UPDATE – About 1 week after originally writing this post, Wirecard shat the bed and dropped from $100+ to around low $2 on the back of some serious fraud allegations. I’ve chosen not to remove this post but to preserve it as a lesson. No matter how good you think a stock might be, it can turn out to be hiding a nasty surprise. Fortunately, I had stop losses set, so I only lost 40% of my value in WDI before closing my trade.

Wirecard AG is one of my sleeper stock picks and for good reasons. Wirecard is a technology company, provides outsourcing and white label solutions for electronic payments worldwide.

This internet and financial services company offer its clients payment solutions, such as physical and virtual payment cards. The company has a market cap of over $11 billion and in 2017 it expanded its services beyond Europe and into the US.

All the points below are correct as at the time of writing. I have $WDI as part of my portfolio on eToro. Check out my other analysis updates here.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Wirecard Quick points

- Current price = €94.85

- Market cap = €11.6b

Good points

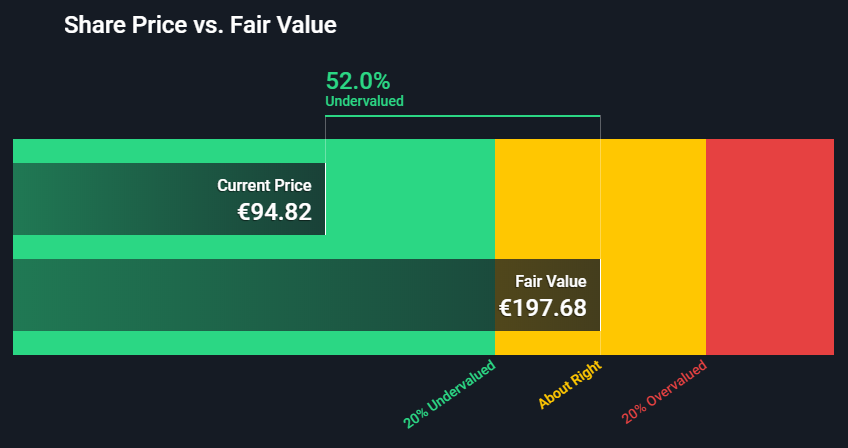

- Trading at 52% below our estimate of its fair value

- 24.87% is the forecasted earnings growth per year

- Earnings grew by 41.7% over the past year

Bad points

- Has a high level of debt

- Highly volatile share price over the past 3 months (but what stock hasn’t?)

In one sentence – $WDI.DE has an outstanding track record with exceptional growth potential. Similar companies include $V $MA and $FIS

Let’s look at how $WDI.DE has faired when compared to the industry and overall German market (including dividends)

WDI Industry Market

30 Day 4.0% 8.2% 12.4%

90 Day 10.4% 9.7% 18.4%

1 Year -35.5% -11.6% 6.9%

3 Year 61.3% 73.8% 1.3%

5 Year 167.2% 216.3% 15.2%

So $WDI has taken a hit from the recent drop in the market and has plenty of room to run back up to the normal value

Valuation

Compared to its fair value and its price relative to the market, is Wirecard undervalued?

- GOOD – Below Fair Value: WDI (€94.82) is trading below our estimate of fair value (€197.68)

- GOOD – Significantly Below Fair Value: WDI is trading below fair value by more than 20%.

- Fair Value is an estimate of what the stock price is worth today, based on the cash flows the company is expected to generate in the future.

Price To Earnings Ratio

- GOOD – PE vs Industry: WDI is good value based on its PE Ratio (24.3x) compared to the IT industry average (25x).

- BAD – PE vs Market: WDI is poor value based on its PE Ratio (24.3x) compared to the German market (20.3x).

- PE ration measures the current share price relative to the company’s earnings per share. So, a high PE can indicate a company’s share price is high relative to its earnings and is possibly overvalued

Wirecard’s Price to Earnings Growth Ratio

- GOOD – WDI is good value based on its PEG Ratio (1x)

- A good value is anything x1 or below.

- PEG ratio measures a stock’s value while factoring in the company’s forecast earnings growth rate. A PEG ratio over 1 is considered overvalued.

- Undervalued is a ratio under 1.

Future Growth

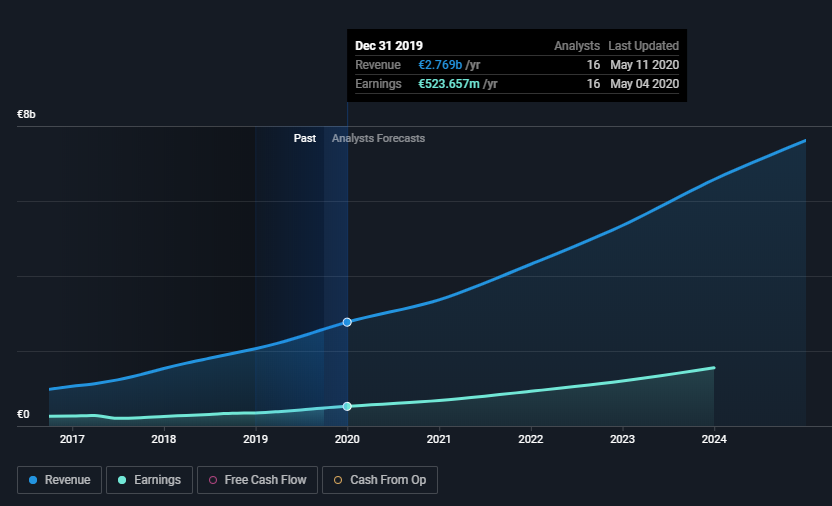

What is the performance over the next 1-3 years look like? Good… really good

It currently has a 24.9% forecasted annual earnings growth

Analyst Future Growth Forecasts

- GOOD – Earnings vs Savings Rate: WDI’s forecast earnings growth (24.9% per year) is above the savings rate (0.2%).

- Bouns – Earnings vs Market: WDI’s earnings (24.9% per year) are forecast to grow faster than the German market (23.1% per year).

- GOOD – High Growth Earnings: earnings are expected to grow significantly over the next 3 years.

- Bonus – Revenue vs Market: WDI’s revenue (20.2% per year) is forecast to grow faster than the German market (5.8% per year).

- GOOD – High Growth Revenue: WDI’s revenue (20.2% per year) is forecast to grow faster than 20% per year.

Future Return on Equity

- GOOD – Future ROE: WDI’s Return on Equity is forecast to be high in 3 years (24.4%) which is great as the market only expected to return 12.8%

- A return on equity is a profitability measure which shows how efficiently a company’s management team has used its shareholders’ money to generate profits.

Wirecard Past Performance

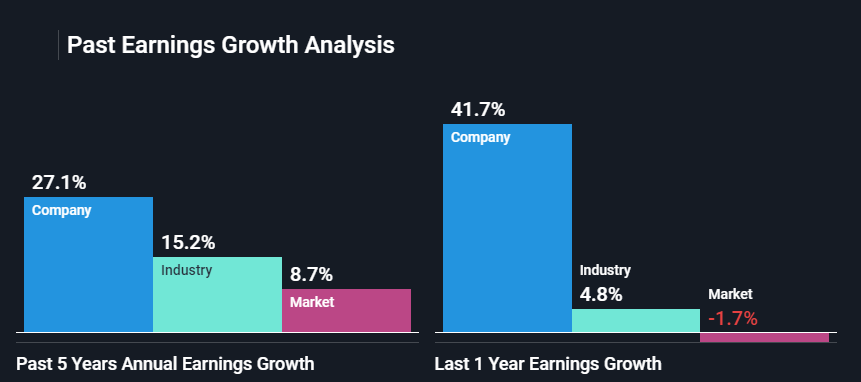

How has Wirecard performed over the past 5 years? Solid continuous growth. It has a historical annual earnings growth of 27.1 % for the last 5 years.

- GOOD – Quality Earnings: WDI has high-quality earnings.

- Bonus – Growing Profit Margin: So WDI’s current net profit margins (18.6%) are higher than last year (17.6%).

- GOOD – Earnings Trend: WDI’s earnings have grown significantly by 27.1% per year over the past 5 years.

- Bonus – Accelerating Growth: WDI’s earnings growth over the past year (41.7%) exceeds its 5-year average (27.1% per year).

- GOOD – Earnings vs Industry: WDI earnings growth over the past year (41.7%) exceeded the IT industry 4.8%.

Return on Equity

- GOOD – High ROE: WDI’s Return on Equity (20.8%) is considered high.

Financial Health

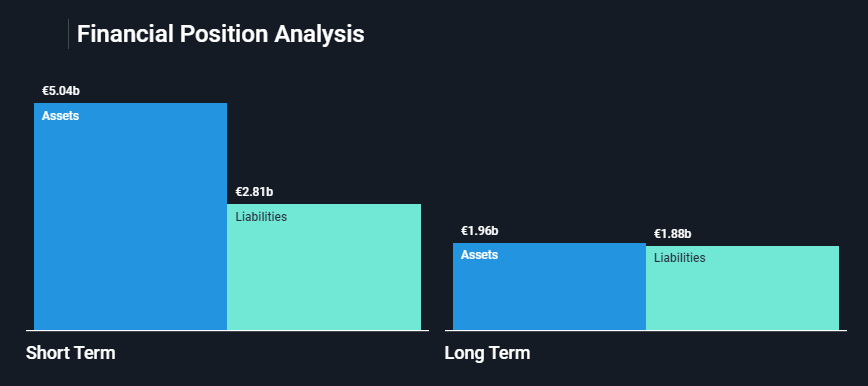

How is Wirecard’s financial position? Getting better – needs to focus on reducing their debt-equity ratio. Debt to equity ratio measures how much a company is financing its operations through debt versus wholly-owned funds. The higher the ratio the more debt a company uses to fund its operations.

- GOOD – Short Term Liabilities: WDI’s short term assets (€5.0B) exceed its short term liabilities (€2.8B).

- GOOD – Long Term Liabilities: WDI’s short term assets (€5.0B) exceed its long term liabilities (€1.9B).

- BAD – Debt Level: WDI’s debt to equity ratio (77.1%) is considered high.

- BAD – Reducing Debt: WDI’s debt to equity ratio has increased from 9.5% to 77.1% over the past 5 years.

- GOOD – Debt Coverage: WDI’s debt is well covered by operating cash flow (61%).

- GOOD – Interest Coverage: WDI’s interest payments on its debt are well covered by EBIT (27.1x coverage).

Dividend

WDI has a very low dividend – 0.21% but we are not after it for it’s dividend.

What else is Wirecard involved in?

Wirecard offers products and services in the areas of mobile payments, e-commerce, digitization and finance technology. This traditionally comprises the integration of payment methods, payment transactions via e-commerce as well as payment transactions at the stationary checkout (POS). So, in these areas, Wirecard currently works in cooperation with 280,000 companies (as of December 2018), including Allianz, KLM, Qatar Airways, Rakuten.com and Transport for London, among others. The transaction volume in 2018 was US$125 billion. In the first half of 2019, the transaction volume grew by 37.5 per cent to EUR 77.3 billion.

Mobile payments

Since 2015, Wirecard offers consumers the fully digitalized, mobile payment-app boon., which works independently of banks or network operators. Boon is based on a virtual Mastercard and runs on mobile devices with the Android or iOS operating systems. The Android version is currently available in Germany, Austria, Belgium, the Netherlands, Spain and Ireland. France, Great Britain, Switzerland, Spain, Italy, Ireland and Germany all can use boon via Apple pay. Google Pay supports boon. in France. So, they have a fair amount of Europe covered.

eCommerce

In terms of acquiring, one focus is on travel and transport. Already in 2007, Wirecard took over payments and credit control for the tour operator TUI, and in 2014 for KLM Royal Dutch Airlines. The product Supplier and Commission Payments (SCP) by Wirecard is also made to measure the travel sector. It is based on the automatic output of virtual credit cards and enables electronic payments to partners and suppliers, for instance for commission payments.

Since 2014, Wirecard has offered its Checkout Portal – a fully automated application for easily connecting different payment methods in online shops, with a focus on SMEs and virtual marketplaces.

Alternative Chinese payment methods

Wirecard has been collaborating with Alipay since 2015, to offer Chinese tourists a familiar payment method during their travels in Europe. As part of this, Wirecard has integrated this alternative payment method into the till systems of retailers such as Printemps, The Body Shop and The National Bank of Greece.

Since July 2017, Wirecard has partnered with Tencent to also offer WeChat Pay.

Finance technology

Many FinTech companies work with Wirecard, for instance, using their banking licence. Some well-known partnerships include Curve, Funding Circle; start-up banks such as Atom and Tandem; money apps including Revolut, Monese and Pockit; spending management apps such as Loot, U Account and Soldo and business accounts like Tide.

What happened in 2019?

Those looking further back to WDI all-time high would notice a sharp drop in 2019.

On January 30, 2019, Wirecard shares plunged after the Financial Times reported that a senior executive was suspected of “falsification of accounts” and “money laundering” in the company’s Asia-Pacific operations. Wirecard issued a statement calling the report “false, inaccurate, misleading and defamatory.” Wirecard also announced a lawsuit against the Financial Times for “unethical reporting” and a lawsuit for market manipulation.

The public prosecutor’s office Munich I in February 2019 launched criminal investigations against Financial Times journalist Dan McCrum because of alleged violations of the German Securities Trading Act (Wertpapierhandelsgesetz, WpHG). The German Federal Financial Supervisory Authority BaFin banned short-selling Wirecard shares on 18. February 2019 until 18. April 2019.

In 2019, KPMG was hired by the German payments company for an independent audit so that they can address the mentioned allegations. Wirecard claimed that KPMG concluded that no discrepancy was determined during the audit. However, on April 28, 2020, Wirecard shares tumbled 26% when its auditor announced that it did not receive sufficient documentation to address all allegations of accounting irregularities. Potentially misleading statements to investors by CEO Markus Braun and three other board members regarding the audit, lead to a search by police.

Overall summary

I like Wirecard and i think it has a lot of room to grow over the coming years, particulary with digital currency becoming the norm and the move away from traditional cash.

Do you have Wirecard in your portfolio?

The analysis above was created with information sourced from Simply Wall St, Yahoo Finance, and Stake.