Even the greatest stock pickers of all time make investing mistakes. Investing is a funny business. It makes billions upon trillions but people still make mistakes. No one on the face of this planet is exempt from these mistakes but you can learn to spot these investing mistakes and ensure that there is little impact on your portfolio.

Throughout my trading experience, particularly on the social trading platform, eToro, where every trade is scrutinised, knowing what to look out for is paramount.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

These are my top 6 investing mistakes you make when in the stock market. They might not apply to every one of you but I can assure you that at some stage in your investing career, you’re going to come across the potential investing mistakes.

Attempting to time the market.

What does it mean to time the market?

To time the market is to essentially buy/short the market just before a turn. So, if you were buying a stock, you would buy at the very low of a recent dip to maximise your profits. If you were shorting a market, you would short just at the peak, maximising your profits as the market fell. It’s one of the key investing mistakes when trading.

Attempting to time the market example

Below is the chart for TSLA over the last month or so. You see peaks and troughs where the price has fluctuated, normally in a short time frame.

Why is timing the market bad?

Timing the market is bad for many reasons.

- It’s pretty hard to do. There are so many variables in the market that everything and anything can influence the price in a heartbeat.

- It’s not that better than continuous investing. Research shows that instead of trying to buy/sell at the peaks and troughs, just investing continuously (say $500 each month) comes out on top compared to buying the dip with perfect timing. This is probably due to the time between peaks and troughs.

Is it possible to time the market?

It is possible to time the market but it is hard to do it consistently. Sure, I’ve hit the peak or bottom a few times but never done it twice in a row. There’s a significant amount of research needing to be done to read charts, analyse news, and other factors. So it could be done but that’s a rarity. So, anything can set it off on a different path – tweets, news items, videos etc – in the age of modern technology, it only takes a few minutes for the market to turn.

Who said time in the market not timing the market?

It is timeless advice from Peter Lynch. Peter is recognised as one of the best investors and mutual fund managers that have ever lived. He managed the Magellan Fund at Fidelity Investments between 1977 and 1990. During this period, the fund averaged an annual return of 29.2%. That is nearly 3 x the average return of the SP500 for 14 years. That’s why people listen to his wise words.

So, to put that in perspective, if you invested $10,000 with Peter in 1977, in 1990 it would have been worth $361,139. Not bad!

What is the biggest risk of market timing?

The biggest risk of market timing is that you will never get it consistently right. If someone was able to time the market, that people would be very very very very rich – multi-trillionaire rich type thing.

Is it better to buy and hold?

Attempting to time the market is one of the worst things a trader can do. There is an expression traders use when the market is in decline – “Catching a falling knife”. If the market is falling, why try to catch and risk injuring yourself (or your portfolio). Would it not be better to wait until the knife has fallen and is laying on the ground? Buy and hold only works if it fits within your time horizon (i.e. how long can you invest for). For younger investors, being in the market longer is better suited when compared to someone close to retirement age. On average, yes, it is better to buy and hold, rather than trying to time the market.

Not understanding what you’re investing in.

After asking yourself how to avoid investment mistakes, there’s a lot of things that will run through your mind. So a common blunder investors make is not understanding what their investing in. Some traders buy stocks because they like the company name or because they heard someone else talk about it. You need to do your due diligence on your investments. Normally it’s a product you believe in and often use. Things like Google, Amazon, Apple, XI are all around us every day. Once you start noticing these investment opportunities, you can start to see trends.

Storytime

One of the stocks I trade is Square (SQ). I first came across square years ago and didn’t think much of it – it was an EFTPOS style payment machine and that’s as far as I got. Then probably a year or two later I was in the middle of a country town, passing through with my family. We came across the local fair and goods events so we thought we’d stop in a kill some time. There were probably 50-60 stores of people selling various things – baby clothes, chopping boards, fruit/veggies/ the usual local market style goods. So after about the 6-7th store I had to do a double-take. Nearly every store had one of these square payment devices… in the middle of the country (the biggest town was probably 3-4hrs away) – the population would have been 4-500 people at the most.

Take notice

As we wandered around, these machines continued to be used in all of the stalls. I think about 45 of the stalls had this Square to process payments. So that’s when I thought, I need to look more closely at this. After researching it, I invested in it, understood what made it appealing to smaller businesses. Now, I see it everywhere in mostly small family businesses. These stores are the backbones of many societies and give them the option rather than the big 4 banks we have here in Australia. So by understanding this product, it leads me to do more research – looking at customer numbers, forecasted revenue, product reviews etc – getting the hard facts to execute a trade.

What next?

So, understanding what you’re investing and what it does gives you a greater insight into how it operates and how valuable it is to their customers. This, teamed with straight number facts, greatly increase your chance of picking a successful stock.

To finish this off, one lesson from Warren Buffett has served me particularly well over the years: “Never invest in a business you cannot understand.”

Making emotional investment decisions.

Ever wondered why there are so many bot traders out there? That’s because robots are emotionless. Binary calculations to buy sell hold. That’s all they do, calculate then execute. Human emotions are both our greatest asset and our greatest weakness. When trading with emotion, you’re making investing mistakes. Try to remove as much emotion from your decision making as possible. You can still be passionate about something but let it be the catalyst to researching that particular stock. Then let the numbers tell you the tale of the company.

If you invest with emotion, then emotion comes back into it when you need to close the trade. It can cloud your judgement and influence your decision. You need to ask yourself ‘ How do I stop investing emotionally?’ easy – just become a robot or have a stranger do your trading for you. They don’t care if you make money or not. They just doing it because that’s what they think is the right decision at the time.

So, don’t make the investing mistakes of making investments based on emotion.

Waiting to break even

Another investing mistake it not knowing when to cut your losses. We’ve all been in the situation. We’ve done our research, made the trade and watched the market. Stocks take a slight hit – that’s alright, we can handle -5%… then a few more weeks, it’s down to -12%… still plenty of room to move upwards. Next thing you know, it’s sitting on -35%.

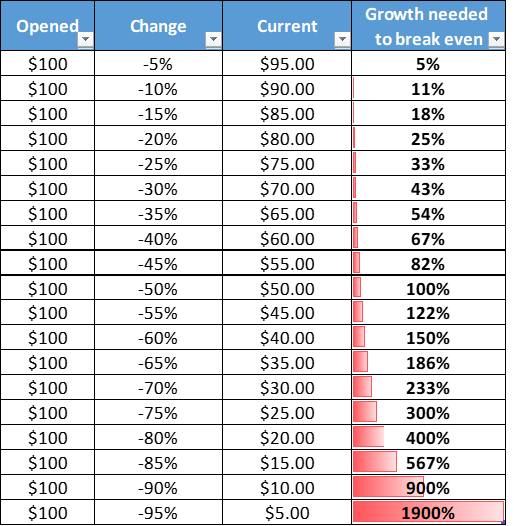

One of the key investing mistakes traders don’t realise is the amount of growth needed to get back to break even. So, if your stock went down by 35% that stock needs to grow by 54% to get back to even. The further south of 35% you go the more of a hole you’ll get into.

Do your homework first

Before you execute a trade, look at your levels of when you’re going to cut losses. Is it 5% 10/20%? And set yourself a Stop Loss. This way it will be executed even if you are not around watching it. This has happened to me several times, particularly when I trade US stocks as the market is open when I’m sleeping in Australia.

Check this table out – so say we bought a stock for $100. If it went down by X%, this is how much the stock would need to grow to get back to $100 and break even.

No diversification or di-worsification

Not diversifying your portfolio is one of the key investing mistakes traders make. The theory behind it is that your portfolio is spread across different markets and different parts of those markets. So, this diversification should act as a float if one market fails, the others should keep it afloat. There are different sectors and indices you can look at, there’s ETFs that are dedicated to whole industries or particular stocks. So it’s about finding what works for you and your trading style. Most people only focus on a handful of stocks – I wouldn’t recommend more than 20 solid stocks and no less than 6 stocks to represent a diversified portfolio.

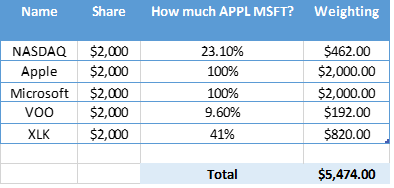

Di-worsification is a mistake traders make when they don’t understand what they are investing in. Sure, they’ve diversified their trades but if you take a look into their portfolio, it is very similar. Take for example a $10,000 portfolio looking at 5 different holdings NSDQ, , APPL, MSFT, VOO and XLK. To make things easy, let’s say they’re worth 20% each of the portfolio. 5 different holdings, sure, but the key here is the indices and ETFs they have invested in.

Breaking it down

NASDAQ 100 index is heavily concentrated with technology companies but also includes companies from other sectors. It is often used as a barometer of the health of the technology sector. so, their top two holdings? APPL and MSFT (11.8% and 11.3% each)

Now we have individual holdings of APPL and MSFT

Then VOO – Invests in stocks in the SP500 Index, representing 500 of the largest U.S. companies. And their top 2 weighted holdings?? Yep, MSFT and APPL (4.8% each)

XLK tracks an index of SP500 technology stocks… so no guesses what they are going to have at the top. MSFT (20.72%) APPL (20.34%).

So when you add this all up it looks like this

So in a portfolio that looks diversified on the surface, it’s not. If MSFT and APPL took a hit in the market, they make up 54% of someone’s profile – just two stocks!

So, keep in mind how this impacts your portfolio.

Not Using Stop-Loss Orders

Key investing mistakes that investors make is not utilising the trading tools they have available to them. One of these tools is the stop-loss function.

What is stop-loss?

Stop-loss is effectively setting the limit for your trade, so if the trade reached that amount, it would automatically close. This is useful if you can’t monitor your trades 24/7 or if you have a limit in mind (i.e. I’m going to risk a 20% loss on this trade, no more). So, if you had a trade that’s worth $100, you could set a stop-loss of 20%. This means your trade would close once it hits $80 (20% down from $100).

Please note that if the holding opens at a rate lower than your SL, it will take that opening figure. So, as an example, I bought stock X and its current value is $100 and I have an SL of $90. If during the aftermarket movement, it drops suddenly to $85 before the exchange opens, once the exchange opens it will automatically close as it has gone below the $190 SL target. So you’ll lose 15% instead of the 10% Stop-loss.

Beware

In normal market conditions, when the market reaches your requested rate and you have lost the predetermined amount, the SL order will trigger and automatically close your position.

What is a Trailing Stop-Loss?

Trailing Stop Loss (TSL) is very similar to SL. A TSL sets the SL order at a fixed amount of pips above or below the market price, so depending on whether the position is SELL or BUY. As long as the market is moving in your favour, the SL will move with it, maintaining the same locked-in pip distance from the current market rate.

For example, if you set TSL for a BUY position, the stop-loss will rise with the market in one-pip increments. This is why it’s called a ‘trailing’ SL; as the price rises, the stop loss rises with it. However, if the market is moving in the opposite direction (falling) the stop loss will not change. A close order will be submitted when the stop-loss rate is reached.

So – you have Stock X at $200 and you put a TSL at $180. If the stock goes up to $220, your TSL will go up to $196. So, the amount it rises, your TSL will rise with the stock. So, if the stock fell from $220 to $195, the TSL doesn’t move back down but stays where it was.

For a Buy position

Your TSL will rise with the price in increments and for a Sell position, it will fall in 1-pip increments. So it is important to note that your stop loss will not change if the market is moving against you.

I found this feature very useful when I have a stock that I believe has run its course. I’ll set the TSL in the positive profit territory and let it run its course. Sometimes the stock continues to grow and I get more profit. Other times it falls and I catch it with the most profit I can. So, the Stop Loss and Trailing Stop Loss are both important risk management tools in any traders arsenal.

Can a stop-loss fail?

A stop-loss shouldn’t fail but it doesn’t always execute at the price you want it. Specifically, if you’ve set a tight stop-loss and there is a lot of movement after hours, it could impact your stop-loss. Also if you’re trading a leveraged highly volatile market, then it can move 10% in an instant so it may not be as useful if you don’t monitor highly volatile markets.

Final words on investing mistakes

So there you have it – there are my top 6 investing mistakes traders make. You’re almost guaranteed to come across these in your investing journey. Have you come across these when you’ve traded and what did you do to counter them?