Have you seen the words stop loss and trailing stop loss and wondered, what is an eToro stop loss? Well, this guide will help you translate it into an easy to understand format.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

It is a risk management tool which aims to add protection to your investment. Essentially, it is the loss limit that you set on your position. If the price of my holding hits this target, close the trade.

So, on eToro, it is mandatory on every position with the exception of cryptocurrencies and real assets.

You can adjust it as you see fit and it can help you minimise your losses if the market decides to turn quickly.

Please note

If the holding opens at a rate lower than your eToro Stop Loss, it will take that opening figure. As an example, I bought stock X and its current value is $200 and I have an SL of $190. If during the aftermarket movement, it drops suddenly to $185 before the exchange opens, once the exchange opens it will automatically close as it has gone below the $190 SL target.

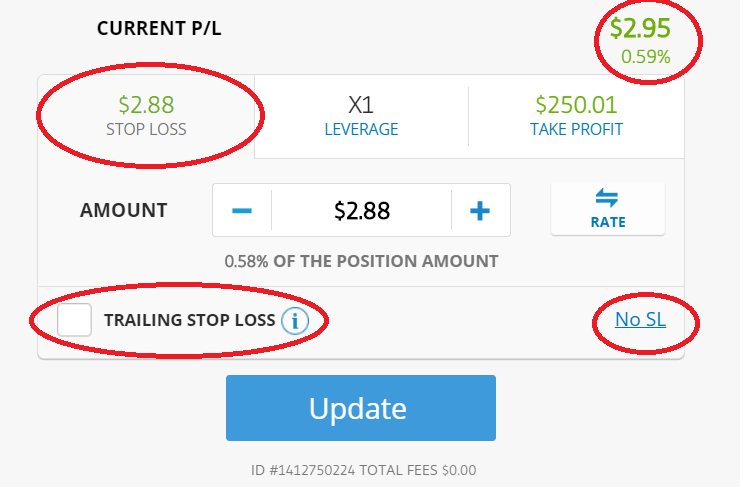

You can set your SL according to a specific level in the market (Rate) or as a monetary amount, which is also shown as a percentage of your initial investment in the trade window.

In normal market conditions, when the market reaches your requested rate and you have lost the predetermined amount, the SL order will trigger and automatically close your position.

What is a Trailing Stop Loss?

Trailing Stop Loss (TSL) is very similar to SL and something that eToro has featured in response to feedback from their community.

A TSL sets the SL order at a fixed amount of pips above or below the market price, depending on whether the position is SELL or BUY. As long as the market is moving in your favour, the SL will move with it, maintaining the same locked-in pip distance from the current market rate.

For example, if you set TSL for a BUY position, the stop-loss will rise with the market in one-pip increments. This is why it’s called a ‘trailing’ SL; as the price rises, the stop loss rises with it. However, if the market is moving in the opposite direction (falling) the stop loss will not change. A close order will be submitted when the stop loss rate is reached.

So – you have Stock X at $200 and you put a TSL at $180. If the stock goes up to $220, your TSL will go up to $196. So, the amount it rises, your TSL will rise with the stock. If the stock fell from $220 to $195, the TSL doesn’t move back down but stays where it was.

For a Buy position

Your TSL will rise with the price in increments and for a Sell position, it will fall in 1-pip increments. It is important to note that your stop loss will not change if the market is moving against you.

I found this feature very useful when I have a stock that I believe has run its course. I’ll set the TSL in the positive profit territory and let it run its course. Sometimes the stock continues to grow and I get more profit. Other times it falls and I catch it with the most profit I can.

The Stop Loss and Trailing Stop Loss are both important risk management tools in any traders arsenal.

What are the indicators around my stop loss?

Now and then, you’ll notice something different about your stop loss.

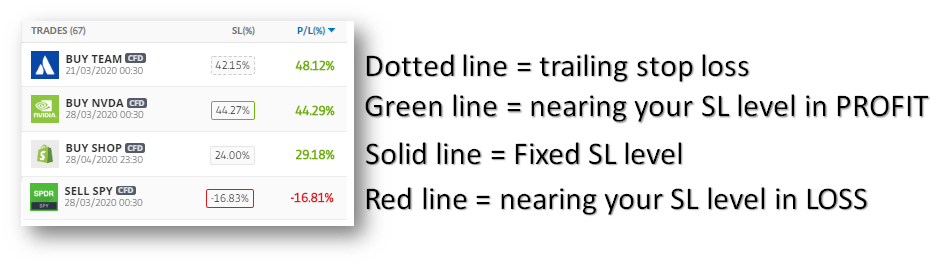

- A dotted line around your stop loss means that there is a trailing stop loss for that position.

- The solid green line around your stop loss means that you are nearing your stop loss level in profit.

- A solid line around your stop loss means that your stop loss is a fixed number.

- A solid red line around your stop loss means that you are nearing your stop loss level in LOSS

If you enjoyed this little piece of information, you’ll love reading about

You can find more information on SL and TSL here. Whilst you’re on eToro, feel free to check out my profile

Thanks for any other magnificent article. Where else could anybody get that type of information in such a perfect means of writing? I have a presentation next week, and I am at the look for such info.