Hi everyone! Welcome to my eToro Portfolio review for 2021. Here I’ll go through my eToro portfolio each month and document how I’m tracking against my goals and what is in store for my portfolio.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

2021 – eToro portfolio review

There are several categories I’m going to cover in my monthly reviews. Firstly, I’ll look at my trading goals for the year, review each month of trades, track how my Top 5 Stock Picks are performing and give an excellent analysis of where the portfolio is heading.

2021 Portfolio Goals

These are my goals for the year.

| Category | Start of 2021 | End of 2021 Goal | YTD Progress) |

| Copiers | 20 | 40 | 20 |

| Followers | 5650 | 7000 | 5746 |

| AUM | $13,280 | $30,000 | $26.6k |

| Realised Profits | 0 | 12% | 6.72% |

| Portfolio Growth | 0 | 17% | 17.06% |

| SP500 beat | 0 | TRUE | No (17.06% vs 22.83%) |

| Risk | 4 | 4 | 4 |

| Avg Profit | 0 | +10% | 15.22% |

| Avg Loss | 0 | < -10% | -15.29% |

October 2021 – eToro Portfolio Review

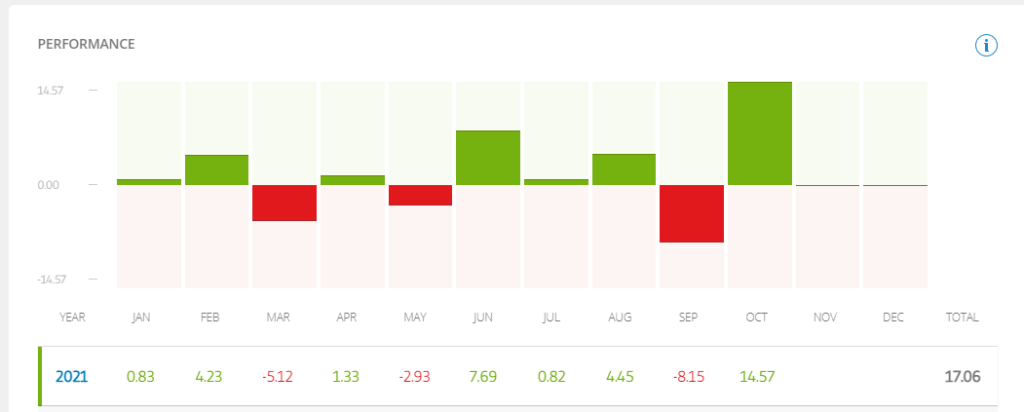

It’s been a long time between updates. Unfortunately, lockdown, homeschooling and lack of time have hindered my ability to provide updates regularly, but the portfolio has continued performing in the background. We had our best month ever since joining eToro, which was an excellent result for October. The growth for October brought our portfolio growth ever closer to the SP500 comparison.

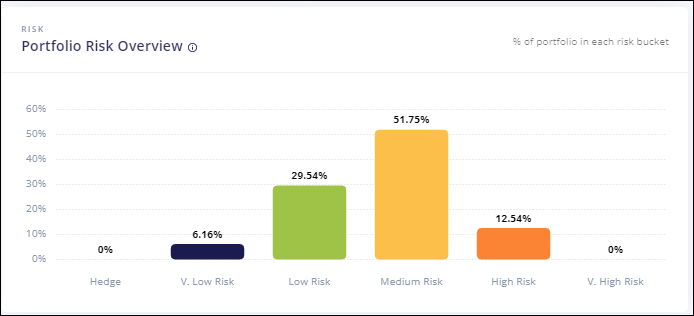

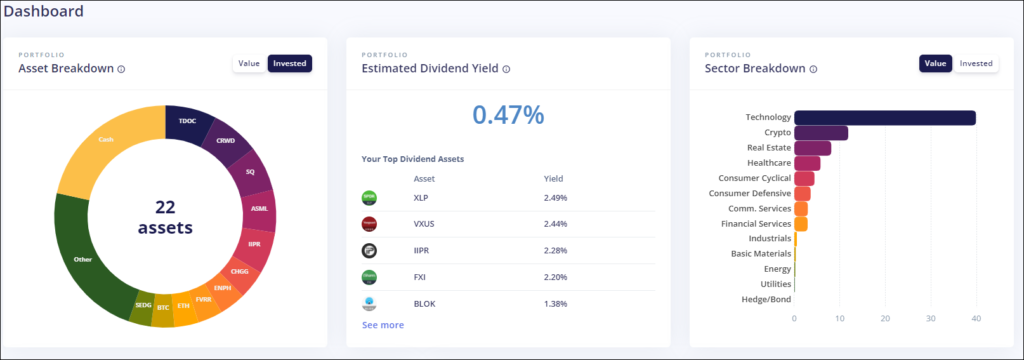

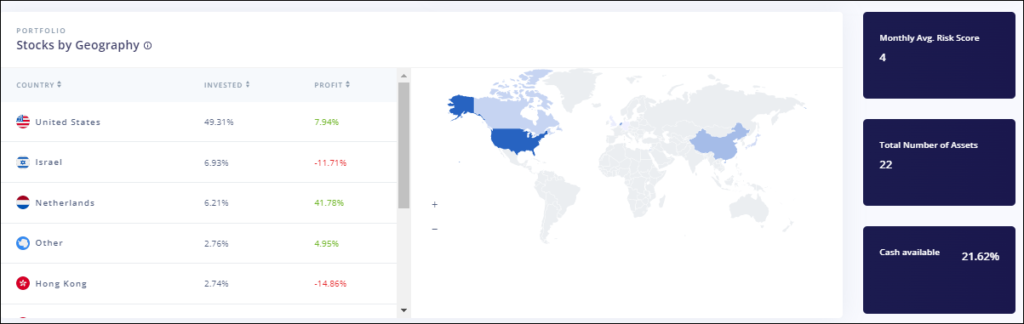

62 trades were closed from June 2021 – October 2021, with an average profit of 2% per trade. Whilst not a significant number, it is in the positive realm. So, our risk is hovering around the 4-5 level, aligning with how the over portfolio is performing. A new addition to this review is leveraging a new platform passed on to me called Bullsheet – this website works with eToro and provides some great insights to traders. I’ll be doing a full review of the platform soon, but I thought I’d use it this month to give a taste of what it can do for you.

Portfolio Growth

October saw our best month ever with +14.57% growth, and our portfolio reached an all-time high since joining eToro. The growth was due to nice gains with cryptocurrency and our solar stocks. These gains have set us up nicely and ensured we are on target for our +17% portfolio growth for 2021.

Realised Profits stats

My eToro Portfolio had some incredible growth, but I have slowed down on closing trades to ensure no significant capital gains/losses. Another problem is that as my portfolio grows, it impacts the realised gains figures. So, whilst the returns have reduced to the 6% mark, it is still relative to the overall portfolio growth.

Top 5 Stock Picks Progress

At the start of 2021, I picked 5 of my favourite stocks that I believe will have a breakout year. I also put my money where my mouth is, making these five stocks some of the largest holdings in my eToro portfolio account. At the end of October 2021, they made up approximately 33% of my portfolio. This is how they are fairing in 2021.

| Ticker | Name | Open Price | End Oct Price | % up/down |

|---|---|---|---|---|

| ASML | ASML Holding NV | $499.99 | $807.45 | 61.49% |

| CRWD | Crowdstrike Holdings Inc | $209.96 | $269.17 | 28.20% |

| ENPH | Enphase Energy Inc | $178.70 | $239.53 | 34.04% |

| IIPR | Innovative Industrial Properties Inc | $184.00 | $268.45 | 45.09% |

| TDOC | Teladoc Health Inc | $199.80 | $151.53 | -24.16% |

Overall, these stocks have had a great 2021, outpacing the SP500 for growth. ENPH had a stellar bump in October due to a better than expected earnings call and positive sentiment from the US Government favouring the sector. ASML leads the way with +61% growth for the year, which is outstanding considering the chip shortages for the year, so I’m expecting a solid finish to 2021 and an even better 2022. Overall, these stocks are well-positioned to finish 2021 in the positive. We’ll keep an eye on TDOC – I have faith in its long term growth, so we’ll look for more opportunities to increase the positions.

The Above and Beyond Club

These stocks are going above and beyond – so they are crushing their returns and setting up our portfolio nicely. I’ll highlight these stocks, the average number of trades, and the average closing % each month. Because nobody ever went broke taking profit!

| Stock | Avg % Gain | # of Trades |

|---|---|---|

| Qudian Inc. | 49% | 6 |

| Enphase Energy Inc. | 23% | 9 |

| Square, Inc. | 22% | 3 |

| Teladoc Health Inc | 21% | 11 |

| Fiverr International | 20% | 17 |

Nothing changed in our above and beyond club for October 2021.

Visual Portfolio Review – Bullsheet

As I noted above, I’ve been diving into Bullsheet website and found it quite helpful. It provides a wealth of information covering from risk overview, where your stocks companies are located, asset breakdown, sector breakdown, and much more detail. For those copying others, it also provides good insight into copytraders and how their portfolio breaks down and how desynced you are from the trader. I highly recommend you check out the website.

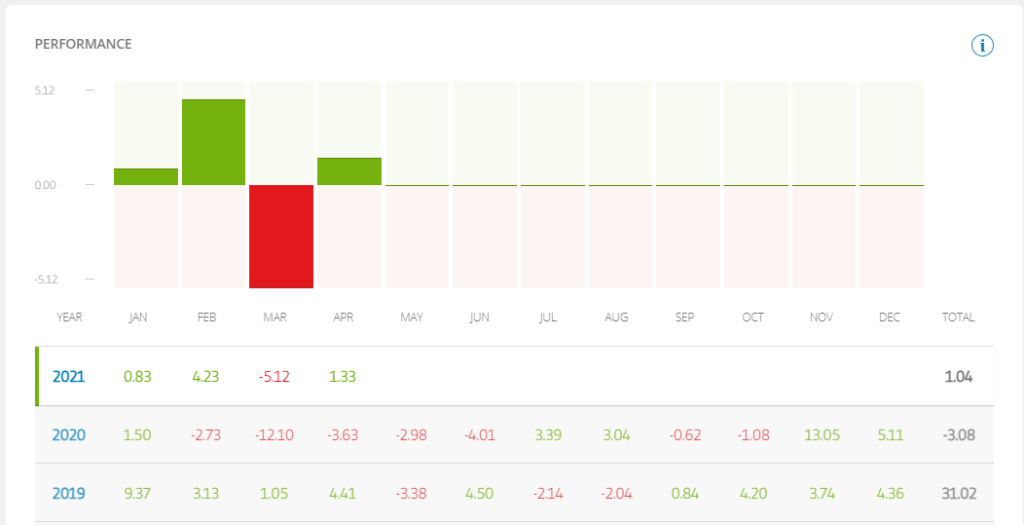

April 2021 – eToro Portfolio Review

We were back in the green for April, but our portfolio still lags behind our benchmark of the SP500. Whilst we compared better to April 2020, we still have a long way to go to get back to where I’d be comfortable. We have some strong stocks that have taken a hit, so I will continue to hold on to them as they have a long pathway ahead. We don’t measure our success from month to month but rather over the years. I have complete confidence that these stocks will outperform in the long run.

Only a few stocks closed this month, so our realised returns didn’t move much in the grand scheme of things. Our risk is staying around the six mark, which correlates to a more significant allocation to the top 5 stocks I picked out at the start of the year. As time progresses, I’ll reduce the number of holdings to around 20 in my portfolio, which should even the risk across these shares.

Portfolio Growth

Our stocks saw mediocre returns for April compared to the growth of the SP500. This is due to our larger allocation taking a significant hit during April, but we still ended the month in green territory. Hopefully, this has set us up for a prosperous year. However, we noted that there is still a downtrend coming into May, where traders usually sell up and do not interact with the volatility that usually follows in April.

Realised Profits stats

My eToro Portfolio had great returns, and I took profits where required. This shows by the +11% realised profits this year. Significantly up from the year before. As my equity grows, I have to continue making a profit because the realised profits have to grow as the portfolio grows. Otherwise, the % ratio will be off. So, you can see my progress in the Above and beyond club below for my outstanding performers.

Top 5 Stock Picks Progress

At the start of 2021, I picked 5 of my favourite stocks that I believe will have a breakout year. I also put my money where my mouth is, making these five stocks the five largest holdings in my eToro portfolio account. At the end of April 2021, they made up approximate 6.5% (each) of my account – so a little under 33% of my portfolio. This is how they are fairing in 2021.

| Ticker | Name | Open Price | End Mar Price | % up/down |

|---|---|---|---|---|

| ASML | ASML Holding NV | $499.99 | $648.10 | 29.62% |

| CRWD | Crowdstrike Holdings Inc | $209.96 | $208.51 | -0.69% |

| ENPH | Enphase Energy Inc | $178.70 | $139.25 | -22.08% |

| IIPR | Innovative Industrial Properties Inc | $184.00 | $183.13 | -0.47% |

| TDOC | Teladoc Health Inc | $199.80 | $172.35 | -13.74% |

There were mixed results for April, three stocks growing from their previous month’s results and the other two decreasing – most notably ENPH. ASML continues to shine with a nearly 30% increase YTD, but they could be in trouble with the chip shortage. There are still many more months to go in 2021; I have faith in these stocks. We’ll update this month by month to see how they are progressing, for instance.

The Above and Beyond Club

These stocks are going above and beyond – crushing their returns and setting up our portfolio nicely. I’ll highlight these stocks, the average number of trades, and the average closing % each month. Because nobody ever went broke taking profit!

| Stock | Avg % Gain | # of Trades |

|---|---|---|

| Qudian Inc. | 49% | 6 |

| Enphase Energy Inc. | 23% | 9 |

| Square, Inc. | 22% | 3 |

| Teladoc Health Inc | 21% | 11 |

| Fiverr International | 20% | 17 |

Nothing changed in our above and beyond club for April.

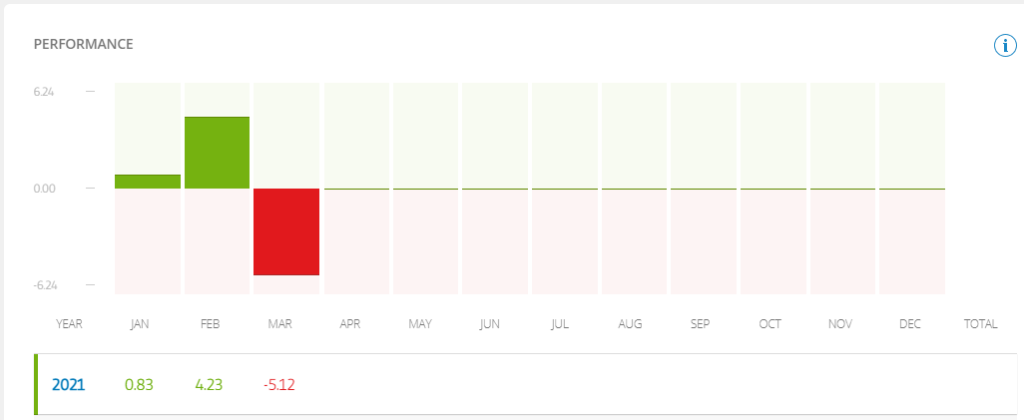

March 2021 – eToro Portfolio Review

A below-average return for March, with the portfolio dropping -5.12%. I will note that I didn’t react the same way as in March 2020, where the market also turned. In 2020, I tried to time the market and buy/sell when possible. This time around, I stuck to my strategy and hardly sold anything. This resulted in a loss of only 50% compared to last year. I see this as a lesson learned and applied to my strategy.

Portfolio Growth

Our stocks saw some great returns in the first six weeks of the year, with only a downturn wiping out most of those profits, for instance. So, this was a healthy downturn as we were up 15% at one stage in February, which is not sustainable for our portfolio. Fortunately, I took some profit and reinvested those funds in some of my favourite stocks. I’ve reduced my holdings and moved into more diversified ETFs to offset some of the volatility while still taking advantage of the growth.

Realised Profits stats

My eToro Portfolio had great returns, and I took profits where required. This shows by the +12% realised profits this year. Significantly up from the year before. As my equity grows, I have to continue making a profit because the realised profits have to grow as the portfolio grows. Otherwise, the % ratio will be off. You can see my progress in the Above and beyond club below for my outstanding performers.

Top 5 Stock Picks Progress

At the start of 2021, I picked 5 of my favourite stocks that I believe will have a breakout year. I also put my money where my mouth is, making these five stocks the five largest holdings in my eToro portfolio account. At the end of March 2021, they made up approximate 5.9% (each) of my account – so a little under 30% of my portfolio. This is how they are fairing in 2021.

| Ticker | Name | Open Price | End Mar Price | % up/down |

|---|---|---|---|---|

| ASML | ASML Holding NV | $499.99 | $617.36 | 23.47% |

| CRWD | Crowdstrike Holdings Inc | $209.96 | $182.51 | -13.07% |

| ENPH | Enphase Energy Inc | $178.70 | $162.16 | -9.26% |

| IIPR | Innovative Industrial Properties Inc | $184.00 | $180.16 | -2.09% |

| TDOC | Teladoc Health Inc | $199.80 | $181.75 | -9.03% |

So, we can see that they got hit during March except for ASML. There are still nine months to go for the 2021 year, but we are thinking long term. We’ll update this month by month to see how they are progressing.

The Above and Beyond Club

So, these stocks are going above and beyond – crushing their returns and setting up our portfolio nicely. I’ll highlight these stocks for each month, the average number of trades, and the average closing %. Because nobody ever went broke taking profit!

| Stock | Avg % Gain | # of Trades |

|---|---|---|

| Qudian Inc. | 49% | 6 |

| Enphase Energy Inc. | 23% | 9 |

| Square, Inc. | 22% | 3 |

| Teladoc Health Inc | 21% | 11 |

| Fiverr International | 20% | 17 |

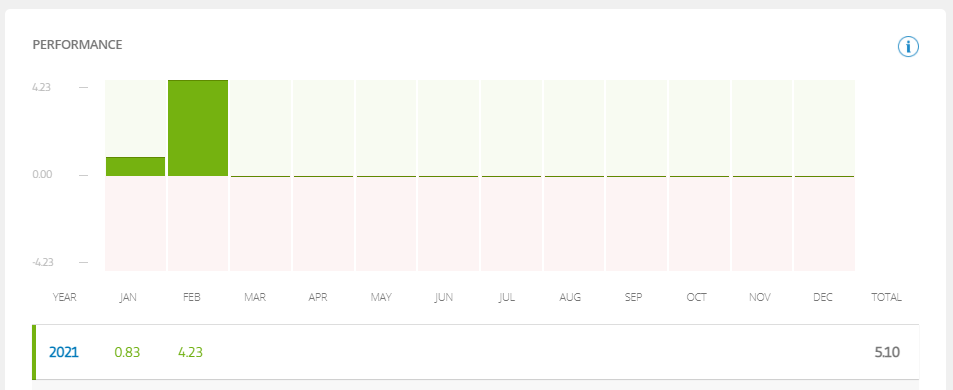

February 2021 – eToro Portfolio Review

A solid start to the year with two months of green, fairing better than the major indices. There will be some turbulence in March as the anniversary of the crash comes back to haunt people. We already saw a slight downturn in the last few weeks of February, but we kept our head above water to close out February in positive territory.

Portfolio Growth

Our stocks saw some great returns in the first six weeks of the year, with only a downturn wiping out most of those profits. This was a healthy downturn as we were up 15% at one stage in February, which is not sustainable for our portfolio, for instance. Fortunately, I took some profit and reinvested those funds in some of my favourite stocks. I’ve reduced my holdings and moved into more diversified ETFs to offset some of the volatility while still taking advantage of the growth.

Realised Profits stats

My eToro Portfolio had great returns, and I took profits where required. This shows by the +12% realised profits this year. Significantly up from the year before. As my equity grows, I have to continue taking profit because as the portfolio grows, the realised profits have to grow as well. Otherwise, the % ratio will be off. moreover, You can see my progress in the Above and beyond club below for my outstanding performers. In conclusion, out of the 225 closed trades this year, 195 were closed in profit (86% in profit). 37 of those in profit closed above 20%.

Top 5 Stock Picks Progress

At the start of 2021, I picked 5 of my favourite stocks that I believe will have a breakout year. I also put my money where my mouth is, making these five stocks the five largest holdings in my eToro portfolio account. At the end of Feb 2021, they made up approximate 5.3% (each) of my account – so a little of 25%. This is how they are fairing in 2021.

| Ticker | Name | Open Price | End Feb Price | % up/down |

|---|---|---|---|---|

| ASML | ASML Holding NV | $499.99 | $567.09 | 13.42% |

| CRWD | Crowdstrike Holdings Inc | $209.96 | $216.00 | 2.88% |

| ENPH | Enphase Energy Inc | $178.70 | $176.06 | -1.48% |

| IIPR | Innovative Industrial Properties Inc | $184.00 | $195.00 | 5.98% |

| TDOC | Teladoc Health Inc | $199.80 | $221.09 | 10.66% |

So, we can see that they have had a solid start, but there are still ten months to go. We’ll update this month by month to see how they are progressing.

The Above and Beyond Club

These stocks are going above and beyond – crushing their returns and setting up our portfolio nicely. I’ll highlight these stocks for each month, the average number of trades, and the average closing %. Because nobody ever went broke taking profit!

| Holding | No. of Trades | Avg % Gain |

|---|---|---|

| Qudian | 6 | 49% |

| Enphase | 9 | 23% |

| Square | 3 | 22% |

| ASML | 5 | 22% |

| Lemonade | 8 | 21% |

| Teladoc | 11 | 21% |

| Fiverr | 17 | 20% |

Final thoughts on my eToro Portfolio Review

It has been a solid start to the year. I was glad to see January close in profit – I. Every January, I have traded on eToro, I have closed January in profit, so it is good to see that streak continue. We’ll have to see what happens in March as the end of February started to decline, taking out most of my portfolio growth year to date, but we’re still in positive territory for the year.

If you’re looking for people to copy, why not check out my latest list of people from my Top Copy Traders Competition.