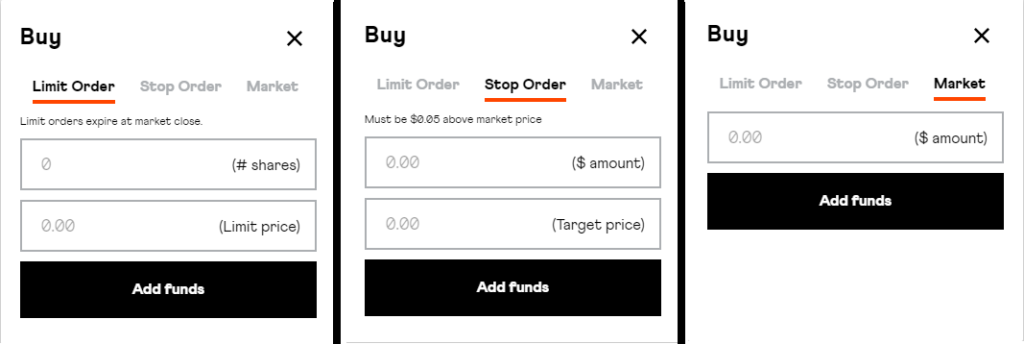

Limit Orders

A limit order is an order to buy or sell a whole number of shares at a specific price or better.

A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. A limit order is not guaranteed to execute.

If not executed, a Limit Order will expire at the end of the U.S. trading day if it is not executed before market close.

Stake does not offer Good-Till-Cancel (GTC) orders, whilst eToro does.

Limit orders will be rejected if placed more than 5% above (for buys) or 5% below (for sells) the current market price.

Market Orders

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately.

However, the price at which a market order will be executed is not guaranteed.

A market order on the platform can be placed at any time but will only be executed when the market is open.

Stop Order

A stop order becomes a market order when a stop price is triggered. This is the same as the Stop Loss offering eToro provides. A buy stop order is entered at a stop price above the current market price, while a sell stop is entered at a stop price below the current market price.

Note that the stop price needs to be 5 cents below (for sells) and above (for buy stops) the current market bid or offer, respectively. All Stop Orders remain queued until it is executed, or you delete it. This means they do not expire at the end of the day (like Limit Orders do).

An example of a Stop Sell Order is below:

Joe has some TSLA shares that he would like to sell if the price drops below $800. He places a Stop Sell order on Sunday for $800. The stock continues trading above $800 until Friday’s trading session when TSLA opens at $785. A market order is immediately triggered, and the shares are sold. John exits the position at $785.

Pattern Day Trading Rule

The US regulation has certain restrictions and rules in place to protect individual investors from taking on too much risk. One that applies to trading on unsettled funds is the Pattern Day Trading (PDT) rules.

This only applies to Stake Black customers as they are trading on unsettled funds. The PDT rule only becomes an issue after January 2021, as all Stake Black is currently only available to customers with $30K or more in their accounts.

The PDT Rule

The basic premise of the PDT rule is that you cannot make more than three-day trades (buys and sells of the same share in the same day) in a “rolling” five-day period. This 5-day period may not be a calendar week, it is any 5 trading days in a row.

This rule does not apply if you have $25,000 or more of equity in your account.

Whilst eToro does allow PDT, it does not allow scalping.

Breaches

The potential risk of being marked as a Pattern Day Trader is that you may not be able to make day trades for a certain period (90 days).

Minimum & Maximum order size

The maximum size of an order in the US market is 10,000 shares, but you can place as many orders (subject to your cash or holdings) under that amount.

The minimum trade size is $10.

Fractional investing

Instead of buying individuals shares, you can invest smaller dollar amounts (minimum $10). For example, if one Google share cost $1,200, you have the option of investing just $100 if you choose. If you invest $1,800, you will own 1.5 shares.

T+2 Trade Settlement

The settlement time for the US market has a settlement period of T+2 trading days. This means the cash for executed sell orders takes 2 days to clear back into your trading account. The settlement date for all trades is available on the trade confirmation.

Customers who are on Stake Black can re-invest with these funds before they have settled. For those who are not trading on unsettled funds, we provide you with a calendar of settlement amounts to show you when those funds will be available in your account.

Trading on unsettled funds

Trading on unsettled funds is available as part of Stake Black, our premium brokerage pack. Until January 2021 Stake Black is free of charge for those with account values over US$30k. For a detailed overview of trading on unsettled funds, how to access it and the regulations that sit around it, please read this blog post.

Stake vs eToro – types of trading overview

When it comes to the breadth of trading availability, I will have to side with eToro for their extensive features, ability to short sell and leverage. It gives more options to the traders to better suit their style. If you do not need all that fancy stuff, then Stake is also a great choice. Simple and non-cluttered. In this Stake vs eToro – who do you fancy?

Stake vs eToro – Deposits and withdrawals

eToro

Deposit funds

Funding your account is quick and simple. There are various payment methods at your disposal. Simply choose

whichever method you prefer and follow the steps below to make a successful deposit:

- Log in to your account

- Click on “Deposit Funds”

- Enter the amount and select the currency

- Finally, select your preferred deposit method

Is depositing safe and secure?

Yes, depositing money into your account is safe, private, and secure. All transactions are communicated using Secure Socket Layer (SSL) technology, ensuring that your personal information is kept safe.

For your convenience, eToro has provided a range of payment methods. These are the one relevant to Australians. Note there are additional methods if you have a US or European based bank account.

| Method | Time | Currencies | Countries | MAX Deposit* | Withdraw Available? | More info |

| Credit/Debit Cards | Instant | USD, GBP, EUR, and AUD | International | $40,000 | Y | Supported cards: Visa, MasterCard, Diners, Visa Electron and Maestro. Transactions will appear on your statement as EToro or www.eToro.com. Transactions in the EEA region may require authentication. |

| PAYPAL** | Instant | USD, GBP, EUR, and AUD | International | $10,000 | Y | Must have an active PayPal account with funds available on the account balance or a credit/debit card linked to it. |

What is the minimum First Time Deposit?

Depending on your region and country regulations, the minimum first-time deposit varies from $50 to $10,000.

Can I deposit from a Business Account?

Please be advised that using any corporate method of payment to deposit into a personal eToro trading account is against our terms and conditions. We can, however, offer you the option to open a corporate trading account.

Depending on whether your business is a sole proprietorship, partnership or corporation, certain documentation will be requested to set up the Business trading account.

If your PayPal account is not linked to a real business, and you wish to continue to use this for depositing, please downgrade your account to a premium or personal account through PayPal.

Is there a minimum for deposits made after the First Time Deposit?

Yes. All deposits other than the First Time Deposit (which varies from country to country) are required to be at least $50. For deposits made by wire transfer, the minimum required is $500.

Which currencies does eToro support?

All eToro trading accounts are in USD. Therefore, when depositing with a different currency, the deposited amount will be converted at the current market rate. Please note that this is subject to a conversion fee. The fee schedule is available here.

Why does this matter? For two reasons. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don’t have to pay a conversion fee.

A convenient way to save on currency conversion fees is opening a multi-currency bank account at a digital bank. Revolut or TransferWise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Opening an account only takes a few minutes on your phone.

Why can’t I deposit using a payment method under another person’s name (3rd party payment)?

eToro does not allow third-party payments. A third-party payment is a deposit made using a payment method that is not in the same name as the owner of the eToro account. As stated in our terms and conditions, the owner of the trading account should be the owner of the funds. Therefore, there is no option to make a deposit using someone else’s payment method.

However, if you wish to use a method of payment belonging to your spouse or another first-degree family member, they can set up a joint account for you. This must be set up before depositing with the 3rd party payment method. This means that both parties will be allowed access to deposit/withdraw funds, however, only the account owner will be permitted to trade. You will be asked to provide identification documents, a proof of your relation (such as marriage certificate/ birth certificate), as well as to complete our joint account form.

If you do use a third-party payment method without a joint account, your account will be limited until the third-party funds can be refunded. Please note that your account might be closed if we are not able to refund the full amount.

Withdraw money

Are there any withdrawal fees?

Yes, withdrawal requests are subject to a withdrawal processing fee. You will see the actual withdrawal fee in the Cashier after you have entered the withdrawal amount; at this point, you can still call a halt to the request.

| Withdrawal Amount (USD) | Fee (USD) |

| 30.00 + | 5 |

Any withdrawals sent in currencies other than USD are subject to conversion fees. Details of fees can be found here: Fees. Please note, you may be charged by the funding provider involved in the transfer (intermediary bank, receiving bank, or your credit card provider).

How will I know if my withdrawal request has been processed?

You will be notified via email once the processing of your withdrawal request has been completed, together with the payment provider details of where we sent your funds. Also, you can click on ‘Portfolio’ and then on the history tab to see the status of your withdrawal.

How do I withdraw money?

Want to withdraw funds from your account? No problem! Customers may withdraw funds from their eToro account at any time. Funds can be withdrawn up to the value of the balance of your eToro account, minus the amount of margin used.

Funds are withdrawn using the same method, and sent to the same account, as previously used for your deposit. Payment will be made in the following order of priority:

- Credit card

- PayPal

- Bank transfer

How long will it take to process my withdrawal request and when will I receive my funds?

eToro processes withdrawal requests within one (1) business day, provided we have all the necessary information. The estimated time it will take to receive your payment is dependent upon the payment method used:

| Payment Method | Estimated time to receive funds |

| Asia Online Banking | 1-2 business days |

| China Union Pay | 1-2 business days |

| Credit / Debit card | Up to 8 business days |

| Neteller | 1-2 business days |

| PayPal | 1-2 business days |

| Skrill | 1-2 business days |

| Wire Transfer | Up to 8 business days |

How can I cancel my withdrawal?

To cancel your withdrawal request, please follow the steps below:

- Enter your trading account and click on the “Withdraw Funds” tab

- A pop-up message will appear. Use the “click here” link to view your withdrawal history

- Click on the “Reverse” button

- Confirm that you wish to cancel the request

- All funds, including withdrawal fees, will be immediately returned to your account balance

Please note that if your transaction status is “In Process” you will be unable to cancel via the platform. In this case, please contact us and we will be happy to assist you.

What conditions are required to open a withdrawal request?

- The minimum amount for withdrawal is USD $30

- You must have withdrawable funds available

- Your account needs to be verified, meaning a green tick appears on your profile (if you have not yet verified your account, please contact us, and upload the required documents)

Your personal information, payment details and accompanying documentation are protected by eToro’s stringent information security policy. Strict guidelines to safeguard your private information are in place and will satisfy the most demanding security-conscious financial services end-user.

What should I do if my funds do not appear in my account?

- Click on the portfolio tab, then on the history tab, to see via which payment method your funds were sent. Alternatively, you can check the email you received concerning the processing of your withdrawal, which will specify the payment method to which the funds were sent, and the date processed.

- Take into consideration that from the time we process your withdrawal, it can take up to 8 business days for the funds to appear in your account statement.

- If everything above was checked and you still cannot find the funds, please contact us. We will request you provide us with a payment method statement showing the incoming and outgoing transactions, from the time the withdrawal was processed, until the time you contacted us. Please make sure we can see your name, the transaction dates, and the payment method detail.

Stake

Depositing Funds

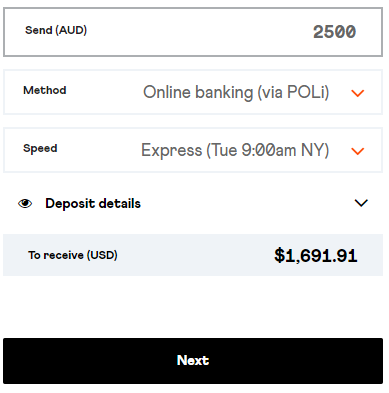

You can make an FX transfer of Australia dollars into USD on Stake. You will get direct access and visibility to the spot FX rate with full transparency of any fees. The minimum amount you can fund is $50AUD.

Ways to fund

You can transfer AUD into USD on Stake using:

- Bank Transfers (with POLi)

- Debit or Credit Card (there is a 60-day hold before you can withdraw funding made by card for security reasons).

Your funds go directly to our FX partner and then into your brokerage account. You can fund and place a trade in the stock market on the same day.

For non-individual accounts (such as SMSF and Company accounts), we provide you with a linked Macquarie Cash Management account which is also available to fund with. Customers with SMSF and Company accounts will receive the details (BSB & A/C #) of the CMA with instructions on how to fund their accounts.

Speed

When you fund your account, you can choose the speed (express or regular) you want it in your brokerage account. With express funding, your funds will be in your account and ready to be invested just a few hours later.

Getting Free Stock

When you fund your brokerage account (AUD into USD) for the first time on Stake, you will get a free stock of Nike, Dropbox, or GoPro. All you need to do is fund within 24 hours of your account opening. Simple as that.

Card Funding & 60 Day Holds

Funding by card (debit or credit) is subject to a 60-day hold period before you can withdraw those funds. This is for compliance reasons, and to provide an additional layer of security against fraud. You will be able to see the amount that is always available for withdrawal in your Cash Available for Withdrawal in Stake. For more information, please see Withdrawing Funds

Direct USD transfers

You can fund your account directly if you have USD already, or would like to transfer any currency (like AUD etc) into USD using your bank or preferred FX remitter (such as OFX, XE, WorldFirst etc).

Making a direct deposit

The key banking and transfer information for your accounts will be found inside your Account tab on Stake.

Within the section “Direct USD Transfer” your specific transfer information is provided – it is unique to your account and ensures that if followed, your transfer will arrive as you planned.

To make a direct USD deposit, please also ensure you follow the information in this section.

Correct Details

Ensure the details of your transfer, found in the “Direct USD Transfers” section, are entered correctly with your FX provider. Match your reference number exactly as included.

No 3rd party transfers

Ensure that the name on the remitting account is an EXACT match to your Stake account we are NOT able to accept fund transfers otherwise, for any reason – no related company accounts, friends & family accounts etc.

Transfer and other fees

Make sure that you are aware of the feeds provided by your bank or FX provider (i.e. wire fees etc).

Stake charges a flat USD 5.00 fee which is passed through to our US broker-dealer to reconcile and undertake fraud checks on each transfer.

Notifying Stake

Once you’ve made your Direct Deposit, be sure to let us know on our Direct Deposit form and attach your transfer receipt. We will keep an eye out to make it processes as quickly as possible. Please note that Stake is not able to view the status of this transfer until funds arrive in the US with DriveWealth.

Things to note

Please note that withdrawals cannot be made USD to USD. All withdrawals must come back through to your local Australian bank account.

Link an Existing Macquarie CMA

If you already have an existing Macquarie Bank CMA, you can link it to your Stake account. This gives you great flexibility in moving money across and it will become your default funding method when transferring AUD to USD on Stake.

Linking your CMA to your Stake account

To link your CMA to Stake, you will only need to fill out section 1 & physically* sign section 6 of the attached Third-Party Authority Form. We will manage the rest! Once complete, please scan the entire form and send it back to us at support@helloStake.com.

By completing this form, you grant Stake general authority over the CMA, which allows us to arrange transfers from your CMA to your US trading account. These transfers are always initiated and requested by you on Stake. It also means you can see the balance of that account on Stake.

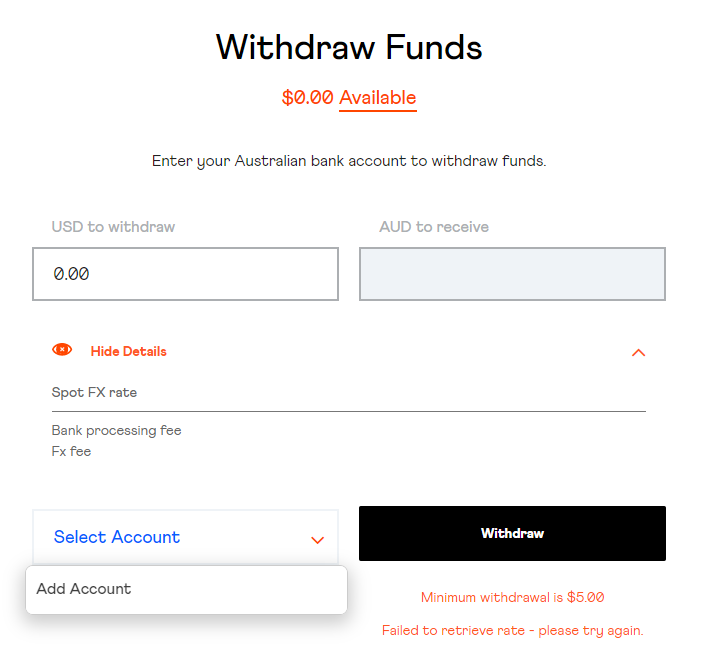

Withdrawing Funds

You can withdraw your available funds any time from Stake. Much like funding your account, the spot FX rate and all applicable fees will be provided to you before you decide to process your transfer. The minimum amount you can withdraw is $5 (USD).

Transfers can only go from Stake to your local bank account, which must be in your name. Before you make your first withdrawal, you will need to provide your bank details (BSB & Account Number).

Speed

It normally takes approximately 2 business days for the withdrawal to arrive in your local bank account.

Security

Make sure you enter the correct bank account details and verify your withdrawal. We will ask you to double-check and then validate your transfer.

As an additional check, which ensures the security of your funds, we have extra validation on withdrawals and may contact you or request extra documentation. This ensures your details are correct and prevents any fraud on your account.

Available funds & Reserved Cash

You will only have funds available for withdrawal when your settled cash balance is greater than the amount of any cash that is reserved for:

- any holds on funds for funding by card, which has a 60-day hold period

- any pending buy orders (i.e. any order you must buy stocks).

This amount (Reserved Cash) may be greater than your portfolio value due to market fluctuations (i.e. you funded $1000 by card 30 days ago, but your current cash value is only $900). If this happens, you will not be able to make a withdrawal until your portfolio’s cash balance is greater than this amount or the 60-day hold period on your card funding has passed.

Stake vs eToro – Deposit and withdrawal overview

In this deposit and withdrawal battle of Stake vs eToro – Stake wins. It’s simple and to the point. eToro does have it’s merits but it gets very confusing if you use different methods. So look at Stake vs eToro – stake wins this based purely on simplicity.

Fees

eToro

Is there a brokerage fee?

No, eToro is commission-free

Is eToro free?

You can join eToro for free and any registered user receives a $100,000 demo account for free.

However, like many online platforms, eToro charges various spreads and fees for some trades and withdrawals.

What is a bid/ask rate?

Bid and ask rates are equivalent to BUY/SELL prices on eToro. When a position is long (BUY), the ASK rate is applied. When a position is short (SELL), the bid rate is applied.

What are overnight and weekend fees?

CFD positions that stay open overnight incur a small fee, relative to the value of the position. It is essentially an interest payment to cover the cost of the leverage that you use overnight. Weekend fees are overnight fees that are charged for keeping positions open over the weekend. Therefore, a weekend fee is triple the overnight fee. Weekend fees are charged either on Wednesday or Friday, depending on the asset.

What is leverage?

Leverage is a temporary loan given to the trader by the broker, enabling the trader to open a trade of a larger size with a smaller amount of invested capital. Leverage is presented in the form of a multiplier that shows how much more than the invested amount a position is worth.

For example: If you trade with no leverage at all and invest $1,000, for every 1% move in the market, you can gain or lose $10, which equals 1% of $1,000. However, if you were to invest the same $1,000 and trade using x10 leverage, the dollar value of your position would be equal to $10,000.

What is LIBOR

The LIBOR is the most used benchmark rate that is given by banks when charging other banks for short-term loans. LIBOR stands for London Interbank Offered Rate. There is a total of 35 different LIBOR rates posted each day, ranging from overnight to 12 months, and based on five different currencies. eToro uses the 1-month USD LIBOR rate for calculating overnight fees for stocks.

Can daily rollover fees change?

Rollover (weekend/overnight) fees change from time to time based on global market conditions. When this happens, we will implement the changes. Please be aware that fee changes always apply to open positions. We encourage you to keep up to date with the current rollover fees/refunds by checking our fees page. Please note that fees may change without advance notice.

How are fees calculated?

Spread = Spread * Price in USD * Number of units

Overnight fees (per night): Fee * amount of units

Where can I see the overnight fees I have to pay?

Overnight fees appear at the bottom of the trade window when opening a new trade.

When do I pay overnight fees?

Overnight fees are charged every night between Monday and Friday at 21:00 GMT for open CFD positions. The weekend fee (x3) is charged on Fridays for stocks, ETFs, and indices CFDs and Wednesday for Cryptocurrencies, Commodities and Currencies. Overnight fees are not charged on Saturdays and Sundays.

When do I pay the spread?

As soon as you open a new trade, you will see a “loss” in the position — this is due to the spread. However, the final calculation of the spread is made when you close the position and it is adjusted at that moment, according to the closing price.

How does eToro make money?

eToro makes money through various fees, and the trading services they provide on their website. Although eToro does not make its financial statements public, the main source of revenue for eToro is likely to be:

- Spreads: Spreads are the gap between the price you and the broker buys/sells at. To put it simply, if an Apple stock costs $100 at market price, eToro will charge $100.1 for it. The difference of $0.1 per CFD is kept by eToro. For further info, read how CFDs work.

- eToro overnight fee: For this, you need to understand two things, leveraged trades and loans. Leveraged means that you can trade with more money than you have. Let us say you want to trade Apple with 1:10 leverage and you have $10. This means that using leverage you can buy $100 worth of Apple with your ten bucks, as the missing $90 will be lent to you by eToro, which will charge you a fee (interest) for this loan.

- Other non-trading fees: eToro charges fees for several services on their website, which are not directly related to trading, also known as non-trading fees. Some examples of non-trading fees are:

- Withdrawal fees ($5/transaction): pay to withdraw your money

- Conversion fees: pay when eToro converts money to fund your account

Stake

No brokerage fees

This is probably the easiest section to write. As Stake does not use leverage or CFDs, there are no brokerage fees. Zip, Nada, naught. No brokerage fees or commissions.

How does Stake make money?

No brokerage? But CommBank charges $20 each time… Sounds like a poor business plan. Well, Stake makes money on the currency exchange when you fund your account or withdraw money from your account.

Currency exchange fees

- FX fee: $0.70 for every AU$100 transferred, which is an FX spread of 0.7%.

- Card fee: If you choose to fund your Stake account using a credit or debit card, you will be charged 2% of what you transfer by the card merchant.

- Express transfer: If you want your money to arrive in your account within the next 24 hours, you will be charged 0.5% of what you transfer.

- US tax form: When you sign up to Stake, there is a one-off $5 fee for US taxation purposes.

- External transfer fee: If you already have US dollars that you would like to transfer into Stake, there is a $5 transfer fee applied.

Stake vs eToro – Fees overview

Straightforward and simple is Stakes take on fees but limits you in the types of trades you can do based on your brokerage plan. If you use no leverage/CFD trades on eToro, you can gain a better experience than Stake due to the standard options available. The confusion (and fees) adds up once you leverage your trades. If you are a simple buy and hold trader, then Stake is the way to go for simplicity. For those wanting more, then check out eToro’s options. Stake vs eToro comparisons is aligned to the user. What works for one person might not work for the other.

Stake vs eToro – Affiliate and promotions

eToro

This is where eToro outshines Stake in terms of affiliate programs and promotions

Affiliate Program

The affiliate program is separate to the eToro trading platform. You do not need an eToro account to become an eToro Affiliate. The program is based at people who link to certain eToro products and are successful in signing up new traders to eToro. Payments are based on different levels, but you could earn $150USD + per trader you get to sign with eToro. This is great for people who create blogs or YouTube videos that have a high view count. eToro Affiliate program is a separate platform and payments are sent to your Australian bank account (or your eToro portfolio if you do have one). You can check out the affiliate program here https://affiliates.eToro.com/en-gb/auth/registration

Popular Investors:

I provide a detailed walkthrough of the Popular Investor program but in a nutshell – you can also earn money from eToro by becoming a Popular Investor. If others copy your investments, you can earn a 2% management fee for the portfolios that are copied from your own. That means if you get enough copiers and significant assets under management (AUM), you get a kickback from eToro. This does not cost your copiers anything.

Say you have $5 million AUM; you can earn about $8300 USD per month… not bad!

Stake

The platform has two nice features when it comes to affiliates and promotions. The first is gift-giving.

They also allow you to give shares as a gift; you can purchase as little as USD $10 or as much as USD $500 worth of shares in a company of your choice, and that amount of shares is then sent to whomever you’re gifting them to.

Invite a friend

If you get one of your friends (or someone reading your article) to sign up to Stake, they will you are your friend and you a free stock. Once they make a deposit, you both get a stock. No questions asked.

This is my referral code.

https://helloStake.com/referral-program?referrer=josephm745

Now, it is a random selection from GoPro, Dropbox, or Nike… not a bad result

Stake vs eToro – Affiliate and promotions overview

eToro has a great program in place to earn extra money here. Whilst receiving a free stock from Stake is nice, it is just not on the same level as potentially earning thousands of dollars per year with eToro. So when it comes to Stake vs eToro, eToro wins.

Tax compliance

When trading in US stocks, both Stake vs eToro makes you fill out a W8-Ben US tax form to avoid paying 30% tax instead of 15% on your profits to the US government.

Neither platform sends tax information to the Australia Government and it is up to the trader to provide these details during tax time.

Safety

eToro

There is a significant amount of information on eToro’s safety and regulation, but I will just highlight the parts related to Australian traders.

Regulation and License

In Australia, services and products are provided by eToro AUS Capital Pty Ltd. (“eToro Australia”), ABN 66 612 791 803 is the holder of an Australian Financial Services Licence (AFSL) 491139 issued by the Australian Securities and Investments Commission (ASIC), and regulated under the Corporations Act (Commonwealth). They arrange for its clients to be provided services by eToro Europe.

eToro AUS Capital Pty Ltd.

eToro, having its registered office at Level 19, 9 Hunter Street, Sydney NSW 2000, Australia, is licensed to deal in derivatives and foreign exchange contracts as agent for you and as principal. When we act as an agent, we will use another executing broker, including eToro Europe or a non-affiliated third party, to execute our clients’ orders.

Gleneagle Asset Management Ltd.

GAML, having its registered office at Level 27, 25 Bligh Street, Sydney NSW 2000, Australia, is licensed to deal or decide in investments as an agent. GAML financial services are provided by its Corporate Authorised Representative, eToro Australia Pty Ltd ABN 46 621 283 369 (Corporate Authorised Representative. No. 1281634) (eToro Australia) concerning eToro Service (ARSN 637 489 466) (eToro Service). GAML deals with you as an agent and will use another executing broker, including eToro Europe or a non-affiliated third party, to execute our clients’ orders.

Jurisdictions

eToro Australia Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC) and a Corporate Authorised Representative (CAR) of Gleneagle Asset Management Limited.

eToro AUS Capital Pty Ltd is authorised by the Australian Securities & Investments Commission (ASIC).

Stake

Regulatory & Partners

Stake works work with several partners to deliver a seamless, intuitive, and safe investing experience. Some of the regions in which Stake and its partners are regulated include in the US, the UK, across Europe and Australia.

In Australia, Stake is an authorised representative (Authorised Representative No. 1241398) of Sanlam Private Wealth Pty Ltd (Australian Financial Services Licence No. 337927).

Our Partners

Stake’s FX transfer partner in Australia (and globally) is OFX (OzForex Limited), an ASX listed FX transfer service. OFX enables Stake to provide customers around the world with a more competitive and seamless FX service inside the Stake product. The company manages the FX transfers for Stake customers and sits behind each transaction ensuring that customers funds are transferred in a timely and affordable way to your US brokerage account. It is regulated globally, including in the United Kingdom by the Financial Conduct Authority (FRN: 902028), in Australia by ASIC (AFS Licence number 226 484) and in the USA as a licensed money transmitter (NMLS #1021624).

DriveWealth provides the US brokerage and execution services to Stake and its customers. It is connected to the relevant exchanges to ensure that orders are executed in accordance with the client’s instructions. DriveWealth, LLC is a US broker-dealer registered with FINRA (US regulator) and is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). You can read more about SIPC at www.sipc.org.

We work with several other regulated partners to bring better & safer access to the US stock market, including:

- Trulioo – For the digital verification services required to meet our KYC and AML requirements

- Macquarie Bank – providing bank accounts for non-individual accounts (SMSF, Company accounts)

- Tiingo – Our data provider for market and company data you see on Stake

- Poli (Australia Post) – A payment gateway for faster online funding

Safety & Security

With Stake, there are lots of ways your cash, securities and data are safe and protected.

Our Partners

It is worth noting that Stake never holds or touches your money – your money goes directly to our regulated FX partner (OFX) and then onto DriveWealth. When you withdraw your funds, it is the same, just the other way back!

Your cash and securities in the US are held in custody for your benefit with Citibank, one of the world’s largest banks.

Insurance

The US broker, DriveWealth, LLC is a US broker-dealer registered with FINRA (US regulator) and is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). You can read more about SIPC at www.sipc.org.

This protects you, as a non-U.S. citizen with an account at a brokerage firm that is a member of SIPC. Stake customers are treated the same as a resident or citizen of the United States.

No more Stake

In the unlikely situation that Stake goes down, you would still have access to all your cash and securities.

Our broker partner, DriveWealth and the custodian (Citibank) will establish access for customers if anything happens to Stake.

Account security

You have full control of your account and can enable advanced security in the form of 2 Factor Authentication (using an app like Google Authenticator or Authy) at any time.

Data

We work to meet the highest standards of the privacy regimes in Australia and all the markets we operate. As we are also a UK regulated firm, we adhere to a privacy policy that is set out in accordance with GDPR.

In terms of storing data, we encrypt and store all your data securely with AWS.

Stake vs eToro – conclusion

Stake vs eToro – is there a clear winner? No.

Both eToro and Stake have their benefits and you will be able to find out what the best platform is for you. If you are a simple straight-forward trading platform, with a clean interface, low fees and plethora of US stocks and ETFs to choose from? Then Stake is more suited to your style. If you enjoy arguing with people from all around the world, showcasing your latest trades, using leverage, or having the potential to earn a significant amount off people copying your trading. Then eToro is your platform. I use both platforms for trading. eToro is my main account and whatever I can find on eToro, I use Stake for.

They both offer great products for their traders and they are both similarly sized in terms of the Australian cohort. It can be hard to separate the two, it just depends on what you are looking for. One thing for sure is that they both are more enticing to me than the big 4 offerings.

What about you? Which platform are you thinking of using? Stake vs eToro – who do you have? Have I missed out on any critical information above? Let me know in the comments below.

Hi! I just wanna be sure about what you say about the PDT rule on etoro; Im a colombian trader who uses etoro, and I guess that if what you say is correct, Im able to open and close trades intraday without limit as long as it is not scalping. A I right?

Correct, as long as you’re not scalping, you should be fine. Etoro will warn you if your trading moves into scalping territory