CopyPortfolios (formerly known as CopyFunds) is eToro’s premium product offering that takes CopyTrading to the next level.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

The three types of CopyPortfolios:

- Top Trader CopyPortfolios. These portfolios look at the best performing traders, according to a predefined strategy.

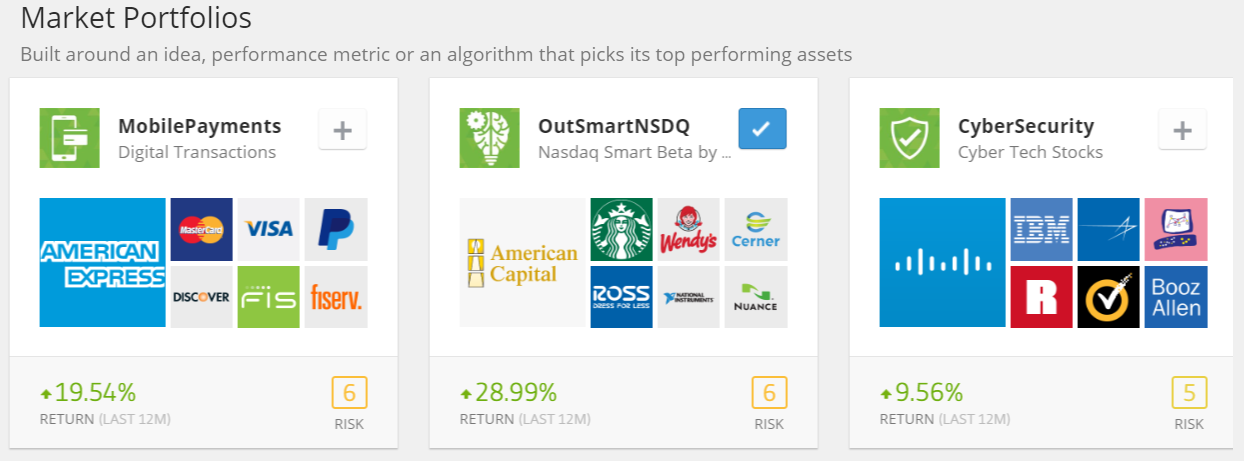

- Market CopyPortfolios. Bundle together stocks/ETFs etc that have a certain theme. THings like Healthcare, travel, gaming or cryptocurrency.

- Partner CopyPortfolios. These portfolios have been created by eToro’s partners. These mimic some of the best fund managers in the world and some of the best companies. Think Tipranks, Berkshire, WeSave, and Meitav Dash.

Copyportfolio is designed to help traders take advantage of current market opportunities. Each CopyPortfolio is periodically re-balanced in order to get the most out of the strategy used.

When you use the CopyPortfolio, each person or market is counted as a single trade. Each trade will open with the same proportional amount. This is the same as when you copy a trader on eToro.

Common Questions

What is the minimum investment amount?

$5,000 is the minimum amount. As there are a number of traders or markets in each portfolio, there are a lot of positions to open.

How can I remove funds?

It is not possible to remove a part of the investment. You would need to close the investment completely.

Can I close individual positions within the CopyPortfolios?

It is not possible to close individual positions within the CopyPortfolio. You would need to close the investment completely.

How can I realize my profits?

You can realize your profit by closing your investment. The funds will go into your available balance.

What factors do you take into account when re-balancing a CopyPortfolios?

eToro looks at how the stocks are performing and how the ETF portions are progressing. Overtime, it is rebalanced to maintain the strategy.

What about rebalancing?

As the rebalancing period changes from one CopyPortfolio to another, you may visit your CopyPortfolio’s page on eToro to know your CopyPortfolio’s specific rebalancing frequency.

Copyportfolio Fees?

There are no management fees associated with CopyPortfolios. However, there are spreads when opening the underlying positions.

For more information about CopyPortfolios, click here.

Some truly interesting details you have written.Assisted me a lot, just what I was searching for : D.