Innovative Industrial Properties, Inc. ($IIPR) is a long term play for me. A long term play means at least a 2-3 year holding for the best benefits. IIPR focuses on acquiring ownership and management of specialised properties leased to experienced, state-licensed operators for their regulated medical-use cannabis facilities. Simply put, they buy and lease warehouses when cannabis companies can grow their weed. This post will go over some key highlights and critical risks to acknowledge. Please note that I hold IIPR in my eToro portfolio.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Who is IIPR, and what do they do?

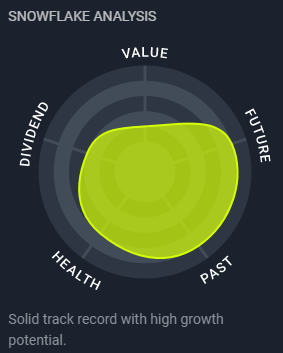

IIPR is one of the first public traded companies to provide real estate to the medical-use cannabis industry. Essentially, they are like a REIT solely in the cannabis industry. They’re growing, and they’re snowballing. At the moment, they have over 70 properties across the U.S. – equating to nearly 55,000m2 of space. IIPR also give out a dividend of around 2.9% yield, so it is attractive over the long term.

What is so special about IIPR?

Investors are sometimes sceptical of putting their money in cannabis stocks, as the drug remains illegal at the federal level. Upon closer inspection, IIPR offers them a safer choice. Why? It only offers real estate capital for the medical cannabis industry but has no direct involvement with cannabis. Hence, it is safe from the legal scrutiny the marijuana industry faces while still enjoying the benefits of its evolution. As far I’m concerned, they are just a company that rents out warehouses. What you do in the warehouse is up to you.

Since its IPO in December 2016, Innovative Industrial Properties’ shares have surged a whopping 970%. Any investor can see the change in the cannabis industry over the last five years. The change is continuing with more and more states within the U.S. allowing cannabis use. As of 2021, seventeen states, two U.S. territories, and the District of Columbia have legalised the recreational use of cannabis. Thirty-six states, four U.S. territories, and D.C. have legalised the medical use of the drug.

How are IIPRs finances?

In short – they’re strong. In its fourth-quarter December 2020, IIPR’s revenue saw an exciting jump of 110% year-over-year to $37.1 million. For the full year 2020, total revenue grew 162% from the year-ago period to $117 million. IIPR is also profitable, with net income rising to $21 million from $9.5 million in the year-ago period. Besides this significant growth, the dividend payout is sticking around 2.9%. What is incredible is that, as a REIT, IIPR is legally bound to pay 90% of its earnings as dividends to shareholders.

Checking out the Investor Relations reports, we can see the Balance Sheet Highlights (at December 31, 2020)

- Approximately $126.0 million in cash and cash equivalents and approximately $619.3 million in short-term investments, totalling approximately $745.3 million.

- No debt, other than approximately $143.75 million of 3.75% exchangeable senior notes maturing in 2024 (the Exchangeable Senior Notes), representing a fixed cash interest obligation of approximately $5.4 million annually, or approximately $1.3 million quarterly.

- 7.9% debt to total gross assets, with over $1.8 billion in total gross assets.

Where’s my rent money?

IIPR collected 100% of contractual rent due for the fourth quarter 2020 and 100% of contractual rent due for the months of January and February 2021 across IIPR’s total portfolio, other than:

- The tenant at IIPR’s Los Angeles, California property that was in receivership until IIPR signed a new lease with Holistic for the entire property in January 2021; and

- Medical Investor Holdings, LLC (Vertical), the tenant at specific properties in southern California, made partial payments of contractual rent due during these periods. Vertical occupies’ properties represented less than one per cent of IIPR’s total gross assets at year-end.

So we’re looking at two properties of their nearly 70 paying up and on time. That cash flow is a beautiful thing to watch.

IIPR’s Sale-Leaseback Program

A great thing about IIPR is that it acquires freestanding industrial and retail properties from state-licensed medical-use cannabis operators. The properties are then leased back under long-term, absolute net lease agreements. They focus on well-capitalised companies that have successfully gone through the rigorous state licensing process and have been granted a license in the state where the property is located. IIPR said this:

We act as a source of capital to these state-licensed operators by acquiring and leasing back their real estate. This allows for the opportunity to redeploy the proceeds into core operations, yielding a higher return than they would otherwise get from owning real estate.

How safe is IIPR from the volatility in the cannabis industry

It is no secret that the marijuana industry is volatile. Regulatory hurdles have been affecting legal store openings in Canada, which impacts revenue. And in the U.S., the illegality of the drug prevents pot companies from having access to an influx of capital to set up more extensive production facilities. Banks and financial institutions shy away from providing financial help to avoid getting penalised.

Here’s the sneaky loophole – being a REIT, Innovative does have access to such capital. Thus, it acquires these production facilities from the cannabis companies and leases right back to them. The rental income earned from leasing becomes the only and ongoing source of revenue for IIPR.

What are the risks for IIPR?

Getting in early for IIPR in the REIT cannabis market has paid (literally) dividends for them. As the market becomes more accessible due to ongoing marijuana legalisation, how will this impact it? The thing that’s made IIPR stock special is that the company can effectively lend to cannabis companies. If marijuana continues down this path, this could eat into their profits as companies start accessing better loans from the bank. But, smaller companies won’t have the capital to innovate at a larger scale, meaning that there will always be a market for IIPR.

The SAFE Banking Act

The SAFE Banking Act would protect banks that lend to marijuana companies in individual states where cannabis is legal. As more states legalise cannabis, this Act could pass through. However, at the moment, it stalled out in the Republican-majority Senate. But this was before Joe Biden took over, and now the Democrats have the Senate and presidency. So, in theory, the SAFE Banking Act could become law. However, if it becomes law, cannabis companies could borrow from banks directly, significantly reducing the need to rely on third-party intermediaries such as Innovative Industrial Properties. I’m just going to be watching the legal developments closely. Suppose marijuana is legalised or other stopgap measures such as the SAFE Banking Act are passed. In that case, it’d likely put an end to the company’s unusually high levels of profitability.

Final thoughts on IIPR

I like the stock – I like its approach, how it brings in money and has carved out its niche in a growing area. I think it is a long-term hold, even with the SAFE Act looming. There will always be reserved banks and small companies needing to seek capital to grow their enterprise. I’m thinking of holding this stock for at least 2-3 years.

What about you? Do you think IIPR will go up in smoke? Should you hold it in your portfolio?

The above article was put together with analysis from