In your investing journey, you’re going to come across dividends. I am going to go through dividends and break it down into easy to understand information. There’ll be tips why you should seriously consider dividend stocks as part of your portfolio.

What is a dividend?

It is a regular cash payment to you from the company you have invested in. Similar to a bank paying you interest on a savings account.

They tend to come out of the profits made by the company that year and are normally paid yearly or 6 monthly.

Why do only some companies offer a dividend?

Not every company offers it. More established companies with predictable profits tend to be the best dividend payers.

Those who do

Companies structured as MLPs (Master Limited Partnerships) and REITs (Real Estate Investment Trusts) are also top payers as a result of their designations require specified distributions to shareholders.

Those who don’t

Start-ups and other high-growth companies – such as those in the technology or biotech sectors – may not offer regular dividends. Companies in the early stages of development may not have sufficient funds to issue dividends.

Who decides to pay a dividend?

The Board of Directors are normally the ones who decide whether or not to issue a dividend payment

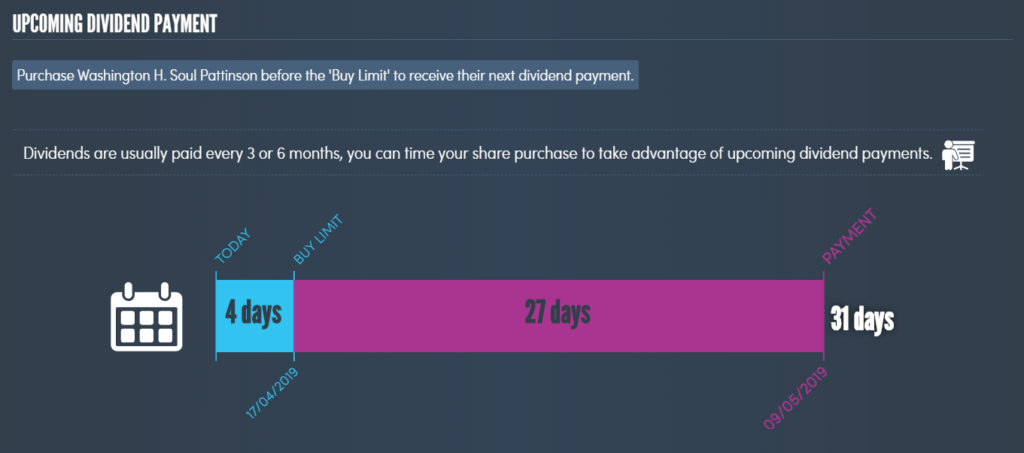

When do dividends occur?

There are some important steps for dividends to occur and what you need to do to receive them.

Declaration date — the day the board of directors announces its intention to pay a dividend.

In-dividend date

The last day to own stock to receive the payment. If you sell the stock, you won’t receive it.

Ex-dividend date

The day on which shares bought and sold, no longer come attached with the right to be paid the most recently declared dividend. Existing holders of the stock will receive the payment even if they sell the stock on or after that date, whereas anyone who bought the stock will not receive the payment.

Book closure date

when a company announces a dividend, it will also announce a date on which the company will ideally temporarily close its books for fresh transfers of stock.

Record date

Is the day when Shareholders registered in the company’s record as of the record date will be paid the dividend. If you’re not registered as of this date, you will not receive the payment. Most of the time, registration is automatic once you buy the shares.

Payment date

The day on which the payment will actually be done. Either mailed to shareholders or credited to their bank account.

How does this impact the stock?

It is relatively common for a stock’s price to decrease on the ex-dividend date by an amount roughly equal to the payment . This reflects the decrease in the company’s assets resulting from the declaration of the dividend.

Dividend Reinvestment Plan vs cash (pay out)

Some companies offer a cash payout or a Dividend Reinvestment Plan (DRIP). One of the great things about DRIP is that it allows shareholders to use those funds to buy more shares.

In some cases, the shareholder might not need to pay taxes on these re-invested dividends, but in most cases they do.

Think of it like compound interest. The interest gets reinvested back into it and continues to grow.

As an example, if you purchased $10,000 worth of 3M stock, 10 years ago, through the power of DRIP, it would now be worth approximately $51,000. If you think that’s cool, if you did the same with Apple, it would be worth a cool $117,000 today!

What the hell is Fully franked/Franked dividends?

In short, it means the company has already paid the tax on it, so you don’t get slugged with it later on. More common in Australia and normally referred to as “Franked” dividends. Investors receive a credit for the amount of tax already paid

Dividend Aristocrat

A company within the S&P500 index, that has continuously increased its payment for at least 25 years are commonly referred to as a dividend aristocrat. This core definition is consistent with that of the S&P 500 Aristocrats. However, there are also different definitions. As an example, Japanese companies only need 10 years of increasing dividends to get listed in the S&P/JPX Aristocrats.

Are Dividends worth it?

Some believe that company profits are best re-invested in the company: research and development, capital investment, expansion, etc. Proponents of this view (and thus critics of dividends per se) suggest that an eagerness to return profits to shareholders may indicate the management having run out of good ideas for the future of the company. Some studies, however, have demonstrated that companies that pay dividends have higher earnings growth, suggesting that the payments may be evidence of confidence in earnings growth and sufficient profitability to fund future expansion

Does eToro pay dividends?

Yes, these are the two situations for payment

Stocks and ETFs

When a stock pays a dividend, its following morning opening price will be at a lower rate depending on the amount of the dividend.

Should our liquidity provider charge or credit eToro for this gap, eToro will pass along this adjustment directly to the impacted positions with no markup or markdown.

If you hold a buy position, you will be credited with 70% of the gross dividend for US-listed stocks (Nasdaq and NYSE exchanges) and 85% for all other stocks.

If you hold a sell position, you will be debited with 100% of the gross dividend

Indices

The price gap of individual stocks causes the index in which the stock is a component to open at a lower rate as well. Should eToro’s liquidity provider charge or credit us for this gap, we will pass along this adjustment directly to the impacted positions with no markup or markdown.

If you hold a buy position, you will be credited with 75% of the gross dividend. If you hold a sell position, you will be debited with 100% of the gross dividend. Holding the position before market close, you will be entitled to the dividend, when it is announced.

You can check out my portfolio here to check out which of my stocks utilise this.

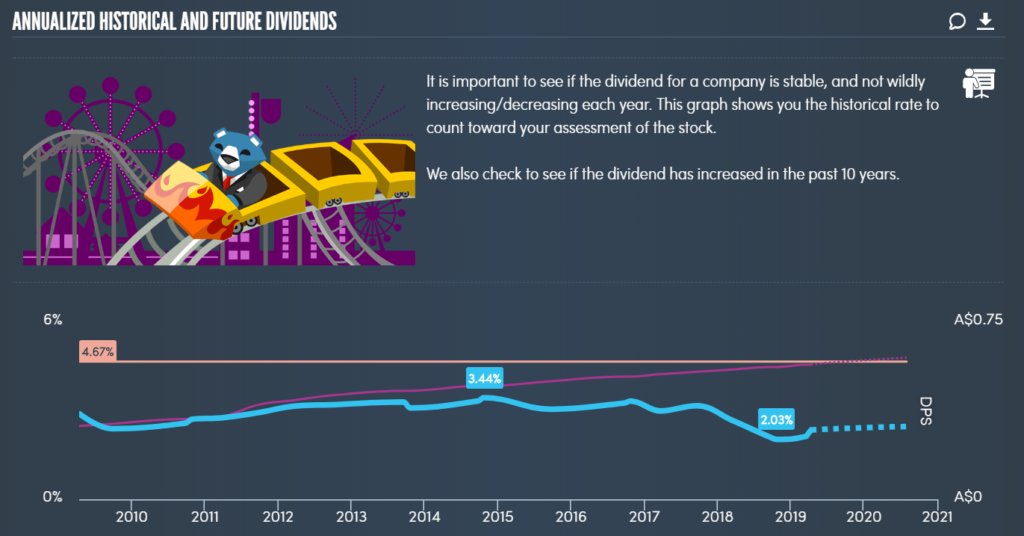

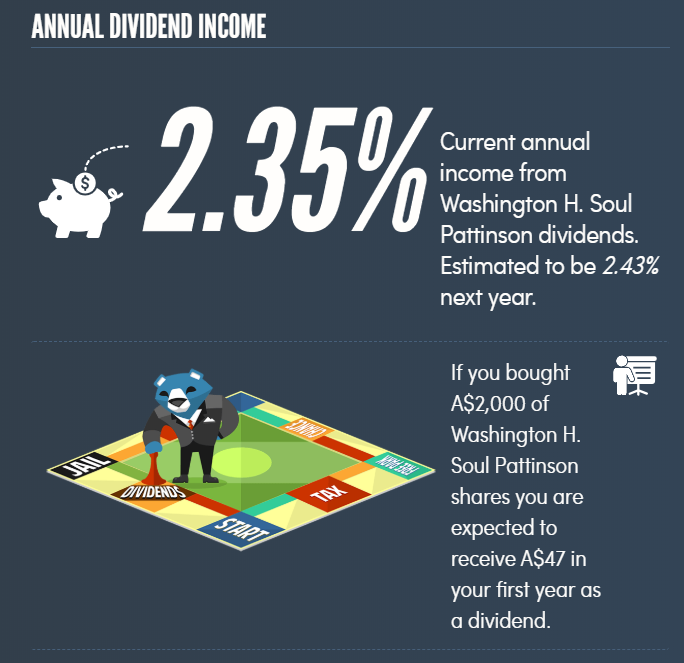

The images above are from Simply Wall St.

More information on dividends –https://en.wikipedia.org/wiki/Dividend and

https://www.investopedia.com/terms/d/dividend.asp

[…] would be Buy and Hold. Most of my investments I’ve held on to for 10+ years, taking advantage of dividend reinvestment programs (DRIPs). I have stocks that I’ve held onto for 15 years and others I buy and sell within a day (mostly […]

It’s actually a nice and helpful piece of info. I’m glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.