Unless you have been living under a rock, a new word has entered our everyday lives – Zoom. The funny thing is that Zoom did not invent their services but they’ve damn near perfected it. Zoom has had a stellar run in 2020 but can it continue into 2021?

I will be looking at key indicators to keep an eye on – both positive and negative on Zoom’s future.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

The case for the bears

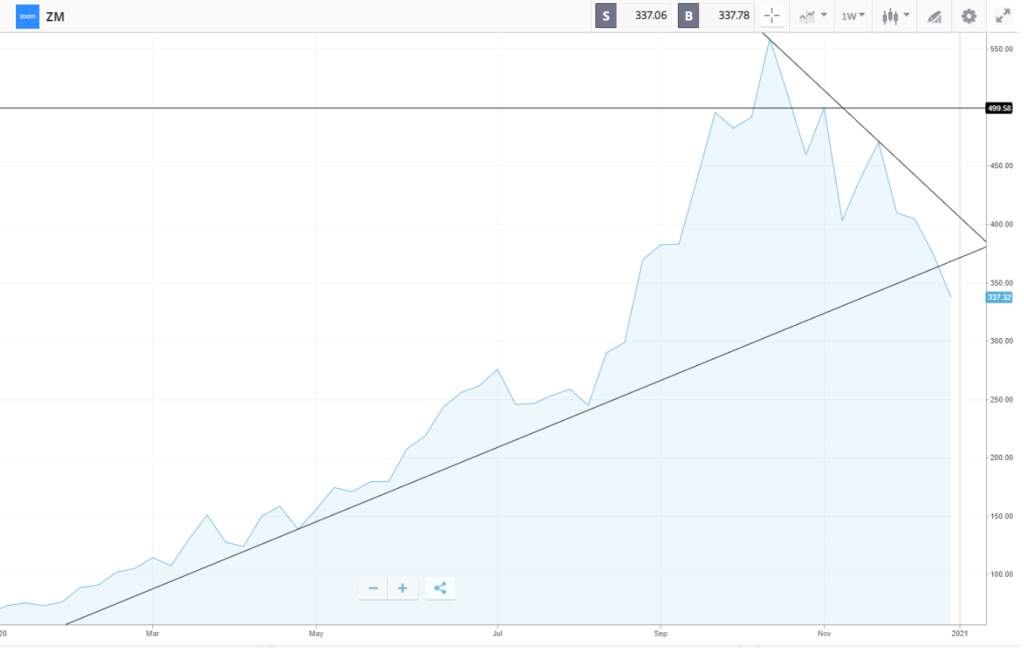

Currently sitting around $337, it is fallen around 40% from its ATH of $568. Now it is continuing its downward trajectory. It fell through the support line of around $365, where it should have bounced back. If it can return towards this line soon, bigger losses could be coming soon.

As I mentioned before, Zoom did not invent video/teleconferencing but put their technology touches on it to make it so appealing. The main drawback with the attention Zoom has received is that competitors do not take kindly to having their market share taken away. Some of Zoom’s competitors are sitting on some cash… a lot more than Zoom has. If they see a better opportunity, these companies could invest large amounts of funds upgrading their platform and begin clawing at Zoom’s market share. So, Zoom will need to be on their toes and continue to improve. I do not believe it comparable to TSLA and the EV market – TSLA is years ahead in their technology compared to other car companies. Although the other car companies have billions in cash, they would burn through so much trying to catch up to them. This is not the case for teleconferencing rivals.

When is the return to normal?

Before COVID, I would seldom have video meetings. Now it seems every meeting is now one. Is this going to continue once we ‘return to normal’? Are video teleconferences going to slide in use? With the vaccine now making the rounds, it is still going to be months, perhaps years, before it is fully rolled out. Does the current market price of Zoom justify its need within today’s environment, and will that need to continue once we return to normal? Could this be the case with the current trajectory of its market price, falling since October 2020?

Follow the Leader

Eric Yuan – current CEO of Zoom and proud owner of 22% of Zoom. His is a visionary and Zoom’s growth is a fine example of that. It is not every day you look at MSFT and say, I can do better than you, then go and do it. As his followers trust his vision, what would happen if he left? It is very highly unlikely he would be but if he did and the replacement was not on the same level or better, this could be disastrous for the stock.

The case for the Zoom bulls

Whilst COVID provided the biggest catalyst for technology improvements, does that mean that it will go back to normal once COVID subsides? I do not think so. I think there is going to be a new foundation of external/remote working for many companies. It does seem like a win-win in many instances for the worker and employer. Employers could reduce their financial footprint by not having to rent large offices and the employees get the added benefit of working from home, helping with their work/life balance. Now, this is not going to apply to everyone – plumbers cannot work from home but potentially their office staff could.

We are coming for you

With a large target on their back, Zoom must keep its lead in the video teleconferencing space. Fortunately, Zoom has established itself based on quality and reliance for its product. Other companies that are trying to compete will have a hard time building it for scratch. Think of Skype – they used to be the go-to for video conferencing and rested on their laurels. They had a 10+yr head start and squandered it in a few months. Imagine if they continued to improve their technology and had a polished product. Zoom needs to be wary of companies like Cisco and Microsoft, especially if they try to expand into a more business-centric scenario.

Will you still love me tomorrow?

Investors and users alike are in love with Zoom. But is this relationship going to continue? It Zoom plays its cards right and focuses on what makes it great, then there will be a strong case for bulls in this market. The more users it can retain, the better the case, particularly once things settle down with COVID.

Zoom in – there is some space over there

Without a doubt, Zooms growth was on the back of remote working. Zoom needs to continue to grow and enhance its product to make sure that it appeals to users and businesses. The remote working market increased significantly and will surely drop over the coming months as workers return to the office but not everyone will return. Zoom will need to capitalise on this, and this should secure their growth for a few more quarters. By then, competitors might want to take away their market share, so if they continue to produce quality products, it is a positive attribute in anyone’s eyes. More market share equates to more growth.

Is Zoom still making money.

If Zoom can increase the EBITDA margin by 15%, they can justify their value and market share. This is a significant figure considering any interest, taxes, depreciation, and amortizations.

Expansion and inclusion

To continue to stay ahead of the game, Zoom needs to expand its business offerings. Several businesses rely on call/support centres as the backbone to customer service. As there is a cult-like following for Zoom customers, making sure that they are catered for will ensure Zooms longevity and growth.

So – what are your thoughts? Will Zoom continue to zoom or will it go boom? I held on to Zoom in 2020 on eToro but sold in July 2020.

My son’s college roommate went to work for Zoom six years ago. He’s made a fortune off that decision!

Smart man and even smarter move! Congrats to him