Leverage means using capital borrowed from a broker when opening a position. Sometimes traders may wish to apply leverage in order to gain more exposure with minimal equity, as part of their investment strategy. Leverage is applied in multiples of the capital invested by the trader, for example 2x, 5x, or higher, and the broker lends this sum of money to the trader at the fixed ratio. Leverage may be applied to both buy (long) and short (sell) positions. It is important to note that any losses will be multiplied as well as profits.

What is Margin?

A margin is the relative amount needed to carry out a leveraged deal, taking into account spreads, leveraging, and currency conversions. Let’s say you want to invest $1,000 in Apple stock at a leverage ratio of 1:10. The margin will be 10%, meaning you will need to invest $100. If the current stock price for Apple is $136, you will receive the equivalent 7.35 Apple shares.

How Does Leveraging Work?

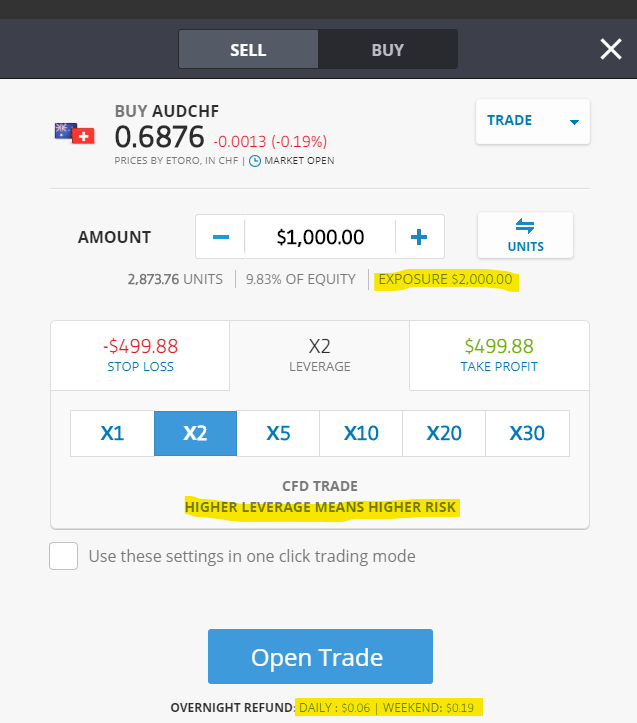

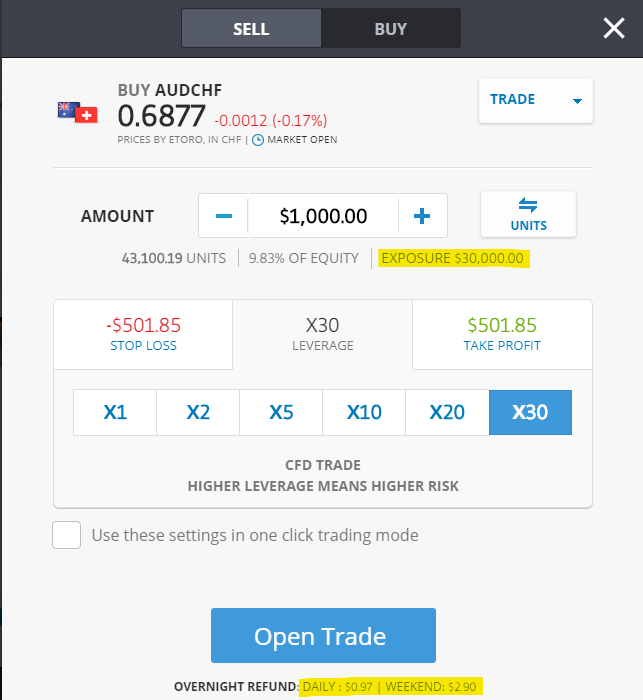

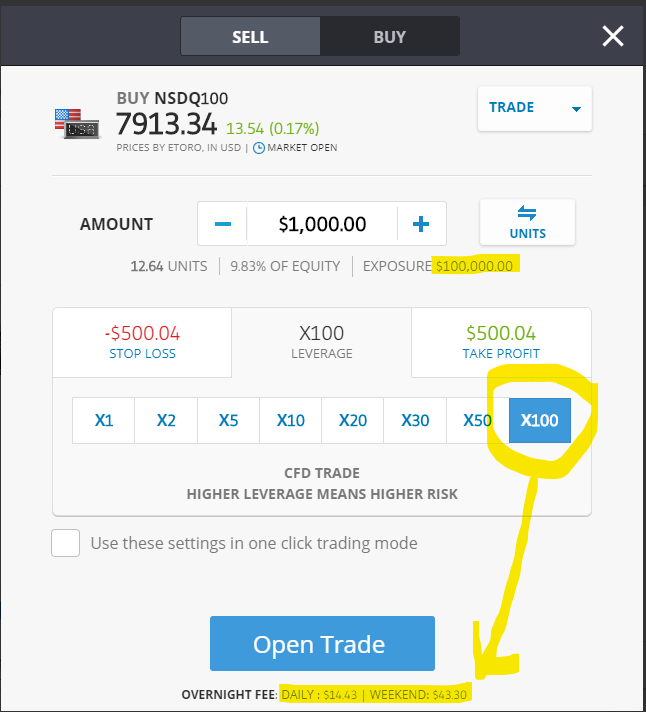

Choose the asset you are interested in trading on the eToro platform and click TRADE. A popup window with the trade parameters will appear, as illustrated below.

Select the appropriate tab at the top for Sell (short) or Buy (long) for your trade.

Set the amount of capital you wish to invest in this trade. Set your leverage multiplier. This ratio differs depending upon the individual asset. Alternatively, you can also trade without using leverage by choosing 1x.

Set your Stop Loss and Take Profit parameters. A Stop Loss limitation is required in order to mitigate the possible risk to your capital.

Click SET ORDER to place the trade. Trades are executed immediately when the market is open.

Leveraged trades are processed as CFDs. To learn more about CFD trading, click here.

Which Instruments Can I Apply Leverage To?

Leverage may be applied when trading stocks, currencies, ETFs, commodities and indices, and, in certain circumstances, cryptocurrencies. Each instrument has maximum leverage limitations which are guided by industry regulations, as well as eToro’s own efforts to promote responsible trading and mitigate the risks of trading with high leverage. For more information on specific limitations, click here.

Maximum exposure will also vary by account type. An eToro Professional Client account allows for higher leverage, as well as a host of other benefits such as reduced margin rates and no withdrawal fees. Only clients who meet certain criteria can opt up to become a Professional Clients. If you wish to read more about Professional Client status, please click here.

What Can I Do To Minimise Risk When Trading With Leverage?

While trading with leverage can lead to increased profits on successful trades, it also carries the risk of magnified losses. There are, however, risk-management tools at your disposal on eToro to help reduce potential loss.

Stop Loss: Apply a Stop Loss to close a trade in the event that the market moves a specified amount against your position. You can set your Stop Loss according to a specific level in the market (Rate) OR as a monetary amount, also shown as a percentage of your initial investment, in the trade window.

Take Profit: Set a Take Profit order to automatically close your position when profit on your trade hits the amount you choose.

Negative balance protection: Although not required by law, in the rare occasion in which market conditions cause your account’s balance to go negative, eToro will absorb the loss and balance your account back to zero.

What Are The Fees For Trading With Leverage?

Overnight fees (also called rollover fees) are calculated using unified equations and will appear in the trade popup window before you set your order. To learn more about how these rates are calculated, click here.

Examples of leverage:

Invested Amount Leverage Trade Size

$50 x 1:20 = $1,000

$200 x 1:30 = $6,000

$400 x 1:10 = $4,000

On eToro, each instrument has its own leverage minimum and maximum, so make sure to choose a leverage level which is right for you.

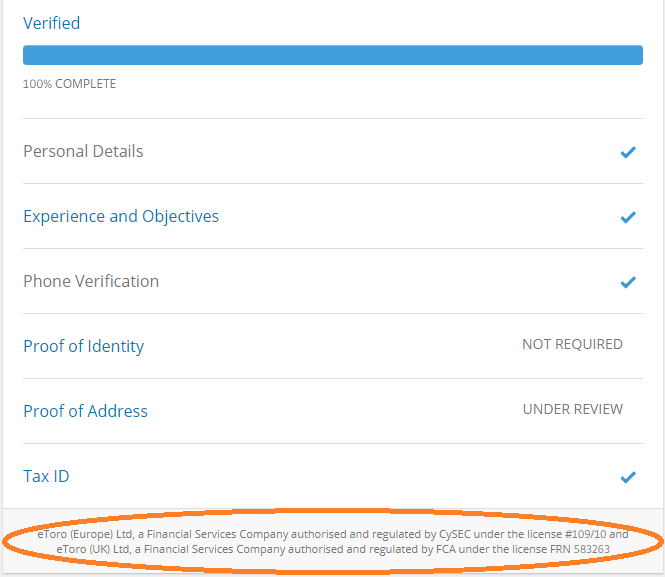

To find out which regulation your account is under, go to your account settings

Leverage, otherwise known as risk level, is a temporary loan given to the trader by the broker. It enables you, as the trader, to open a trade of a larger size with a smaller amount of invested capital. It is presented in the form of a multiplier that shows how much more than the invested amount a position is worth.

The best way to understand leverage is through an example of how it affects your profit or loss potential. If you trade with no leverage at all and invest $1,000, for every 1% move in the market you can gain or lose $10, which equals 1% of $1,000.

In comparison, if you were to invest the same $1,000 and trade using x10, the dollar value of your position would be equal to $10,000.

1% of $10,000 equals $100, so for every 1% move in the market you can gain or lose $100.

When opening a trade, you can decide if you wish to use leverage or not. Different instruments have different leverage limitations.

Limitations

The following limitations are defined by the European Securities and Markets Authority (ESMA), and apply to retail clients of eToro (Europe) Ltd (CySEC regulated) and eToro (UK) Ltd (FCA regulated):

- x30 for major currency pairs (such as EUR/USD)

- x20 for non-major currency pairs (such as EUR/NZD), Gold and major indices

- x10 for commodities other than Gold and non-major equity indices

- x5 for CFD stocks and ETFs

- x2 for cryptocurrency CFDs.

Any retail client who meets certain criteria may opt in and apply to become an Elective Professional client in order to be outside these limitations.

Other clients

The Non-EEA retail clients of eToro (Europe) Ltd and eToro (UK) Ltd may continue to trade with higher leverage by applying to eToro Australia Capital Ltd on the platform.

It is important to be aware that clients with Elective Professional status and clients of eToro Australia Capital Ltd are not entitled to all protections that retail clients have under CySEC or FCA regulations.

The following limitations apply to Professional clients and clients of eToro Australia Capital Ltd (ASIC regulated):

- x400 for currency pairs

- x100 for commodities and indices

- x20 for selected CFD stocks

- x10 for other CFD stocks and ETFs

- x2 for cryptocurrency CFDs.

Please note that the use of leverage carries with it a higher degree of risk because leverage augments both gains and losses. If you use leverage on a trade and the market moves against you, your loss per pip will be greater than if leverage had not been applied.

Can traders in the USA use leverage?

Unfortunately, eToro does not offer the option to trade with leverage in the USA.

Once you understand leverage, you can look at the rest of my eToro posts and investing guide.

[…] lot of traders use leverages for their trading but I would advise against this whilst you’re learning how to trade. Also, […]

I’m impressed, I need to say. Really rarely do I encounter a blog that’s each educative and entertaining, and let me let you know, you might have hit the nail on the head. Your thought is outstanding; the problem is one thing that not enough individuals are talking intelligently about. I’m very happy that I stumbled across this in my search for something relating to this.