Hi everyone – this is my final eToro Portfolio Review for 2019. What a year it was! As I normally do for each month, this is my eToro review for December and overall review for 2019. I

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Goal comparison for 2019

| Category | Goal | Dec-19 | 2019 | Change over 1 Year |

| Copiers | +50 | 25 | Missed | -22% |

| Followers | +2000 | 1815 | Missed | +15% |

| AUM | +$50k | $46990 | Missed | +105% |

| Realised Profits | +10% | 4.74% | Missed | +4.74% |

| Portfolio Growth | +15% | 4.36% | Beat | +31.02% |

| Risk | 4-5 | 4 | Beat | -1 |

There are a few positive and negative outcomes from 2019. Whilst my copier numbers reduced, my AUM increased significantly (it more than doubled!) My portfolio grew above the SP500 benchmark though my realised profits were weaker. This correlates to the high profit % I currently have in open trades, as my realised profits only look at closed trades. I reduced and kept my risk score to 4 and slowly increased my brand awarness with more people following me.

Overall, i’m happy with the progress for 2019 and can’t wait to see what I can achieve in 2020!

eToro Review – December Portfolio

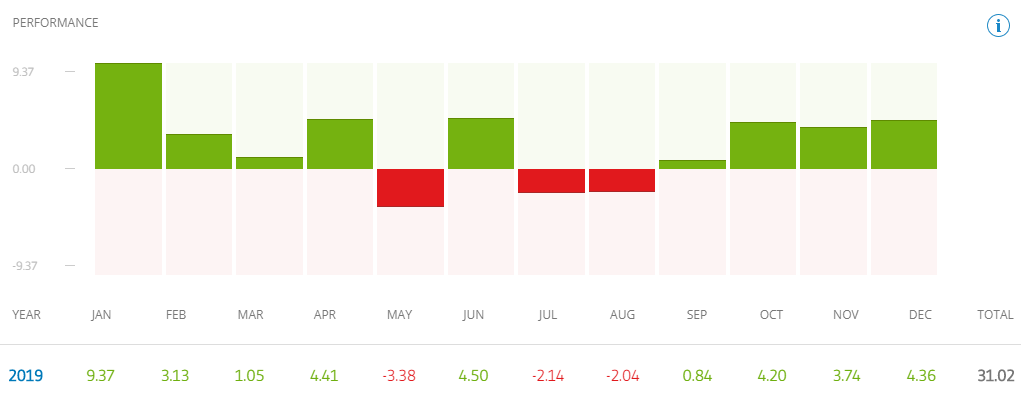

My eToro portfolio has had a good month in December, growing 4.36% – translating to approximately 31.02% for 2019.

My stock choices for the year have started to come into their own and hopefully continue to provide some great growth over the coming months and years. Below is a snapshot of what stocks I’ve opened and haven’t closed yet in 2019.

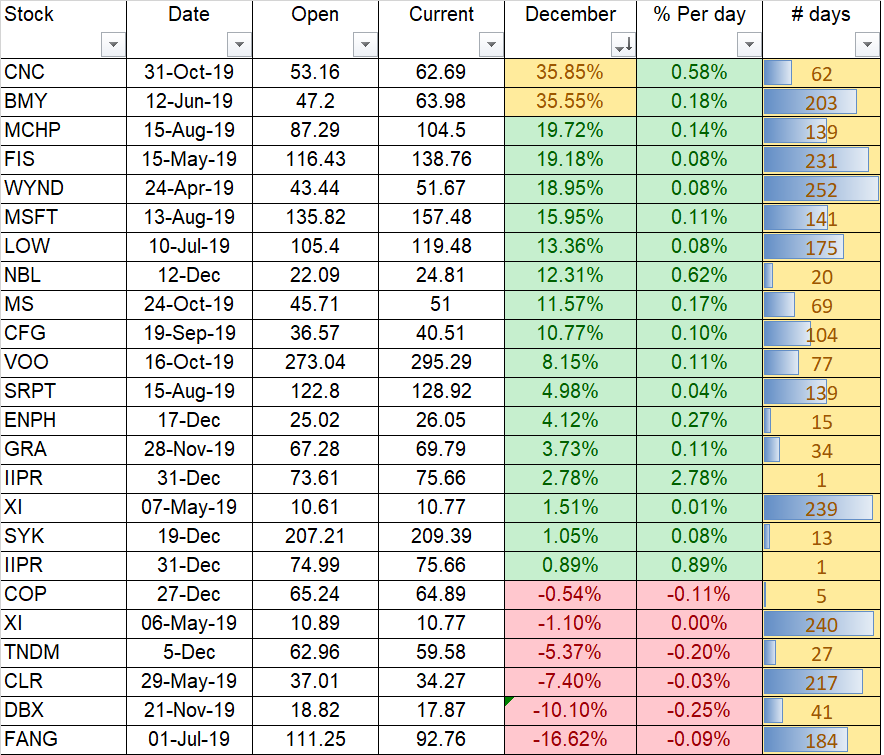

Current 2019 Open eToro stock positions

As you can see, there is more green than red, which is always a good thing. CNC and BMY are crushing it at the moment, with over 35% growth since buying them.

Portfolio Growth and dates

- 5% – Achieved January 8, 2019

- 10% – Achieved February 6, 2019

- 15% – Achieved March 22, 2019

- 20% – Achieved May 17, 2019

- 25% – Achieved November 10, 2019

- 30% – Achieved December 20, 2019!

The Above and Beyond Club

These stocks are going above and beyond – crushing their returns and setting up our portfolio nicely. Aligning with the etoro Club tiers, we have

- Bronze: 20 – 24.99%

- Silver: 25 – 29.99%

- Gold: 30 – 34.99%

- Platinum: 35 – 39.99%

- Diamond: over 40%

Our current open positions include

Platinum

CNC 35.85%

BMY 35.55% (Climbed 15% in a month!)

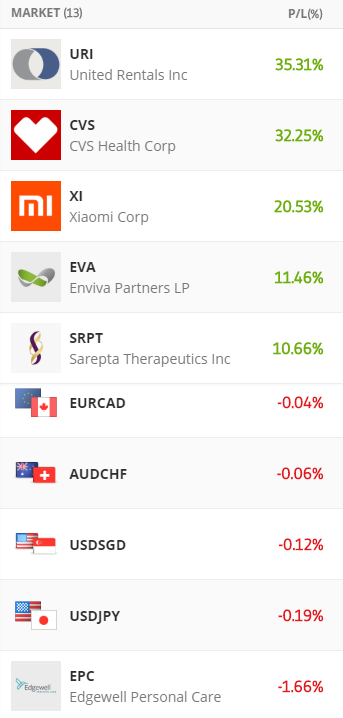

Closed Stocks in the Above and Beyond Club

We’ve been fortunate to have a couple of stocks in 2019 closed in significant profit

$MSFT = 35.77% (Platinum)

$URI = 35.31% (Platinum)

$CVS = 32.25% (Gold)

$PVH = 25.92% (Silver)

$JEC= 20.83% (Bronze)

$XI = 20.53% (Bronze)

Let’s hope we add a few more over the coming months!

eToro December 2019 Review Closed positions

I have taken a different reporting approach for my 2019 closed positions. I realised, if I’m only showing stocks I’ve open in 2019, then I should only be reporting on those same stocks which I have closed in 2019. Each stock has been bought and sold in 2019 only.

December was a fast month, with stocks growing significantly. I closed various trades including testing some signals for Forex. many trades – only 3 overall. AAL started to perform badly so I took my losses and moved on to the next stock. I removed PM as more of an ethical decision – although they were primed as a great growth stock and giving a nice return, I couldn’t continue with them. As always, I’ll look at rebalancing our portfolio and removing some dead weight. With stocks that are loosing I always ask myself the same question – would I reinvest in the stock right now? If I would, I leave it. If I wouldn’t, I’d close it and move on to the next. In saying that, I’ll be evaluating my holdings in ETH and XRP over the next months to see if I take the loss and move my money elsewhere.

Below are the different markets that I closed during November, sorted by % Profit/loss

New Stocks added to my eToro portfolio

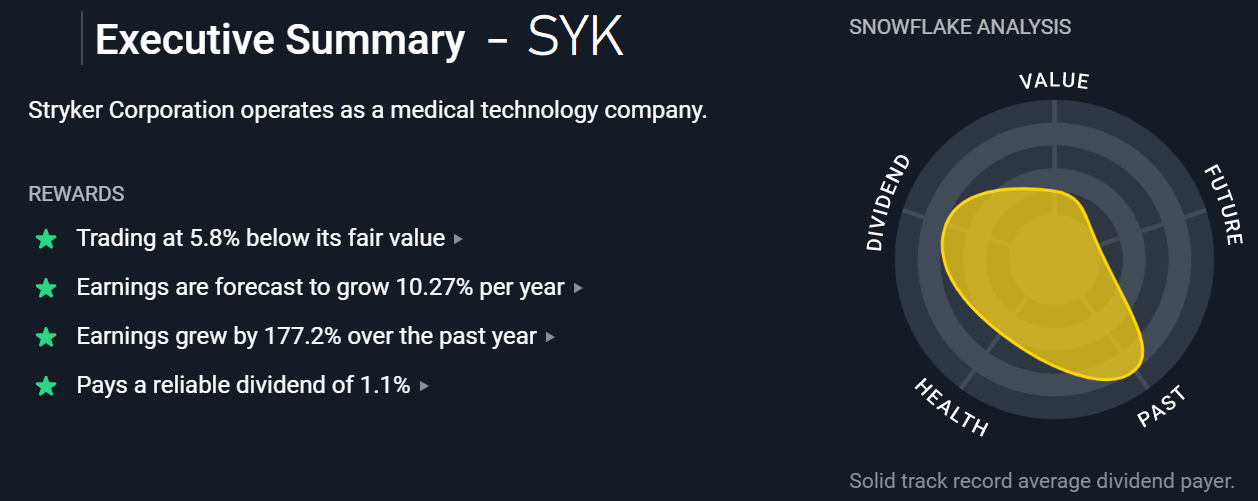

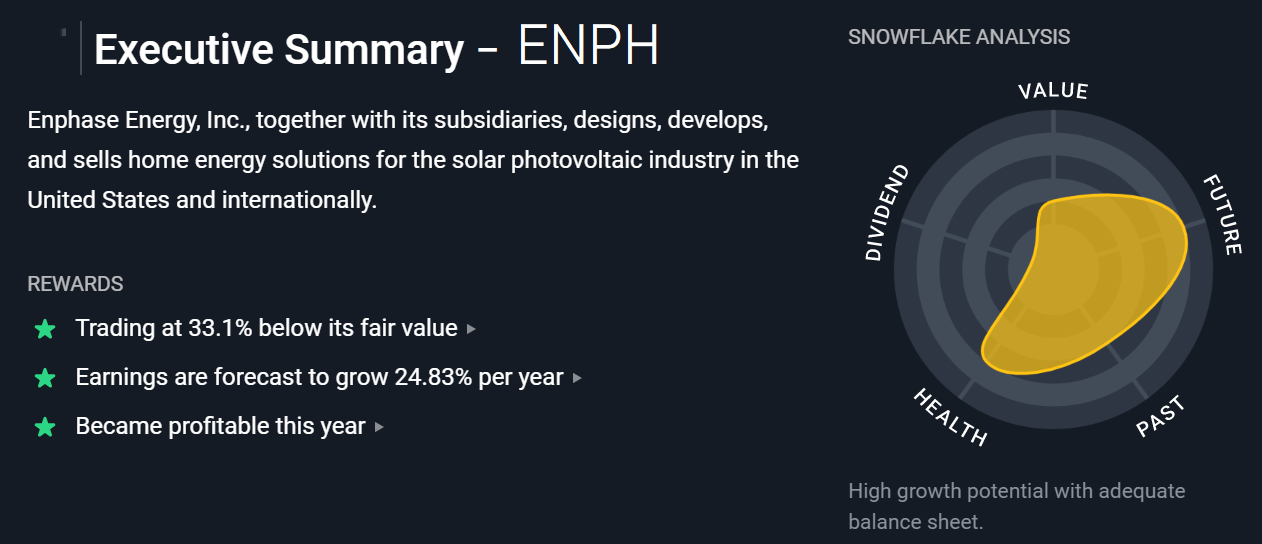

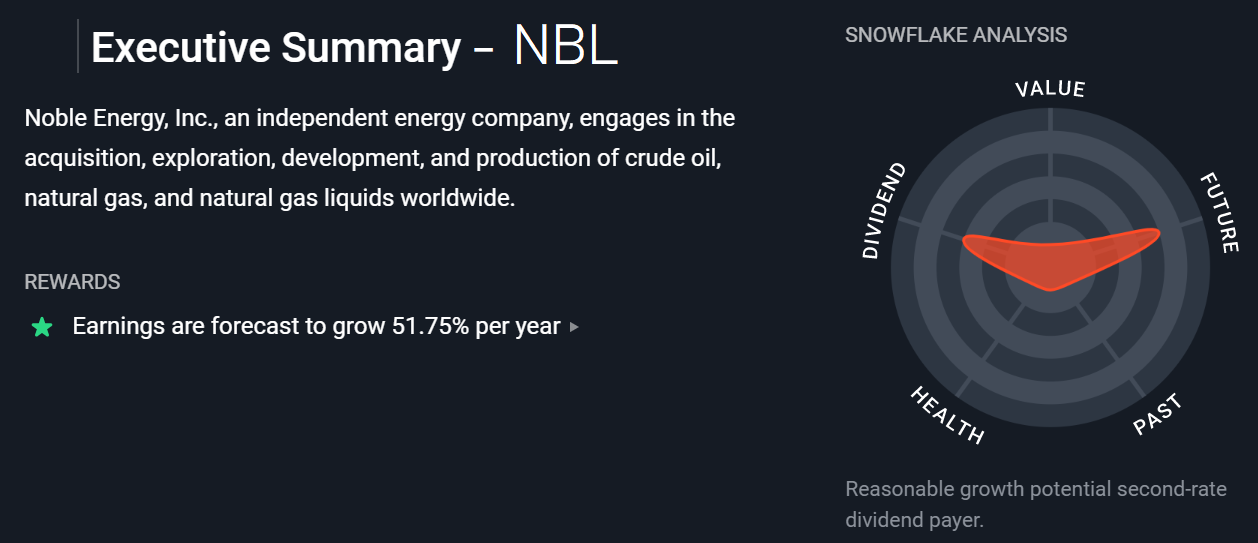

Below are the latest stocks added to our portfolio

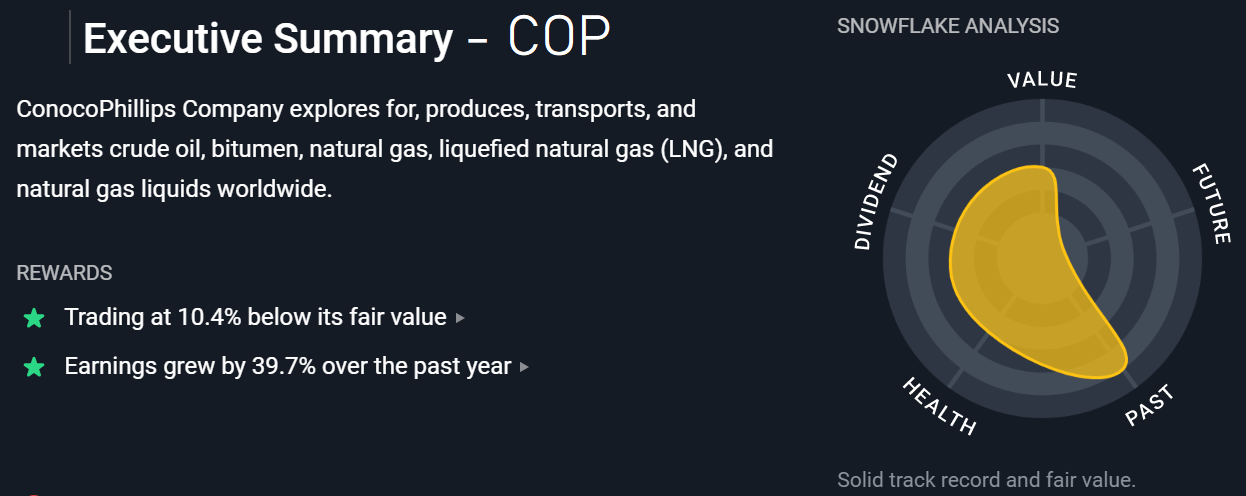

$IIPR – Innovative Industrial Properties

$COP – ConocPhillips

$SYK – Stryker

$ENPH – Enphase Energy

$NBL – Noble Energy

Hopefully, these stocks provide a great return for months to come!

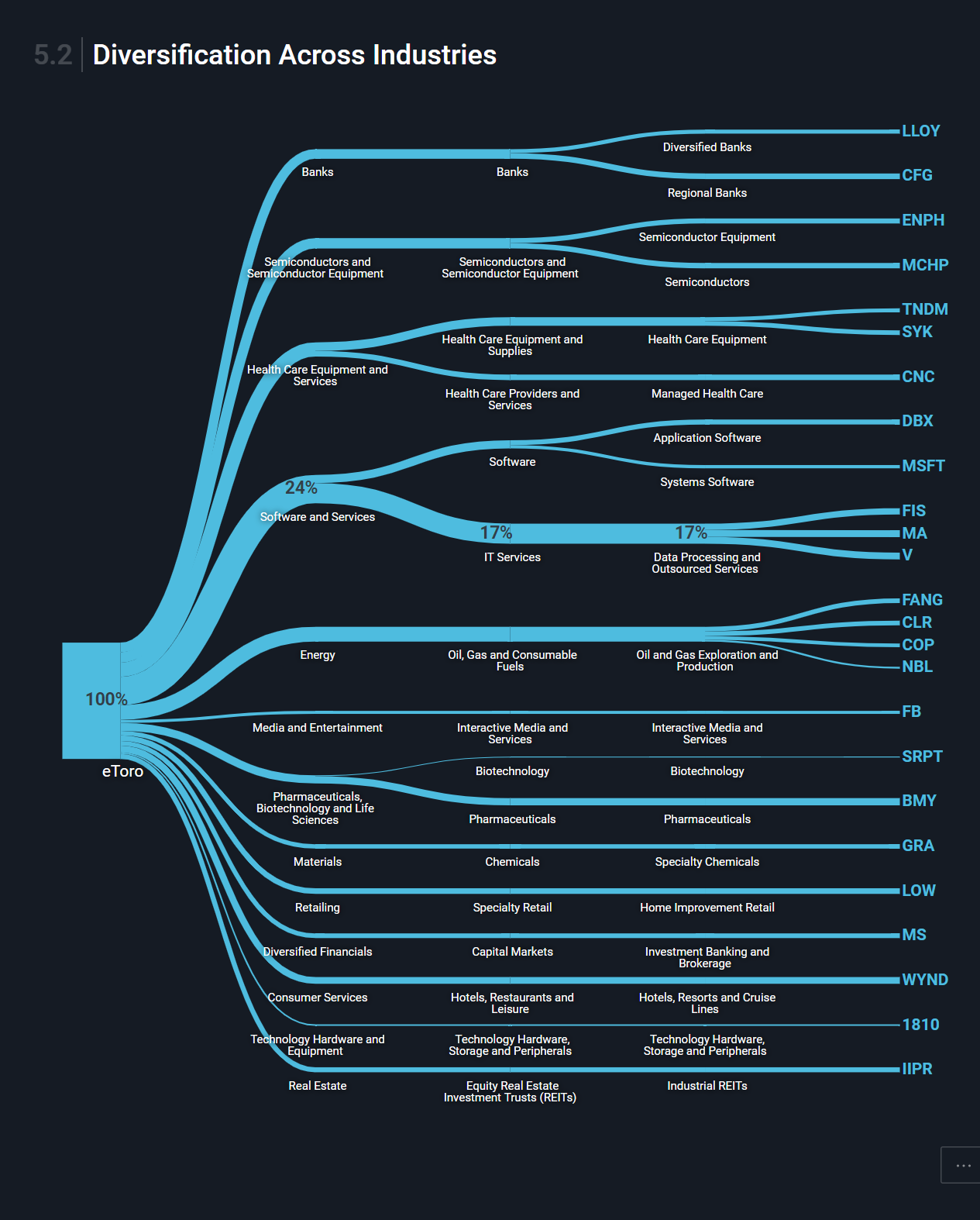

My current Portfolio going into 2020

Below is my current holdings going into 2020 and the breakdown.

Final thoughts on my eToro Portfolio Review for 2019

December saw a good trading month and excellent portfolio growth. Looking ahead, the easing trader war and Brexit could really swing some of our trades but should benefit our portfolio and lead to some great growth in selected stocks – particularly Xiaomi and Lloyds. Thanks for checking out my portfolio review.

Remember to Stock Up with Joe

If you’re looking for people to copy, why not check out my latest list of people from my Top Copy Traders Competition. If you need to figure out your investing technique, check out these books.

Thank you for taking the time to read my eToro review.

My brother recommended I may like this website. He was once entirely right.

This post actually made my day. You cann’t believe simply how a lot time I had spent for this info!

Thank you!

Thank you, hope you enjoyed it. Let me know if you have any questions 😀

Fantastic website you have here but I was wanting to know

if yyou knew oof any message boards tht cover the same topics discussed in this article?

I’d really like to be a part of group where I can get advice from

other knowledgeable people that share the

same interest. If you have any recommendations,

please let me know. Thanks!

There’s an eToro Facebook group if you’re interested

[…] the platform is used. Use my formula to find the best copiers to trade and keep up to date with my monthly reviews to see what stocks I’ve added to my portfolio and […]

Today, I went to the beach front with my kids. I found a sea shell and

gave it to my 4 year old daughter and saod “You can hear the ocean if you put this to your ear.” She put the shell to her

ear and screamed. There was a hermit crab inside and it pinched

her ear. She never wants to go back! LoL I know this is entirely off topic but

I haad to tdll someone!

lol – aren’t kids the best! I tell mine that seaweed is shark hair that’s fallen out 🙂

Hi! Do you use Twitter? I’d like to follow you iff that would be

okay. I’m undoubtedly enhjoying your blog and look forward

to new posts.

thanks! Yes, I have twitter – my handle is @stockupwithjoe – look forward to seeing you on there!

Aw, this was an incredibly good post. Spending some time

and actual effort to generate a siperb article… but what can I say… I procratinate a whole lot and don’t

seem tto get nearly anything done.

thanks mate, appreciate it!

I truly appreciate this post. I?¦ve been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thank you again

Hmm it looks like your blog ate my first comment

(it was extremely long) so I guess I’ll just sum it up what I had written and say,

I’m thoroughly enjoying your blog. I as well am an aspiring blog writer but I’m still new to everything.

Do you have any suggestions for newbie blog writers? I’d

genuinely appreciate it.

Just write what you’re passionate about and the rest will come to you! Read other blogs and see what works for you.

Hi! This is my first comment here so I just wanted to give a quick shout out and

tell you I really enjoy reading through your posts. Can you suggest any other blogs/websites/forums that go over the same topics?

Thanks!