We perform a health check on HMI – one of the biggest players in smart wearable technology devices that many do not even know exists. Please note that i hold HMI in my portfolio on eToro.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Who is Huami (HMI)?

Huami Corporation, a biometric and activity data-driven company, develops, manufactures, and sells smart wearable technological devices in the People’s Republic of China. So those things around your wrist that tell you how you’re going during the day and at night? Yeh, those things. It operates through two segments, Xiaomi Wearable Products, and Self-Branded Products and Others.

It provides charts and graphs to display the analysis of the activity and biometric data collected from users through its Mi Fit and Amazfit mobile apps. So it has its hands on some great health data. Huami Corporation has a strategic collaboration with Timex Group to develop smartwatches; and McLaren Applied Technologies to develop co-branded intelligent, data-driven, and customized performance optimization solutions and wearable technologies. The company was founded in 2013 and is headquartered in Hefei, the People’s Republic of China and because of this, it is the sole partner of Xiaomi wearables, including the Mi band series.

In 2019, Huami shipped 42.3 million smart wearable devices. Leveraging its powerful AI algorithm capabilities along with the massive data analysis, Huami provides 24×7 health monitoring services to millions of its product users.

In early 2020, Huami unveiled four new products spanning three verticals that go beyond smart bands and watches: Amazfit Home Studio, a smart gym hub; Amazfit AirRun, a foldable next-generation treadmill; Amazfit PowerBuds, true wireless stereo fitness earphones with Clip-to-Go design; and Amazfit ZenBuds, sleep-comfort and health monitoring earphones. So there are plenty of new products on the horizon.

What else?

Huami owns a large biometric and activity database in the global smart wearables industry. Huami’s mobile apps, Mi Fit and Amazfit work hand in hand with its smart wearable devices and provide users with a comprehensive view and analysis of their biometric and activity data. As of December 31, 2017, Huami mobile apps had 56.1 million registered users, from whom Huami collects multi-dimensioned user data including heart rate, electrocardiograph, weight, body fat compositions, GPS running track, steps, sleeping duration, etc. So, Huami is well-positioned to develop new application scenarios for smart wearable technology and drive innovation, with a wide range of biometric and activity data from many users. It was also the first smart hardware company in China to land on the US capital market.

Huami Technology has also established its team of medical experts, more than 90% of whom have a master’s degree or doctorate in medicine. A clinical study on intelligent wearable atrial fibrillation detection was carried out through cooperation with the Department of Cardiology of Peking University First Hospital. The results showed that the accuracy of ECG and PPG in judging atrial fibrillation was as high as 94.76% and 93.27%, respectively, reaching the level of human professional physicians.

Huami Technology is rapidly going global. Overseas shipments accounted for more than 50% in 2019, and AMAZFIT smartwatch products have entered 78 countries and regions, including the United States, Germany, and Japan.

HMI Summary

- Market Cap = US$710.6m

- Latest Price = $11.47

- 52 wk. range = $8.51 – $16.77

- ✅ Trading at 46.5% below the estimate of its fair value

- ❎ Highly volatile share price over the past 3 months (most likely due to impacts felt by COVID-19)

- ✅ 21.7% per year – forecasted earnings growth.

- ✅ Earnings grew by 33.7% over the past year

Competitors in the smartwatch sector?

- $GRMN

- $FIT

- $AAPL

- $SMSN.L

HMI Market Performance

✅ Return vs Industry: HMI exceeded the US Electronic industry which returned 0.3% over the past year.

✅ Return vs Market: HMI exceeded the US Market which returned 5.6% over the past year. So outperforming the market over the last year.

| HMI | Industry | Market | |

| 30 Day | 19.5% | 6.4% | 6.0% |

| 90 Day | -10.1% | 41.4% | 36.7% |

| 1 Year | 14.6% | 1.4% | 7.9% |

| 3 Year | n/a | 18.3% | 33.7% |

HMI Valuation

Is Huami undervalued compared to its fair value and its price relative to the market?

46.5% undervalued compared to fair value. Fair value is an estimate of what the stock price is worth today, based on the cash flows the company is expected to generate in the future. So there is a lot of room to climb.

✅ Below Fair Value: HMI ($11.47) is trading below the estimate of fair value ($21.42)

✅ Significantly Below Fair Value: HMI is trading below fair value by more than 20%.

Price to Earnings Ratio

PE Ratio measures the current share price relative to the company’s earnings per share. So, a high PE ratio can indicate a company’s share price is high relative to its earnings and is possibly overvalued. Sitting at 9.6x PE, therefore HMI is not considered overvalued.

✅ – PE vs Industry: HMI is good value based on its PE Ratio (9.6x) compared to the Electronic industry average (19.9x).

✅ – PE vs Market: HMI is good value based on its PE Ratio (9.6x) compared to the US market (16.4x).

Price to Book Ratio

❎ – PB vs Industry: HMI is overvalued based on its PB Ratio (2x) compared to the US Electronic industry average (1.9x).

PB ratio compares a company’s market value to its book value (total assets – total liabilities). So, a low book value indicates a company could be undervalued.

Future Growth

How is Huami forecast to perform in the next 1 to 3 years

21.7% forecasted annual earnings growth

✅- Earnings vs Savings Rate: HMI’s forecast earnings growth (21.7% per year) so it is above the savings rate (2.2%).

✅ – High Growth Earnings: earnings are expected to grow significantly over the next 3 years.

❎ – Earnings vs Market: HMI’s earnings (21.7% per year) are forecast to grow slower than the US market (22.8% per year).

✅ – Revenue vs Market: HMI’s revenue (22.3% per year) is forecast to grow faster than the US market (9.2% per year).

✅- High Growth Revenue: HMI’s revenue (22.3% per year) is forecast to grow faster than 20% per year.

Future Return on Equity

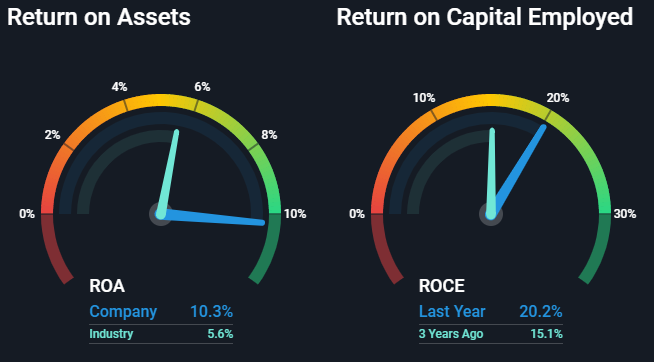

✅ – Future ROE: HMI’s Return on Equity is forecast to be high in 3 years (23.9%)

Past Performance

How has Huami performed over the past 5 years?

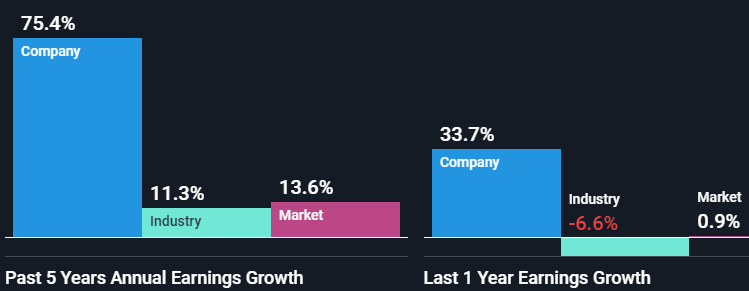

So HMI has returned a 75.4% historical annual earnings growth over the last 5yrs.

✅ Quality Earnings: HMI has high-quality earnings.

❎ Growing Profit Margin: HMI’s current net profit margins (8.5%) are lower than last year (10%).

Past Earnings Growth Analysis

✅ Earnings Trend: HMI’s earnings have grown significantly by 75.4% per year over the past 5 years.

❎ Accelerating Growth: HMI’s earnings growth over the past year (33.7%) but it is below its 5-year average (75.4% per year).

✅ Earnings vs Industry: HMI earnings growth over the past year (33.7%) so it has exceeded the Electronic industry -6.6%.

Return on Equity

✅ High ROE: HMI’s Return on Equity (20.4%) is considered high so keep an eye on that.

Financial Health

How is Huami’s financial position?

✅ Short Term Liabilities: HMI’s short-term assets (CN¥3.9B) exceed its short-term liabilities (CN¥2.0B) so it can cover them.

✅ Long Term Liabilities: HMI’s short-term assets (CN¥3.9B) exceed its long-term liabilities (CN¥187.3M).

❎ Reducing Debt: Insufficient data to determine if HMI’s debt to equity ratio has reduced over the past 5 years.

✅ Debt Level: HMI’s debt to equity ratio (29.7%) is considered satisfactory.

✅ Debt Coverage: HMI’s debt is well covered by operating cash flow (56.8%).

Dividend

HMI does not pay a dividend, which hopefully translates into them reinvesting back into the business.

Overall

HMI is an underappreciated stock with massive upside. As the shift towards hi-tech wearables become greater and greater and the technology continues to advance, HMI has the fan base and backing of large companies to make them stand out from its competitors.

The analysis above was created with information sourced from Simply Wall St, Yahoo Finance, Stake, eToro and TipRanks.