Walmart is one of my favourite sleepy giants. It’s not going to have significant fluctuations each day – just slow and steady, with a dividend to match.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

With $WMT reporting its earnings before market open on the 19th May 2020 – this breakdown isn’t going to tell you whether it is going to beat the estimates. You’ll be able to use the information below to formulate your answer.

If you don’t know what Walmart is and what they do – they engage in the retail and wholesale operations in various formats worldwide. Meaning – bulk goods and everything else found in their big freaking warehouses. They have a proven track record and an average dividend payer.

Walmart Key Analytical points

These are the key analytical points

- Trading at 19% below its fair value

- Earnings are forecast to grow 3.23% per year

- Earnings grew by 123.1% over the past year

- Pays a reliable dividend of 1.72%

but

- Has a high level of debt

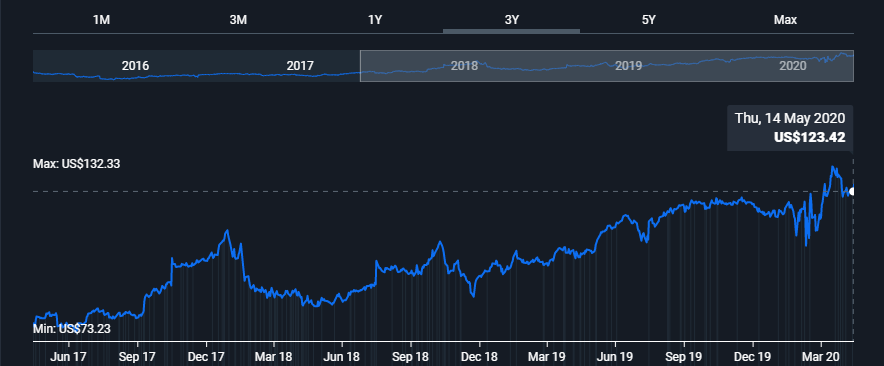

Over the last 3 years, this is what Walmart’s stock price looks like. Except for the last 2 months, there has been little volatility and it continues on an upwards trend. With the current stock price in the mid 120s, it has climbed from low 70’s in price. SO just under doubling in 3 years.

Let’s look at how Walmart has compared to the US Consumer Retailing industry and the US Market averages, including a dividend paid out.

| Timeframe | Walmart | Industry | Market |

|---|---|---|---|

| 30 days | -4.8% | -3.4% | 3.1% |

| 1 year | 27.2% | 13.4% | 0.6% |

| 3 years | 70.4% | 38% | 25% |

| 5 years | 87.5% | 50.1% | 45.5% |

As you can see, Walmart has outperformed the industry and market in all categories except the 30day timeframe.

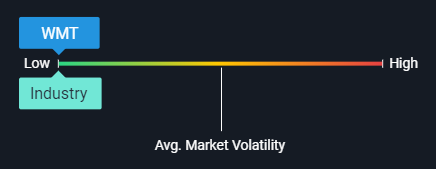

Price Volatility Vs. Market – Walmart’s share price volatility is on par for the industry but significantly lower than the average market volatility over the last 5 years.

Walmart Valuation

Is Walmart undervalued compared to its fair value and its price relative to the market?

At the moment, it seems that Walmart is undervalued when looking at its current share price ($125.94) vs its fair price. The fair price is an estimate of what the stock price is worth today, based on the cash flows the company is expected to generate in the future.

Price to Earnings Ratio. The PE Ratio measures the current share price relative to the company’s earnings per share. A high PE ration can indicate a company’s share price is high relative to its earnings and is possibly overvalued.

$WMT is poor value based on its PE Ratio (24.1x) compared to the Consumer Retailing industry average (20.7x) and the US market (14.3x).

Price to Earnings Growth Ratio

WMT is seen as poor value based on its PEG Ratio (7.5x). PEG ratio below 1 is considered to be good value. PEG ratios measure a stocks’ value while factoring in the company’s forecast earnings growth rate.

Walmart’s Future Growth

How is Walmart forecast to perform in the next 1 to 3 years based on estimates from 19 analysts?

The Forecasted annual earnings growth is 3.2% which underperforms the industry (6.0%) and the Market (20.5%).

Disappointingly, it also falls behind in the forecasted Annual Earnings Growth category. 2.7% vs Industry 3.9% and Market8.8%

Is your money better off in a bank? Well compared to the average savings rate of 1.7% – no. Getting 3.2% growth per year and taking into account the dividend payment, investing in Walmart should be creating more wealth for your money.

Earnings per share – given our current economic environment, the EPS outlook for the rest of 2020 and into the Q1 of 2021 is on a decline. But from there it looks to continue to climb each year at a steady pace.

Return on Equity

$WMT Return on Equity is forecast to be low in 3 years (18.2%). ROE is a profitability measure which shows how efficiently a company’s management team has used its shareholders’ money to generate profits.

One area where $WMT excels is looking at the past year’s Annual Earnings Growth. $WMT has over 123% annual earnings growth over the last year, compared to 5.2% and 2.4% of the industry and market. Over the last 5 years though, it tells a different story. WMT’s earnings have declined by -10.6% per year over the past 5 years., compared to the industry at 6.5%

Walmart’s debt

Looking at some key risks in its financials – WMT’s short term assets ($61.8B) do not cover its short-term liabilities ($77.8B). Short term liabilities are commitments the company has made which are due within one year. Short term assets are assets owned by the company which can be sold, converted to cash or liquidated within one year. This means if stuff went bad, can they cover what they owe with what they currently have in the short term.

WMT’s debt to equity ratio (61.7%) is considered high and because it has increased from 55.7% to 61% over the last 5 years, they aren’t seen as reducing their debt. The debt to equity ratio measures how much a company is financing its operation through debt versus wholly-owned funds.

But we’re talking about $WMT here – they are an operating cash flow giant. Their debt is well covered by this operating cashflow. It’s interest payments on its debt are also well covered by EBIT (earnings before interest and taxes at 8.9x coverage).

One great thing that $WMT has going for them is their enormous physical assets and inventory coverage – $127b and $44b respectively – that’s huge!

Walmart’s dividends

A nice side bonus to this slow and grow giant is its dividend. Currently at 1.72% dividend yield. Whilst it’s not huge, it’s on par with the industry average of 1.8%

If that doesn’t do it for you – consider that $WMT dividends per share have been stable in the past 10 years and that its dividend payments have increased over the past 10 years. So that means a stable dividend and it’s increasing year on year.

If you look at the recent insider trading, there has been a significant sell-off over the last year. This could be for many reasons – owners needing money, reducing their holdings, the recent downtrend in stock price. The key thing here is that there hasn’t been a strong showing in buying the stock by the large players but I assume that is going to change over the months as the economic environment plays out and people gain more confidence in stabilisation.

Walmart overall

Overall, I like $WMT for its slow growth, solid dividend and being in a market that will continue to grow. Walmart is a staple of American life and it is certainly one to consider for your portfolio.

I also own $WMT on my eToro profile.

The analysis above was created with information sourced from Simply Wall St, eToro and TipRanks.

My dad didn’t buy individual stocks, except he did buy $1,000 worth of WalMart stock many years ago. We lived in Arkansas and that was where the company was founded and headquartered. He even got to ask the founder, Sam Walton, a question from the floor of the annual meeting one year. He never sold the stock and when he passed and my brother and I inherited the stock, and it was in the form of actual paper stock certificates. It was worth $80,000. He realized an eight thousand percent return on his investment!

Thank you for sharing that story. I hope you hold onto those stocks for many years to come!