One of the key actions to ensure a successful financial journey is to eliminate your bad debt. On this page, I’ll answer the question – what is the debt-snowball method?

What is the debt snowball method?

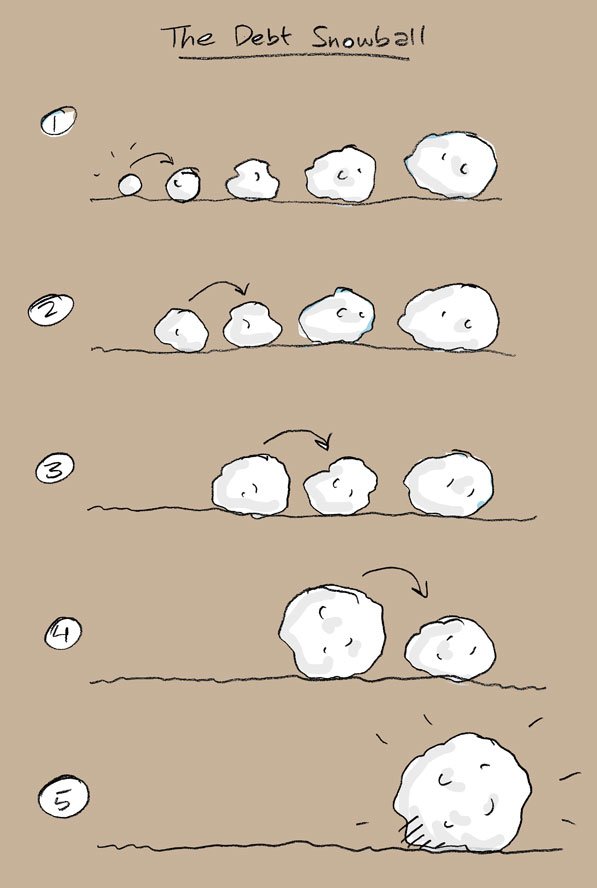

Think of a snowball rolling down a hill. It starts off small and as it picks up momentum, it grows in size. The debt-snowball method uses the same action.

The debt-snowball method is a debt reduction strategy, whereby you write down all your debts. These include things like store cards, credit cards, personal loans etc. You order them by the smallest debt to the largest, not taking into account the interest rate. The key goal is to pay off the smallest debt first and only the minimum on the remaining.

Once you’ve paid off the smallest debt first, use the payment you’ll put towards that debt on the next smallest debt. You can speed up repayments by sending any additional cash towards the smallest loan.

The debt snowball method is similar to the debt avalanche method, which focuses on the highest interest rate first, regardless of debt size. The idea behind this is to reduce the amount of interest paid over time. I’ll do a post about this soon 🙂

A lot of people tend to use this method with revolving credit, like credit cards. Revolving credit means that there are not a minimum number of repayments to make – unlike instalment loans, like a mortgage.

How does the debt-snowball method work?

The basic steps in the debt snowball method are as follows:

- List all debts in ascending order from smallest balance to largest. This is the method’s most distinctive feature, in that the order is determined by the amount owed. Not the rate of interest charged. However, if two debts are very close in the amount owed, then the debt with the higher interest rate would be moved above in the list.

- Commit to pay the minimum payment on every debt.

- Determine how much extra can be applied towards the smallest debt.

- Pay the minimum payment. Any extra amount goes towards that smallest debt until it is paid off.

- Once a debt is paid in full, add the old minimum payment (plus any extra amount available) from the first debt to the second smallest debt. Apply the new sum to repaying the second smallest debt.

- Repeat until all debts are paid in full.

The payments towards the larger debts grow quickly by the time they are reached. This is because of the extra payments towards the end of the method.

The theory works as much on human psychology. By reducing the number of bills to pay, the payer sees the positive feedback on their progress towards eliminating their debt.

A debt-snowball method example

A person has the following amounts of debt and additional funds available to pay debt. The method recommends listing the smallest balance first:

- Credit Card A – $250 balance – $25/month minimum

- Credit Card B – $500 balance – $26/month minimum

- Car payment – $2500 balance – $150/month minimum

- Loan – $5000 balance – $200/month minimum

- Extra money devoted to the repayment of debt – $100.

First two months

Payments:

- Credit Card A – $125 ($25/month minimum + $100 additional available)

- Credit Card B – $26/month minimum

- Car payment – $150/month minimum

- Loan – $200/month minimum

Third-month balance

Presuming the person has not added to the balances, which would defeat the purpose of debt reduction. Credit Card A would have been paid in full, and the remaining balances as follows:

- Credit Card B – $448

- Car payment – $2200

- Loan – $4600

Third month payments – the person would then take the $125 previously used to pay off Credit Card A. Then apply it as an additional payment to the Credit Card B balance, which would make payments for the next three months as follows:

- Credit Card B – $151 ($26/month minimum + $125 additional available)

- Car Payment – $150/month minimum

- Loan – $200/month minimum

After three more months (six total) – Credit Card B would be paid in full. The remaining balances would be as follows:

- Car Payment – $1750

- Loan – $4000

Then the person would take the $151 previously used to pay off Credit Cards A & B and apply it as additional payment to the car loan balance, which would make payments as follows:

- Car Payment – $301 ($150/month minimum + $151 additional available)

- Loan – $200/month minimum

It would take six months to pay the car loan. The person would then make payments of $501/month toward the loan (which would have a $2800 balance) for six months (with the last payment at $234).

Now, the person has repaid four loans. Two of these loans were paid within 5 months and the other three within one year after that.

How effective is the debt-snowball method?

The primary benefit of the smallest-balance plan is the psychological benefit of seeing results sooner. The debtor sees reductions in both the number of creditors owed (and, thus, the number of bills received) and the amounts owed to each creditor. In a 2012 study by Northwestern’s Kellogg School of Management, researchers found that “consumers who tackle small balances first are likelier to eliminate their overall debt” than trying to pay off high-interest rate balances first.[5]

A 2016 study in Harvard Business Review came to a similar conclusion.[6] However, the debtor will pay a price for this confidence, in the form of interest that continues to accrue on higher-rate debts awaiting their turn.[7]

Decision-making research

It has revealed that the debt-snowball method is a very common approach to managing multiple debts. Even when larger debts have larger interest rates.[8] Amar, Ariely, Ayal, Cryder, and Rick (2011) observed this tendency in surveys of indebted consumers and in incentive-compatible experiments. Amar et al. (2011) found that people naturally use the snowball method, by paying off small debts first, and this reflects negatively on their financial outcomes since they keep on paying off debts in an inefficient way. Moreover, Amar et al. (2011) found that restricting participants’ ability to completely pay off small debts actually helped them to reduce overall debt more quickly.

By refocusing their attention on paying off high-interest debts. The natural tendency to pay off small debts first (which Amar et al. termed “debt account aversion”) has been attributed to the appeal of achieving goals that are near completion. Plus, the tendency for multiple losses (e.g., debts) to be more distressing than a single loss of equivalent total value.

Dave Ramsey, a proponent of the debt-snowball method. He concedes that an analysis of math and interest leans toward paying the highest interest debt first (debt avalanche method). However, based on his experience, Ramsey states that personal finance is

“20 per cent head knowledge and 80 per cent behaviour” and that people trying to reduce debt need “quick wins” (i.e., paying off the smallest debt) in order to remain motivated toward debt reduction.

Dave Ramsey

Template sourced from:

https://www.vertex42.com/Calculators/debt-reduction-calculator.html

So, in conclusion, the debt snowball method looks at paying the smallest of your debt first and the minimum on the other debts. Then using that payment, add it towards the next smallest payment on so, until all your debts are paid.

[…] you’re increasing your knowledge, get rid of your debt. Whilst this isn’t a necessary step, you’ll soon realise that not having any debt gives you […]

You made several nice points there. I did a search on the issue and found the majority of folks will consent with your blog.