Everyone who has started their eToro copytrader journey may have noticed their copytrade is out of sync with the trader. They may have asked themselves some basic questions.

- Why doesn’t my copytrades sync with the trader I’m copying?

- How did they make X% in a month and i only made Y% in the same month?

- Why do they have more trades open than i do?

Thankfully, these questions are actually quite easy to answer. If you haven’t already, go check out my eToro Copytrader walkthrough, or the Top Trader to Copy on eToro, or check out my portfolio on eToro.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

It can be a little disheartening when you notice that your trades aren’t synched with the trader you’re copying. You’ve found the perfect trader to copy, allocated a sufficient amount but your trades don’t replicate theirs. Why aren’t my trades synched? Don’t worry, there are some easy to answer explanations to these common scenarios.

Didn’t copy Open Trades

One of the first and easiest scenarios is when you start copying a trader. When you select the copy button, you’re given an option to Copy Open Trades. This means that if you’ve allocated sufficient funds to the copytrade, you’ll copy the trades they have open. But, this means that they will execute at the next market opportunity. So if a trader has 25% on position X, you won’t start at 25%, you’ll start at where the next executed price is at (most likely at market open).

So, if you haven’t selected copy open trades, you will only copy future trades or new trades from that point on. This way, your copytrade won’t be the same as the trader, as they will have existing trades open that you have not copied. This will be the key difference with a variance in your monthly performance statistics and why your copytrade is out of sync.

Didn’t add enough funds

Even if you have selected Copy open trades as mentioned above, you need to have enough funds allocated to open all of their trades. Simply put, each of your trades cannot be below $1 in value. So, $1 needs to equal the amount of their smallest trade. I’ve made a simple copytrader calculator to help you out in this situation. In saying that, if you don’t have enough to open the smallest trade, your portfolio won’t be in sync with theirs. This will lead to a variance in your monthly stats.

Your copy started at a different time

When you start copying someone, you’ll be copying their trades from that point in time. So, if you started halfway through the month, the trader would have had a few weeks of statistical gains/losses for that month already. It might not lead to a reason why your copy isn’t in sync but will definitely give you a reason or two as to why your stats are different.

Currency conversion

eToro is an international platform and as such, has a number of currencies it supports. These are (but are not limited to) AUD GBP EUR and USD. You can see some variance in your profit/loss amount due to exchange rates over time. eToro mostly deals in USD. So, if I exchange my AUD into USD, I’ll get the rate for that particular day. Even if my portfolio doesn’t move, the AUD/USD exchange rate will – for better or worse. Some traders will see a variance in the country of origin’s currency when they ‘exchange’ back from USD to their currency. Another reason why your copytrade is out of sync.

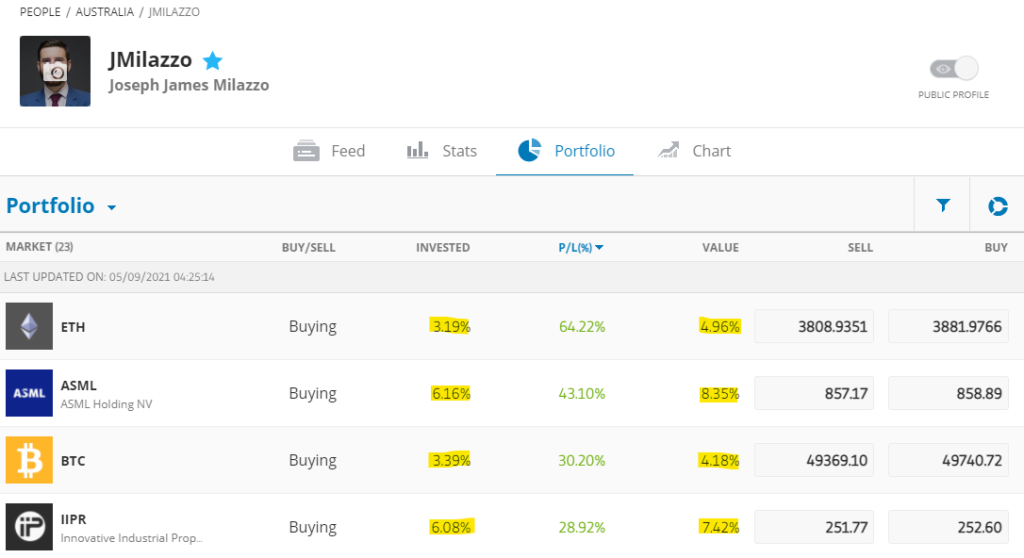

Invested vs Value of holdings

This is another simple explanation but is often overlooked. Below is a screengrab of my current portfolio. You’ll notice two columns that I’ve highlighted – the Invested and Value columns. This means that I’ve invested 3.19% of my portfolio in $ETH but it makes up 4.96% of my portfolio’s value. The issue here is that the potential copier has their funds allocated based on the invested column. This means that if they copied my open trades, then I happened to close that trade straight away, I would have 4.96% returned to my available funds, whilst the copier would only have 3.19%. Then the portfolio slowly un-syncs here due to me having a higher % amount to allocates to markets, than my copier. For copiers who have been copying for a while, their trades would be in sync with my own.

There you have it – so don’t worry too much. Over time as you hold on to your copy of the trader, your copytrade won’t be out of sync. As the trader makes more trades over time, you’ll get closer and closer to replicating theirs and follow their performance very closely!