Stake vs Selfwealth – Australian’s (and soon NZ and the UK) looking to find a better option when trading overseas stocks now have two solid contenders – Selfwealth and Stake. This article provides both positives and negatives of each platform for Australians but is relevant to other customers. So, it is not meant to recommend one over the other. The decision is based on trading style and what you are trying to get out of the platforms. For those interested, there is also eToro – check out the review here.

If you don’t have a Stake account, you can create one here. When you create an account and fund it within 24hrs, you and I get 1 x free stock each!

No SelfWealth account? You can create one here.

If you sign up using that link, you and I get 5 free trades each!

Quick Comparison – Selfwealth vs Stake

- Both platforms

- regulated within Australia

- you own the asset for US Stocks

- deal in USD as their base currency (SelfWealth has 2 separate accounts – one for Aus trading, one for USA trading)

- provide dividends but no Dividend Reinvestment Program (DRIP).

- Both use the W-8Ben tax form.

- No CFDs, options or leveraging

- SelfWealth

- more US stocks available to trade (+7,500)

- does not support fractional trading of US stocks

- allows CFD trading (leveraging and short selling)

- has a demo account where you can practice

- offers more markets to trade (indices, cryptocurrencies, forex, commodities)

- better social trading features (think Twitter meets a broker – news feed, CopyTrading, Popular Investors)

- Stake

- allow fractional share purchases (i.e. buy $10USD of Amazon instead of the full share price)

- you can transfer stock holdings in and out to other platforms (within reason)

- enforces a T+2 Trade Settlement – This means the cash for executed sell orders takes 2 days to clear back into your trading account.

- offer commission-free trading

- has a better search function (you can search for subjects like ‘shoes’)

SelfWealth background

SelfWealth Ltd is an Australian owned and operated company which offers a brand new solution to an age-old investment problem – how to empower investors to make informed decisions without paying exorbitant brokerage fees. Established in 2012, we’re an online community for investors, partnering to achieve a common purpose of better returns. For the first time in Australia, investors can now access an online tool which compares their portfolio’s performance against other investors.

At SelfWealth, we call a trade a trade. That’s why in 2016 we launched Australia’s flat fee brokerage solution. Our members can now trade shares for $9.50 per trade with no commissions – regardless of the size of the trade. As the winner of Money Magazine’s 2018 & 2019 Best of the Best Awards for Cheapest Online Broker, we’re confidently revolutionising the way people invest.

Stake background

Australian digital brokerage company Stake launched in 2017, designed to give Aussies access to Wall Street — home to some of the biggest financial markets in the world such as the New York Stock Exchange.

Matthew Leibowitz founded the company. He was a lawyer by trade who switched to the world of trading because of his interest in the “dynamic nature of the stock market”. After noticing how big the US market was, Leibowitz realised how complicated it was for people outside of the US to access it unless they were wealthy. And thus, Stake was born. Stake – which has an app and a website – allows you to trade more than 3,500 stocks on the US market.

So, at the end of 2019, Stake has around 30,000 Australian customers.

Getting Started

SelfWealth

Signing up to SelfWealth is easy. Go to the homepage, click the sign-up button and away you go. Once you’ve created an account, you can also create an account for US trading. It follows the usual process of identification/verification and the list of usual questions. The overall process was painless and simple.

If you don’t have a SelfWealth account, you can create one here. When you sign up using that link, you and I get 5 free trades each!here

Stake

Signing up to Stake is pretty much the same. It has the usual identification/verification questions with the added step of taking a selfie with the submitted identification. It was quick and efficient.

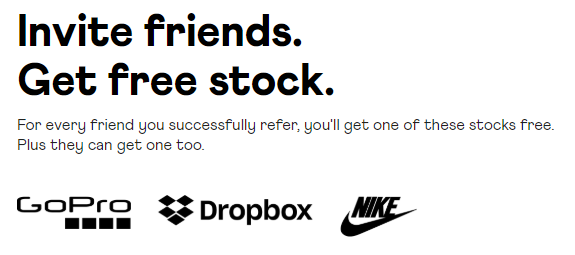

You can create your Stake account here – if you sign up using this link, you get a free stock (now it is either Dropbox, Nike or GoPro)

So whether you’re Stake vs SelfWealth – they both have simple and easy sign up methods.

SelfWealth vs Stake – Platform

SelfWealth

When comparing SelfWealth vs Stake, I believe that the SelfWealth platform has more features than Stake. Here you have several menus to utilise and also get other traders to follow. If you just want a plain and straighforward platform, then Stake would be easier.

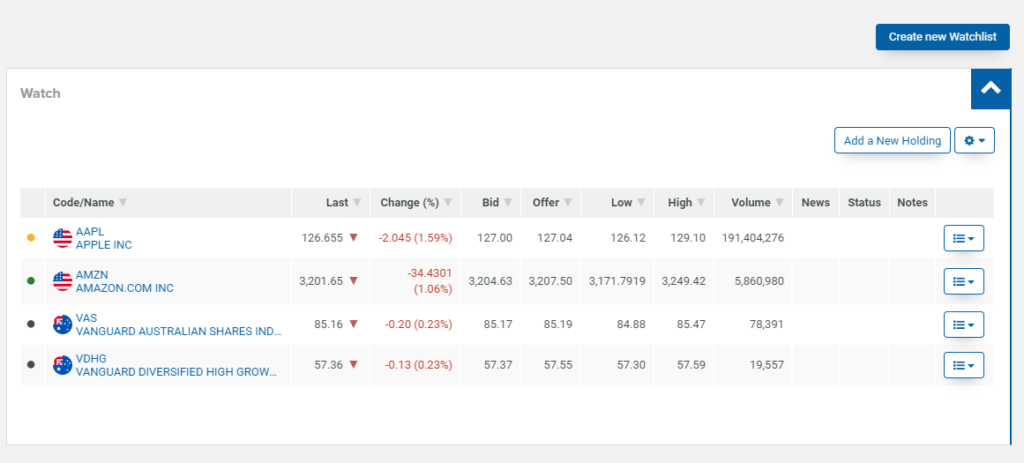

Watchlists

In the watchlists section, you add different markets to a watchlist and see how they are performing. What I like here is that you can add both AUS and US stocks in the same list. It has a traffic light system on the left hand side to show at a glance the valuation (if it is over/under/no valuation)

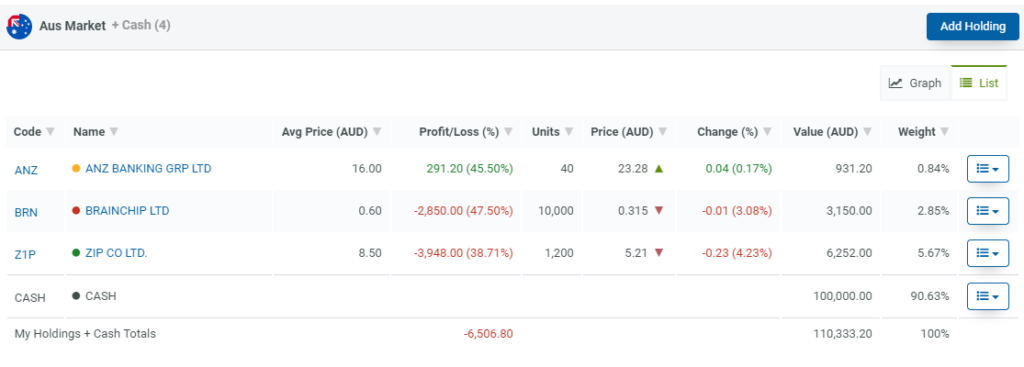

Portfolio

This section breaks down your current portfolio by Aus and US stocks, average price and Profit Loss figures. It’s very basic but presents a lot of good informaiton at a glance.

Trade stocks

There are a number of ways to search and research stocks on the pltform but the easiest is via the search box at the top of screen. Within the Stock Analysis section, you can go into a deeper review of the stock.

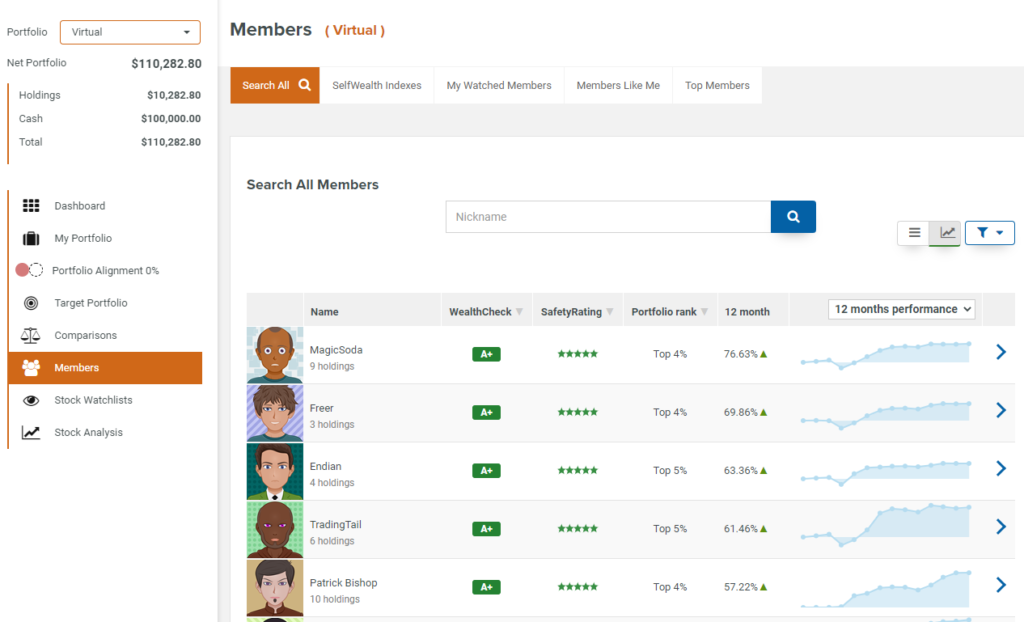

Members

SelfWealth provides a list of traders that are performing well and that you can follow. If you want to see their holdings, you’ll need to upgrade to a premium account.

SelfWealth Demo (Virtual) Account

A great feature for traders using the Selfwealth platform is the demo (or virtual) account. Once you sign up, you get a virtual account where you can play around with fake money and test out your trades before allocating real money in your real account. This feature is great for traders who are just starting and want to learn through experience. I would highly recommend using this feature to get comfortable with your trading.

Overall, the platform is easy to navigate and use. There are several great tools here for you to use to locate the best market that suits your trading style. Some people like a more streamlined service but I find that this suits my style perfectly.

Stake

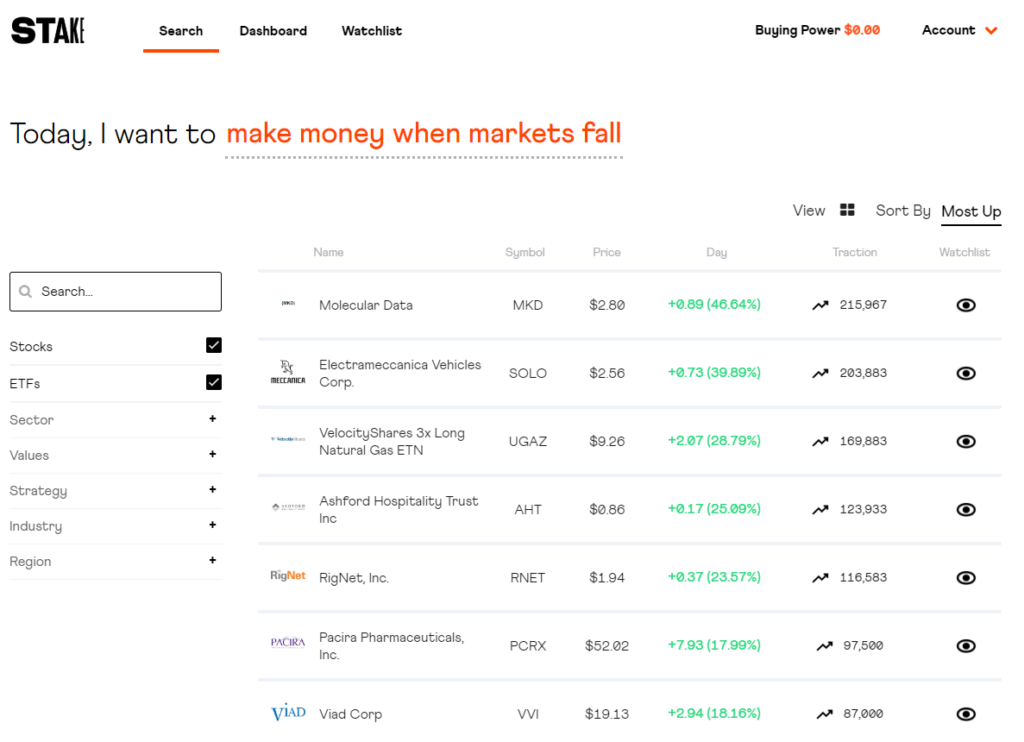

The platform is minimalistic and there is something very appealing about it. There are no fancy features or too many options – it is simple and straight to the point. One of the main reasons that it is so simple is because you do not see what other traders are doing. The focus is on yourself and your trades. If all you need is to buy/sell trades, then this could be the perfect setup for you. The platform is broken down into 3 sections.

Search

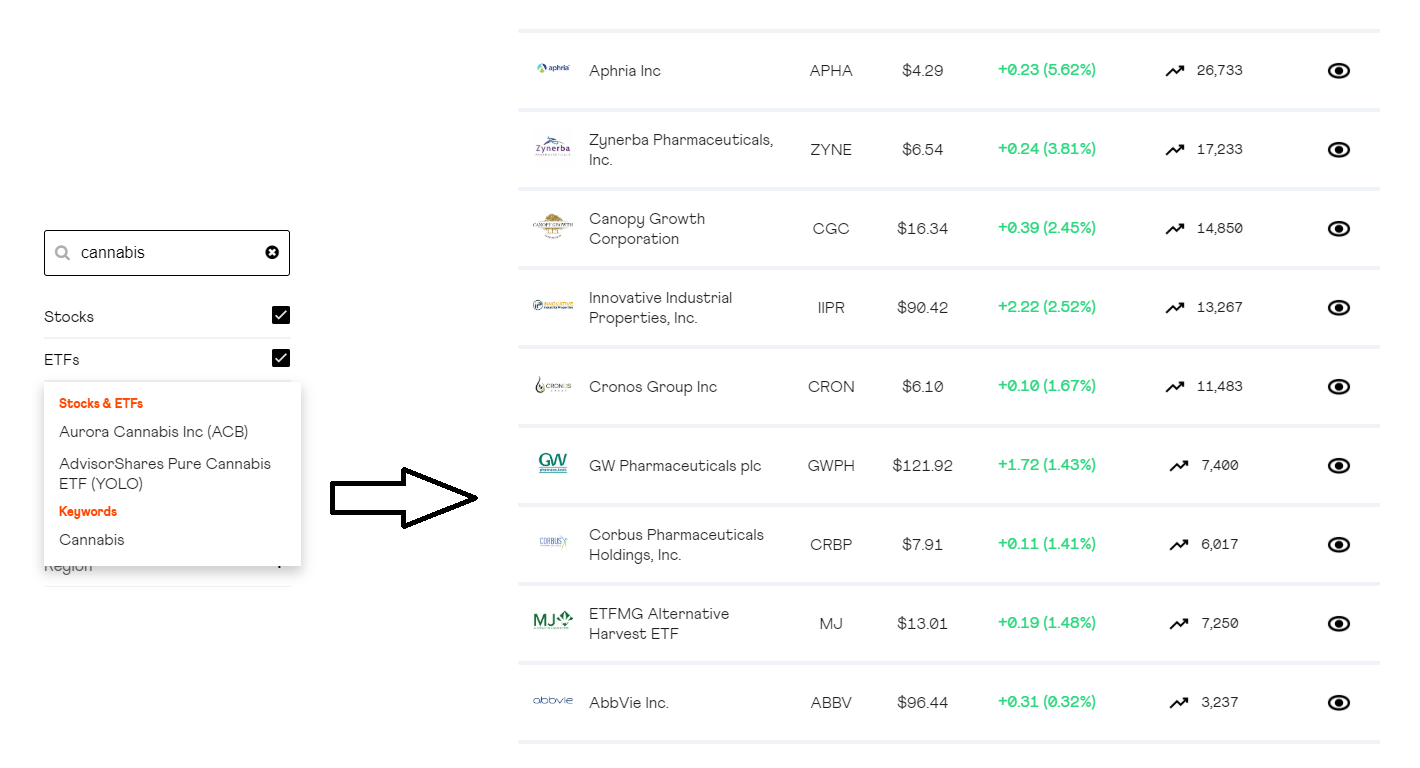

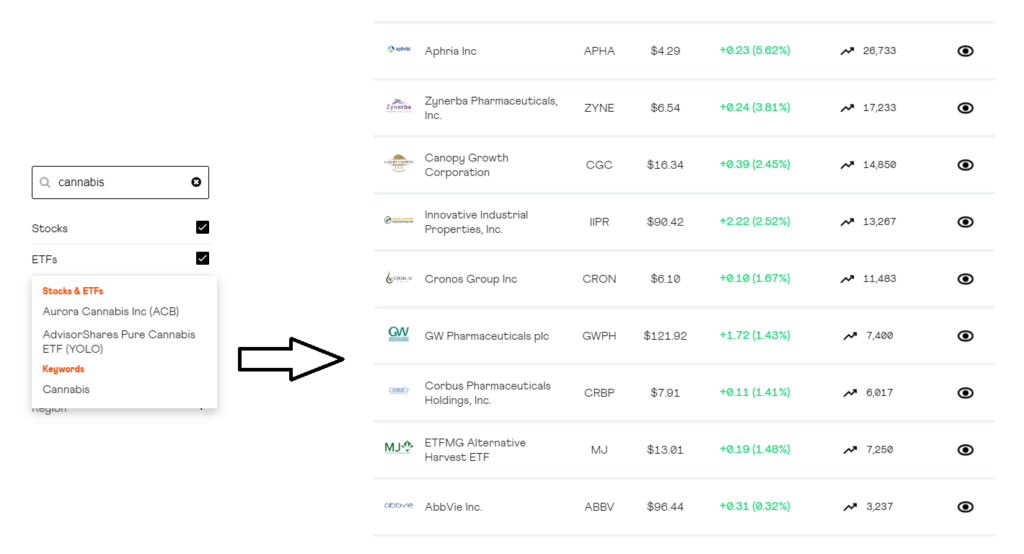

The search function is steps ahead of the SelfWealth search. The best thing I love about their search function is the ability to easily filter to what you need. You can apply different filters until you find what you need, something that SelfWealth does not offer. That also suggest different search topics via a snazzy subject line at the top, which rotates through several choices that could spark interest. To me, the best feature is being able to search via subjects, rather than just by name. If I searched for cannabis, it would show me the stocks with cannabis in their name but also the keyword cannabis. By selecting the keyword, I am presented with all the related stocks in the cannabis industry. Very useful if I cannot quite remember the stocks name but I know the industry.

One thing that does bother me is the ability to sort by columns the way I like it. For example, I cannot sort by name. Whilst it is not the end of the world, simple features like this do make life a lot easier. When you dive into a stock you like, you are present with a clean outlay and easy to understand information. Stake offers a chart, recent data, news on the stocks and related stocks. Do you need more than that? If you do require more analysis, you will need to seek it elsewhere. If not, then this is a great setup to get information cleanly and quickly.

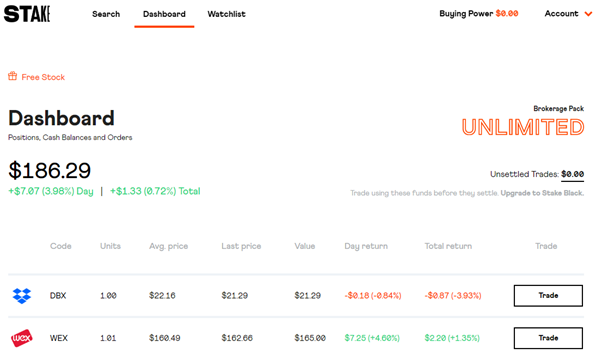

Dashboard

The minimalistic layout continues into the dashboard. Here you get no-nonsense and straight forward details. What you have invested in, units, value and returns. If you are after only those analytics, then this is perfect for you. For certain trades, I know what I am investing in, so I do not need all the bloatware that comes with other platforms. I just need to know how it has performed day by day and my overall return. For this, Stake is ideal in presenting this information.

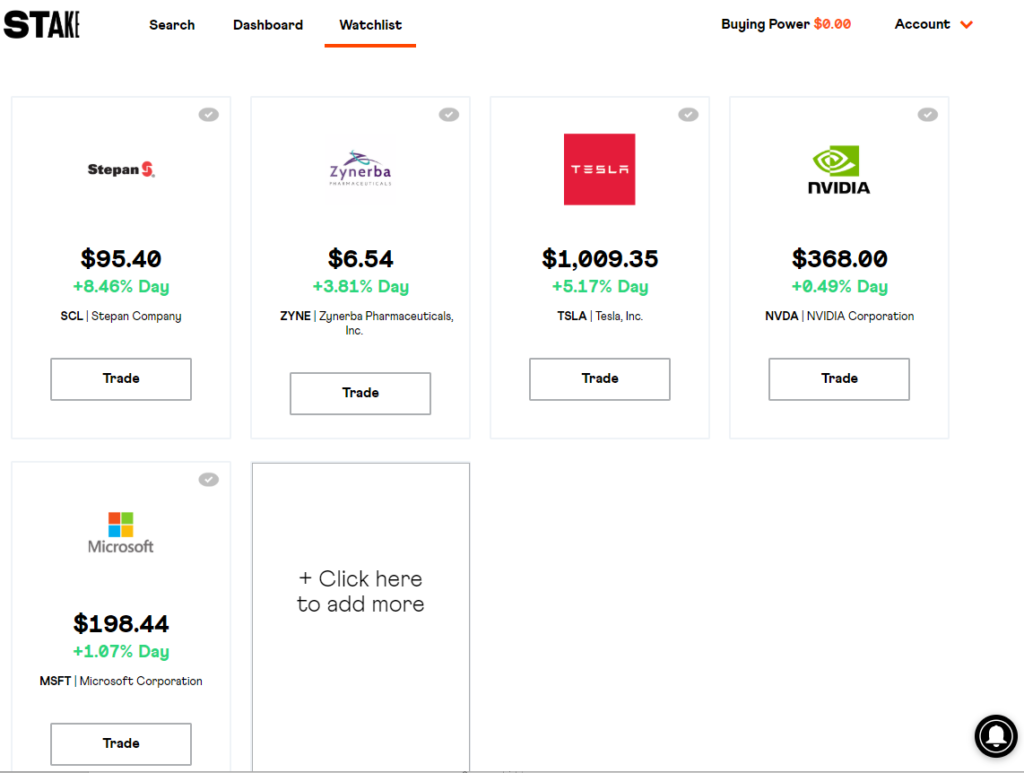

Watchlist

When searching for various stocks, you can add them to your watchlist by clicking on the ‘eye’ symbol on each row. In both Stake and SelfWealth, it is all in one list.

SelfWealth vs Stake – Platform Overview

If you like clean, no fuss, minimalistic platforms then you cannot argue with Stake being the superior platform. The demo account in SelfWealth should not be underestimated as it can provide a safe place for beginner traders to play around without risking real money. Both platforms have their positives and negatives and will just come down to personal choice. As both platforms continue to roll out potential features, you may find yourself swinging one way or the other with Stake vs SelfWealth. If you want a single place to view your Aus and US stocks, then SelfWealth is the choice.

One thing I forgot to add was that both offer mobile apps. The mobile version of Stake is definitely more user friendly and the SelfWealth version isn’t as good as the website version. Stake is similar to its website in a good clean, easy to navigate formula.

Stake vs SelfWealth – What can you trade?

Whilst Stake vs SelfWealth both offer US stocks and ETFs to trade, there are significant differences. SelfWeath has a greater range of available stocks and also includes Australian stocks.

SelfWealth

SelfWealth offers stocks listed on the below US markets for trade on our platform:

- New York Stock Exchange (NYSE)

- National Associated Securities Dealers Automated Quotations (NASDAQ)

- New York Stock Exchange American (NYSE American)

- New York Stock Exchange Arca (NYSE Arca)

Over 7,500 US Stocks are available to trade on the SelfWealth platform*, within these markets. You do not need to know which stock is in which market to trade. Simply search for the stock’s code and the platform will retrieve the stock.

*Total stocks available may vary due to new listings, delistings and code changes.

Stake

US Stocks & ETFs

When it comes to investment opportunities, the US stock market is where it is at. Access the world’s biggest companies, the next generation of game-changers or get involved in the most active ETF market on offer, including access to inverse and leveraged ETFs.

On Stake, you can invest directly in over 3,700 US-listed stocks and ETFs. All these shares are listed on US exchanges such as the NYSE and NASDAQ etc.

There are also more than 200 ADRs (American Depository Receipts) of global companies that trade in the US market that you can access on Stake. American Depository Receipts (ADRs) offer investors a means to gain investment exposure to non-US stocks without the complexities of dealing in foreign stock markets. They represent some of the most familiar companies in global business, including household names such as Nokia, Royal Dutch Petroleum (maker of Shell gasoline), and Unilever. These and many other companies based outside the US list their shares on US exchanges through ADRs.

One thing I love about Stake is that they list all of their stocks/ETFs – this information is publicly available and you can check them out – click here. This is something that SelfWealth doesn’t offer and can make it frustrating to find that particular stock you’re after.

IPOs

On Stake, you can trade a new listing on the day of its IPO. So, when a company announces its IPO, you know that you will be able to access it on day 1 on Stake.

What they don’t offer

- Margin Trading

- Short selling (different to short exposure ETFs like SQQQ or FAZ)

- Options

Stake vs SelfWealth – Trading offerings overview

Stake vs SelfWealth – both platforms have their respective features that will entice traders one way or another. If you want more exposure to the US markets and Australia, plus the ability to follow other traders, then SelfWealth is the platform for you.

If you want depth and no-nonsense trading, then Stake is more suitable. One thing that benefits SelfWealth is that they have Australian shares to trade.

Stake vs SelfWealth – Types of trading orders

SelfWealth

SelfWealth allows clients to place Limit orders when trading US Securities. All orders on the US Market expire at the end of the trading day and cannot be extended.

A limit order allows you, the investor, to specify the price at which your shares can be bought or sold.

Will you add more order types?

More order types will be added in the near future for trading US securities. They will announce when these become available.

Does SelfWealth Have a Minimum Trade Size?

There are two considerations here.

- The initial investment must be $100 (min) for US stocks, for Aus stocks it is $500.

- There is no fractional shares (i.e. you’ll have to buy the complete share)

Stake

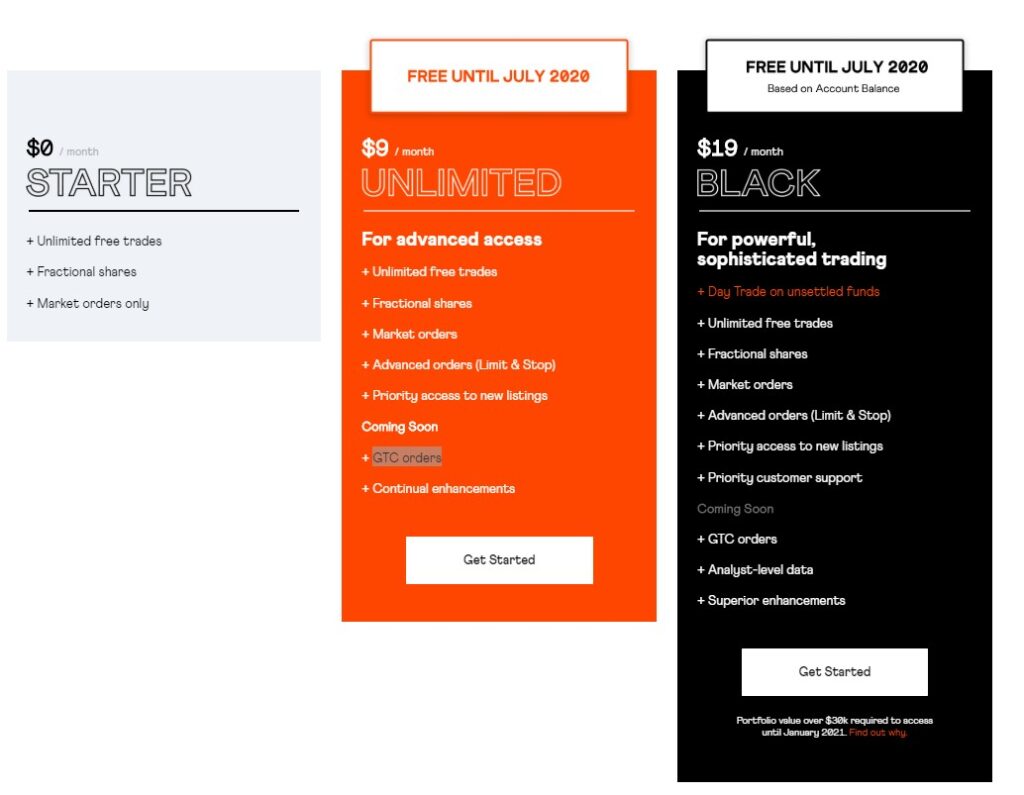

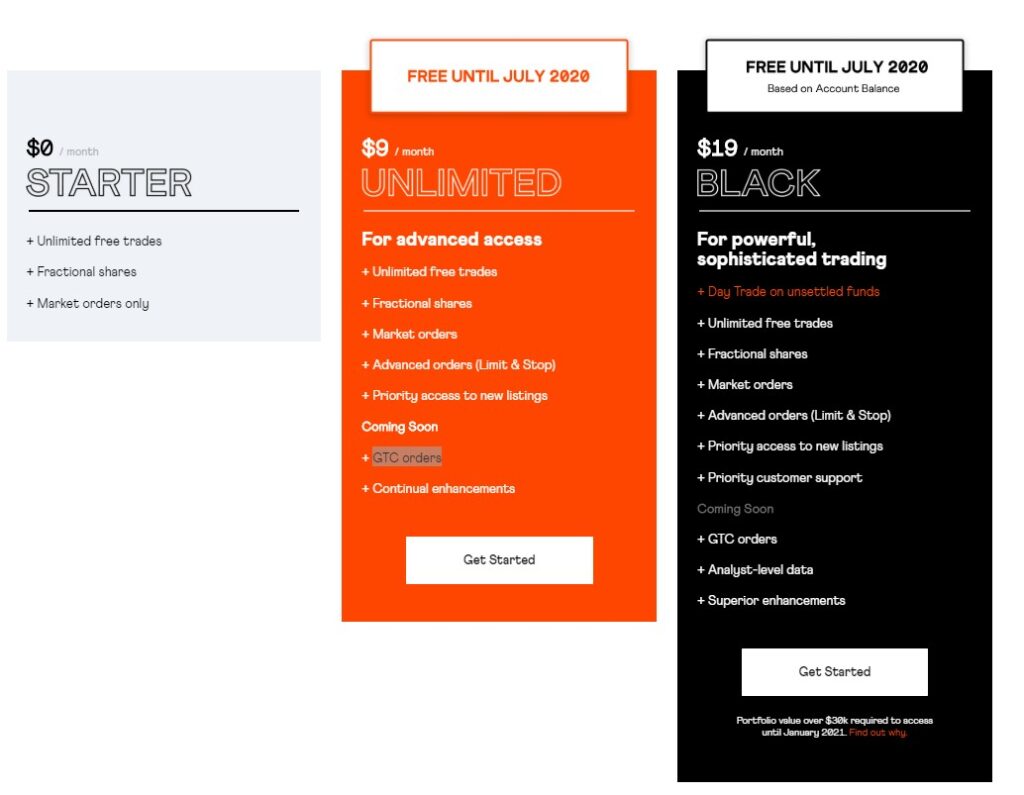

The platform offers straight forward trading options but a fair warning. Stake has three levels of brokerage packs.

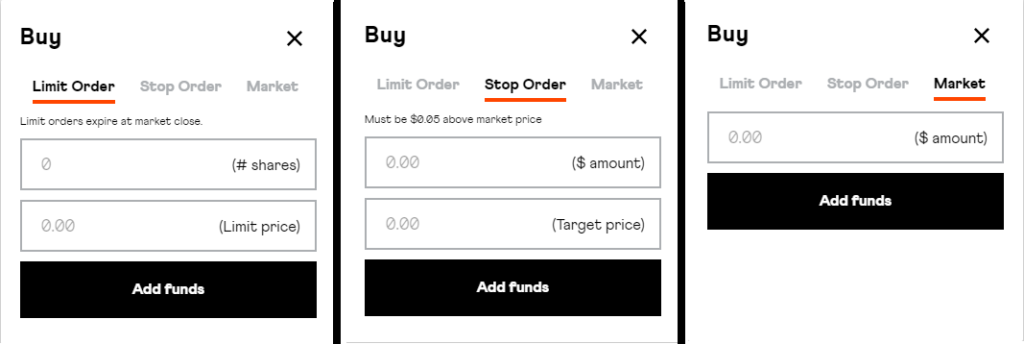

Limit Orders

A limit order is an order to buy or sell a whole number of shares at a specific price or better.

A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. A limit order is not guaranteed to execute.

If not executed, a Limit Order will expire at the end of the U.S. trading day if it is not executed before market close.

Stake does not offer Good-Till-Cancel (GTC) orders, same for SelfWealth.

Limit orders will be rejected if placed more than 5% above (for buys) or 5% below (for sells) the current market price.

Market Orders

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately.

However, the price at which a market order will be executed is not guaranteed.

A market order on the platform can be placed at any time but will only be executed when the market is open.

Stop Order

A stop order becomes a market order when a stop price is triggered. A buy stop order is entered at a stop price above the current market price, while a sell stop is entered at a stop price below the current market price.

Note that the stop price needs to be 5 cents below (for sells) and above (for buy stops) the current market bid or offer, respectively. All Stop Orders remain queued until it is executed, or you delete it. This means they do not expire at the end of the day (like Limit Orders do).

An example of a Stop Sell Order is below:

Joe has some TSLA shares that he would like to sell if the price drops below $800. He places a Stop Sell order on Sunday for $800. The stock continues trading above $800 until Friday’s trading session when TSLA opens at $785. A market order is immediately triggered, and the shares are sold. John exits the position at $785.

Pattern Day Trading Rule

The US regulation has certain restrictions and rules in place to protect individual investors from taking on too much risk. One that applies to trading on unsettled funds is the Pattern Day Trading (PDT) rules.

This only applies to Stake Black customers as they are trading on unsettled funds. The PDT rule only becomes an issue after January 2021, as all Stake Black is currently only available to customers with $30K or more in their accounts.

The PDT Rule

The basic premise of the PDT rule is that you cannot make more than three-day trades (buys and sells of the same share in the same day) in a “rolling” five-day period. This 5-day period may not be a calendar week, it is any 5 trading days in a row.

This rule does not apply if you have $25,000 or more of equity in your account.

Breaches

The potential risk of being marked as a Pattern Day Trader is that you may not be able to make day trades for a certain period (90 days).

Minimum & Maximum order size

The maximum size of an order in the US market is 10,000 shares, but you can place as many orders (subject to your cash or holdings) under that amount.

The minimum trade size is $10.

Fractional investing

Instead of buying individuals shares, you can invest smaller dollar amounts (minimum $10). For example, if one Google share cost $1,200, you have the option of investing just $100 if you choose. If you invest $1,800, you will own 1.5 shares.

T+2 Trade Settlement

The settlement time for the US market has a settlement period of T+2 trading days. This means the cash for executed sell orders takes 2 days to clear back into your trading account. The settlement date for all trades is available on the trade confirmation.

Customers who are on Stake Black can re-invest with these funds before they have settled. For those who are not trading on unsettled funds, we provide you with a calendar of settlement amounts to show you when those funds will be available in your account.

Trading on unsettled funds

Trading on unsettled funds is available as part of Stake Black, our premium brokerage pack. Until January 2021 Stake Black is free of charge for those with account values over US$30k. For a detailed overview of trading on unsettled funds, how to access it and the regulations that sit around it, please read this blog post.

Stake vs SelfWealth – types of trading overview

When it comes to the breadth of trading availability, I will have to side with Stake for their extensive features and different trading options. If you do not need all that fancy stuff, then SelfWealth is also a great choice. Simple and non-cluttered. In this Stake vs SelfWealth – who do you fancy?

Stake vs SelfWealth – Deposits and withdrawals

SelfWealth

Deposit funds

Funds can be deposited into your SelfWealth cash account via electronic funds transfer (EFT) or via BPay.

To view your BSB, account number and BPay details

Log into your account > Trading Account > Add Cash to Trading Cash Account

Please note if your banking institution uses the Osko payments system you will not be able to transfer funds via EFT. You will need to transfer funds via BPay to your cash account.

BPay Limits

SelfWealth can accept deposits via BPAY up to the value of $800,000.

Visit your trading account settings page to view details for a BPAY transfer.

Log in to your account and go to Trading Account > Cash Details

Withdrawal

In Selfwealth, withdrawals are done by your ‘cash’ account.

Your cash account via SelfWealth is a wholesale banking facility managed by ANZ but is not linked to the ANZ retail banking system. As a result, you cannot view or withdraw funds from your SelfWealth cash balance via the ANZ online banking system or via a branch.

To view your cash balance or withdraw funds from your SelfWealth Cash balance log into your SelfWealth account and select:

Trading Account > the Cash Account tab

From here you will be able to:

- View your SelfWealth cash account BSB and account number.

- See your nominated bank account details.

- View your SelfWealth cash balance.

- View your cash transactions.

- Submit a request to transfer cash from your SelfWealth cash account to your nominated bank account.

To Transfer Funds

To transfer funds out of SelfWealth and into your personal/nominated bank account, log into your SelfWealth account and go to the Cash Account page.

Left-hand-side Menu > Trading Account > Cash Account

Payments submitted by 2:00 pm AEST will be available the next business day.

Payments made on a public holiday or over a weekend will not be processed until the next business day.

Important:

Cash deposited into your SelfWealth account will be reserved in your account for 72 hours from the time of the deposit. This means you will need to wait 3 days before you can withdraw the funds back to your nominated bank account.

Please note this rules is limited to direct deposits into your cash account and excludes sale proceeds from the sale of your shares.

Stake

Depositing Funds

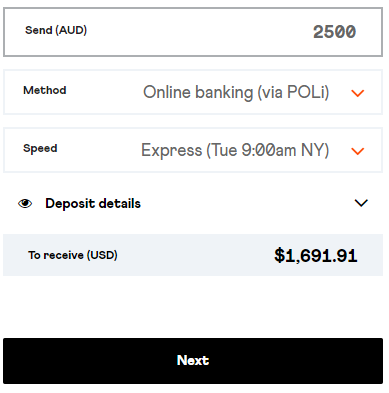

You can make an FX transfer of Australia dollars into USD on Stake. You will get direct access and visibility to the spot FX rate with full transparency of any fees. The minimum amount you can fund is $50AUD.

Ways to fund

You can transfer AUD into USD on Stake using:

- Bank Transfers (with POLi)

- Debit or Credit Card (there is a 60-day hold before you can withdraw funding made by card for security reasons).

Your funds go directly to our FX partner and then into your brokerage account. You can fund and place a trade in the stock market on the same day.

For non-individual accounts (such as SMSF and Company accounts), we provide you with a linked Macquarie Cash Management account which is also available to fund with. Customers with SMSF and Company accounts will receive the details (BSB & A/C #) of the CMA with instructions on how to fund their accounts.

Speed

When you fund your account, you can choose the speed (express or regular) you want it in your brokerage account. With express funding, your funds will be in your account and ready to be invested just a few hours later.

Getting Free Stock

When you fund your brokerage account (AUD into USD) for the first time on Stake, you will get a free stock of Nike, Dropbox, or GoPro. All you need to do is fund within 24 hours of your account opening. Simple as that.

Card Funding & 60 Day Holds

Funding by card (debit or credit) is subject to a 60-day hold period before you can withdraw those funds. This is for compliance reasons, and to provide an additional layer of security against fraud. You will be able to see the amount that is always available for withdrawal in your Cash Available for Withdrawal in Stake. For more information, please see Withdrawing Funds

Direct USD transfers

You can fund your account directly if you have USD already, or would like to transfer any currency (like AUD etc) into USD using your bank or preferred FX remitter (such as OFX, XE, WorldFirst etc).

Making a direct deposit

The key banking and transfer information for your accounts will be found inside your Account tab on Stake.

Within the section “Direct USD Transfer” your specific transfer information is provided – it is unique to your account and ensures that if followed, your transfer will arrive as you planned.

To make a direct USD deposit, please also ensure you follow the information in this section.

Correct Details

Ensure the details of your transfer, found in the “Direct USD Transfers” section, are entered correctly with your FX provider. Match your reference number exactly as included.

No 3rd party transfers

Ensure that the name on the remitting account is an EXACT match to your Stake account we are NOT able to accept fund transfers otherwise, for any reason – no related company accounts, friends & family accounts etc.

Transfer and other fees

Make sure that you are aware of the feeds provided by your bank or FX provider (i.e. wire fees etc).

Stake charges a flat USD 5.00 fee which is passed through to our US broker-dealer to reconcile and undertake fraud checks on each transfer.

Notifying Stake

Once you’ve made your Direct Deposit, be sure to let us know on our Direct Deposit form and attach your transfer receipt. We will keep an eye out to make it processes as quickly as possible. Please note that Stake is not able to view the status of this transfer until funds arrive in the US with DriveWealth.

Things to note

Please note that withdrawals cannot be made USD to USD. All withdrawals must come back through to your local Australian bank account.

Link an Existing Macquarie CMA

If you already have an existing Macquarie Bank CMA, you can link it to your Stake account. This gives you great flexibility in moving money across and it will become your default funding method when transferring AUD to USD on Stake.

Linking your CMA to your Stake account

To link your CMA to Stake, you will only need to fill out section 1 & physically* sign section 6 of the attached Third-Party Authority Form. We will manage the rest! Once complete, please scan the entire form and send it back to us at support@helloStake.com.

By completing this form, you grant Stake general authority over the CMA, which allows us to arrange transfers from your CMA to your US trading account. These transfers are always initiated and requested by you on Stake. It also means you can see the balance of that account on Stake.

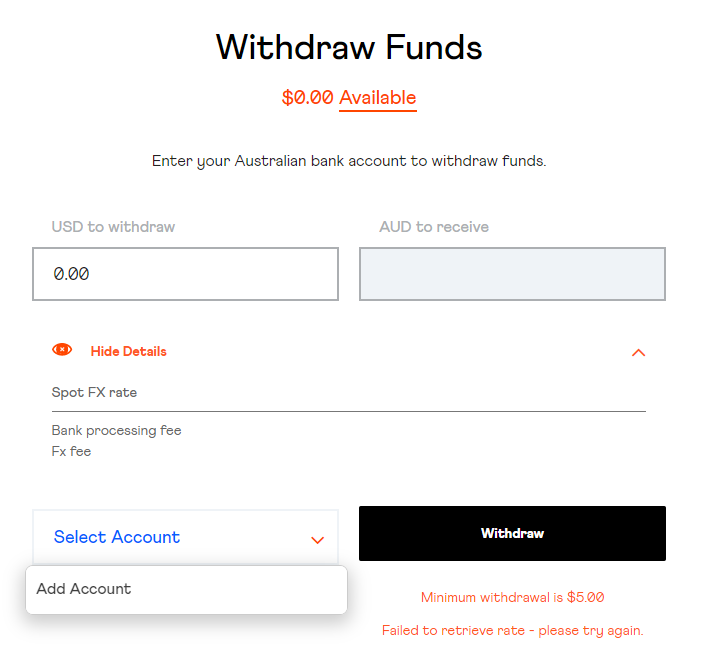

Withdrawing Funds

You can withdraw your available funds any time from Stake. Much like funding your account, the spot FX rate and all applicable fees will be provided to you before you decide to process your transfer. The minimum amount you can withdraw is $5 (USD).

Transfers can only go from Stake to your local bank account, which must be in your name. Before you make your first withdrawal, you will need to provide your bank details (BSB & Account Number).

Speed

It normally takes approximately 2 business days for the withdrawal to arrive in your local bank account.

Security

Make sure you enter the correct bank account details and verify your withdrawal. We will ask you to double-check and then validate your transfer.

As an additional check, which ensures the security of your funds, we have extra validation on withdrawals and may contact you or request extra documentation. This ensures your details are correct and prevents any fraud on your account.

Available funds & Reserved Cash

You will only have funds available for withdrawal when your settled cash balance is greater than the amount of any cash that is reserved for:

- any holds on funds for funding by card, which has a 60-day hold period

- any pending buy orders (i.e. any order you must buy stocks).

This amount (Reserved Cash) may be greater than your portfolio value due to market fluctuations (i.e. you funded $1000 by card 30 days ago, but your current cash value is only $900). If this happens, you will not be able to make a withdrawal until your portfolio’s cash balance is greater than this amount or the 60-day hold period on your card funding has passed.

Stake vs SelfWealth – Deposit and withdrawal overview

In this deposit and withdrawal battle of Stake vs SelfWealth – Stake wins. It’s simple and to the point and has the options for a quick deposit timeframe. SelfWealth does have it’s merits but it gets very confusing if you use different methods. So looking at Stake vs SelfWealth – stake wins this based purely on simplicity.

Fees

SelfWealth

Is there a brokerage fee?

Yes, it is $9.50 per trade. There are also fees associated with currency exchange if you after transferring AUD into your US trading account.

Stake

No brokerage fees

This is probably the easiest section to write. As Stake does not use leverage or CFDs, there are no brokerage fees. Zip, Nada, naught. No brokerage fees or commissions.

How does Stake make money?

No brokerage? But CommBank charges $20 each time… Sounds like a poor business plan. Well, Stake makes money on the currency exchange when you fund your account or withdraw money from your account.

Currency exchange fees

- FX fee: $0.70 for every AU$100 transferred, which is an FX spread of 0.7%.

- Card fee: If you choose to fund your Stake account using a credit or debit card, you will be charged 2% of what you transfer by the card merchant.

- Express transfer: If you want your money to arrive in your account within the next 24 hours, you will be charged 0.5% of what you transfer.

- US tax form: When you sign up to Stake, there is a one-off $5 fee for US taxation purposes.

- External transfer fee: If you already have US dollars that you would like to transfer into Stake, there is a $5 transfer fee applied.

Stake vs SelfWealth – Fees overview

Straightforward and simple is Stakes take on fees but limits you in the types of trades you can do based on your brokerage plan. Where it becomes murky is the size of the trade, which i will cover in a topic down below.

Stake vs SelfWealth – Affiliate and promotions

SelfWealth

SelfWealths affiliate program consists of 5 x free trades when you get a friend to join. Whilst not significant, it is worth up to nearly $50 but there is a limit of when you can use it. So if you’re not a frequent trader, it might not be worthwhile. You just need to get your affiliate link and let people sign up using that. This is my affiliate link https://secure.selfwealth.com.au/Registration/Plan/5/y6jga

Stake

The platform has two nice features when it comes to affiliates and promotions. The first is gift-giving.

They also allow you to give shares as a gift; you can purchase as little as USD $10 or as much as USD $500 worth of shares in a company of your choice, and that amount of shares is then sent to whomever you’re gifting them to.

Invite a friend

If you get one of your friends (or someone reading your article) to sign up to Stake, they will you are your friend and you a free stock. Once they make a deposit, you both get a stock. No questions asked.

This is my referral code.

https://helloStake.com/referral-program?referrer=josephm745

Now, it is a random selection from GoPro, Dropbox, or Nike… not a bad result

Stake vs SelfWealth – Affiliate and promotions overview

There’s not much difference between the two. I like Stake’s referral program as it gives you actual stocks so there is opportunity to get a bigger payload.

Tax compliance

When trading in US stocks, both Stake vs SelfWealth makes you fill out a W8-Ben US tax form to avoid paying 30% tax instead of 15% on your profits to the US government.

Neither platform sends tax information to the Australia Government for the moment and it is up to the trader to provide these details during tax time. Please seek professional advice when doing your tax returns.

Safety

SelfWealth

Funds deposited into your SelfWealth trading cash account are kept in a trust in SelfWealth’s name as bare trustee, with clients designated as the beneficiary. Money is physically held by ANZ, not SelfWealth.

Due to the structure of the cash account, neither SelfWealth nor other third parties such as administrators would ever have access to your money, unless a specific direction is provided by you, the client.

This also means that SelfWealth does not lend out clients cash, nor your shares, for that matter. We do earn interest on your funds, which is what allows SelfWealth to offer our award-winning low-cost flat-free brokerage as well as CHESS sponsorship. In the past, in high-interest rate environments, we have paid out interest to clients.

ASIC regulates the trust account and it cannot be used for any corporate purpose, even in the event SelfWealth were to enter administration or the like.

Furthermore, your funds are covered by the Australian Government-backed deposit guarantee under the Financial Claims Scheme. This scheme guarantee deposits up to $250,000 per individual per Authorised Deposit-Taking Institution (ADIs), which includes your SelfWealth trading cash account.

In the highly unlikely event that ANZ were facing bankruptcy, funds up to this amount would be guaranteed by the scheme and would cover your loss by repaying your funds. For joint accounts, each individual is entitled to a guarantee per ADI, so for two holders of an account, the combined coverage would total $500,000.

For further details on the Financial Claims Scheme and the government guarantee, you can read more on the APRA website.

A strong Record

Since 2017, SelfWealth has been trading as a publicly-listed company on the ASX. As part of our listing status, we are required to meet ongoing reporting and regulatory commitments in accordance with corporate governance, listing rules and legal requirements.

We do not act as a representative of any other licensee in relation to the services we provide our clients. SelfWealth holds an Australian Financial Services Licence (No. 421789) and we are licensed under the Corporations Act to provide general financial product advice in relation to certain financial products and arrange for dealing in certain financial products.

SelfWealth’s financial accounts are audited and published. We also release quarterly Appendix 4C and activities reports. These interim reports provide the public with details of SelfWealth’s operational activities across the prior quarter and insights into our financial position. In addition, we maintain the requisite meetings for SelfWealth shareholders to attend, using these forums as an opportunity to field queries on the business.

All of this means, not only do you, our members, have access to see how SelfWealth is performing, but the wider investment community also scrutinises our performance each and every trading day.

Stake

Regulatory & Partners

Stake works work with several partners to deliver a seamless, intuitive, and safe investing experience. Some of the regions in which Stake and its partners are regulated include in the US, the UK, across Europe and Australia.

In Australia, Stake is an authorised representative (Authorised Representative No. 1241398) of Sanlam Private Wealth Pty Ltd (Australian Financial Services Licence No. 337927).

Our Partners

Stake’s FX transfer partner in Australia (and globally) is OFX (OzForex Limited), an ASX listed FX transfer service. OFX enables Stake to provide customers around the world with a more competitive and seamless FX service inside the Stake product. The company manages the FX transfers for Stake customers and sits behind each transaction ensuring that customers funds are transferred in a timely and affordable way to your US brokerage account. It is regulated globally, including in the United Kingdom by the Financial Conduct Authority (FRN: 902028), in Australia by ASIC (AFS Licence number 226 484) and in the USA as a licensed money transmitter (NMLS #1021624).

DriveWealth provides the US brokerage and execution services to Stake and its customers. It is connected to the relevant exchanges to ensure that orders are executed in accordance with the client’s instructions. DriveWealth, LLC is a US broker-dealer registered with FINRA (US regulator) and is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). You can read more about SIPC at www.sipc.org.

We work with several other regulated partners to bring better & safer access to the US stock market, including:

- Trulioo – For the digital verification services required to meet our KYC and AML requirements

- Macquarie Bank – providing bank accounts for non-individual accounts (SMSF, Company accounts)

- Tiingo – Our data provider for market and company data you see on Stake

- Poli (Australia Post) – A payment gateway for faster online funding

Safety & Security

With Stake, there are lots of ways your cash, securities and data are safe and protected.

Our Partners

It is worth noting that Stake never holds or touches your money – your money goes directly to our regulated FX partner (OFX) and then onto DriveWealth. When you withdraw your funds, it is the same, just the other way back!

Your cash and securities in the US are held in custody for your benefit with Citibank, one of the world’s largest banks.

Insurance

The US broker, DriveWealth, LLC is a US broker-dealer registered with FINRA (US regulator) and is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). You can read more about SIPC at www.sipc.org.

This protects you, as a non-U.S. citizen with an account at a brokerage firm that is a member of SIPC. Stake customers are treated the same as a resident or citizen of the United States.

No more Stake

In the unlikely situation that Stake goes down, you would still have access to all your cash and securities.

Our broker partner, DriveWealth and the custodian (Citibank) will establish access for customers if anything happens to Stake.

Account security

You have full control of your account and can enable advanced security in the form of 2 Factor Authentication (using an app like Google Authenticator or Authy) at any time.

Data

We work to meet the highest standards of the privacy regimes in Australia and all the markets we operate. As we are also a UK regulated firm, we adhere to a privacy policy that is set out in accordance with GDPR.

In terms of storing data, we encrypt and store all your data securely with AWS.

Stake vs SelfWealth – conclusion

Stake vs SelfWealth – is there a clear winner? No.

Both SelfWealth and Stake have their benefits and you will be able to find out what the best platform is for you. If you are a simple straight-forward trading platform, with a clean interface, low fees and plethora of US stocks and ETFs to choose from? Then Stake is more suited to your style. If you want the ability to also trade Austalian stocks and follow other traders, the SelfWealth is the better platform.

They both offer great products for their traders and they are both similarly sized in terms of the Australian cohort. Whilst SelfWealth has only recently released their US stock trading platform, they still have a significant number of traders for Aus stocks. No doubt a lot of them will shift over to trade US stocks as well. It can be hard to separate the two, it just depends on what you are looking for. One thing for sure is that they both are more enticing to me than the big 4 offerings.

What about you? Which platform are you thinking of using? Stake vs SelfWealth – who do you have? Have I missed out on any critical information above? Let me know in the comments below.