The eToro Ideas Lab is a way of introducing new updates to eToro. This helps eToro stays ahead of the competition. The simplistic user interface and unique features provide an outstanding experience to its clients. I have been trading on eToro since 2016 and have seen many changes implemented and removed during that time. With each update that has been implemented, it continuously improves the platform and experience for all their traders. Throughout my trading, I have come across certain aspects of the platform that I believe, if implemented, will change the online trading game.

Welcome to the eToro Ideas Lab

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Please note that these eToro Ideas Lab are only my thoughts and are no way a true reflection of eToro or the current eToro application. Some of these may have already been introduced – if they have, please let me know in the comments below! The purpose of this article is to highlight potential eToro ideas to take our experience to the next level!

eToro Ideas Lab Poll

Now, there’s no point in detailing all the eToro Ideas here without letting people know what is the most popular idea. So, I’ve created an easy to view poll to track what people think the best eToro Ideas are within the list below. If you want something added to the list, comment down below!

Here are some of the ideas detailed below. You can choose up to 3 ideas to vote for in this poll.

Education

Recently updated their video library! See it under the implemented section at the bottom of this article.

Notifications

Order notification email

When you execute an ‘at market’ or trade outside of market hours, your order will be displayed in the ‘orders’ section of your portfolio. This is important and it contains details about your order – target price/at market, date, ID number etc. One thing that would take eToro to the next level is an email notification letting you know that an order has been set (and the details) and when an order has been executed (again, with the order details).

This came to me one day as I had put in an order to execute a certain trade when the market opened. The market had opened for the day and I believe I logged in maybe an hour or two later. A little popup flashed on my screen for a few seconds, then was gone. It told me that my order was unable to be executed. When I opened a ticket with eToro contact centre, I could not provide any details as I did not have a transaction ID. Without executing the trade, it was difficult for the Help Team to assist me.

One thing I have been doing to get around this is to take a screenshot of my trade order just in case I need to refer to it later. It would include the order ID number – but be warned, this is a different ID to the transaction ID once the trade has executed. Including this in the eToro updates would be beneficial.

Notification via email

eToro does currently offer certain notifications to be sent to your email but there are a few key actions I believe are missing.

Notifications upon logging in

The popup messages when you log in do not seem, to me, to last very long and if you have several of them coming through, it is hard to remember all of them. I have noticed that sometimes these notifications end up on your notifications page, but the majority do not show there.

Email when CopyTrader deposits or withdraws money

One of the key elements in CopyTrading is to ensure that you have sufficient funds in your copy amount to open all their trades. This ensures that you are getting the best ratio of portfolio growth. Now and then, a CopyTrader will add funds to their account. The next time you log in you’ll (hopefully) get a notification that ‘Trader X just deposited additional Y%. Add $ABC to the Copy for optimal results.’

The notice is useful but if you are not paying attention or have several them coming through, it is hard to remember the amount. If new eToro ideas included an email of these notifications, that would be extremely useful.

Popular investors

Limit popular investor loss

As I have mentioned before, I have been trading on eToro since 2016 and have been a Popular Investor for around half the time. As a Popular Investor, I have a higher exposure to users of eToro and with higher exposure, comes more responsibility.

There is no direct negative impact implemented by eToro for Popular Investors. Specifically, to the Popular Investor if they have a shocking year of trading. The only ways I can think of are when a trader goes above the allowed risk rate, or they lose copiers by ways of natural attrition and their AUM falls below the threshold for their PI level. I have seen in very few cases where a Popular Investor is on the Rising Star/Champion or even the Elite status but are sitting on -55% for the last 12 months.

At these Popular Investor levels, these traders are still receiving a payment from eToro based on their AUM. In a normal world, copiers constantly monitor their profile and if they see a trader having a terrible trading streak, they will remove their copy. Or they set a copy stop loss to minimise their losses. Unfortunately, this is not always the case.

I would love to see some loss threshold applied to Popular Investors where if they lose X% of their portfolio in the last 12 months, there would be put on some sort of pause, where their returns have to reduce to an acceptable level or they could be demoted. Like when Popular Investors hit a risk score 7, the ability to copy the trader is suspended. This pause could be correlated to their max drawdown for the year.

Ask why a copier left a trader

Most PIs have experienced this – someone joins then leaves for some reason. Sometimes this can be within 5 minutes of joining. It would be great if the copier was presented with a survey for their reason as to why to help PIs understand what their copiers feel.

Copy trades on value not invested %

This eToro idea would easily help address one of the most common questions asked about CopyTrading – why haven’t my trades copied?

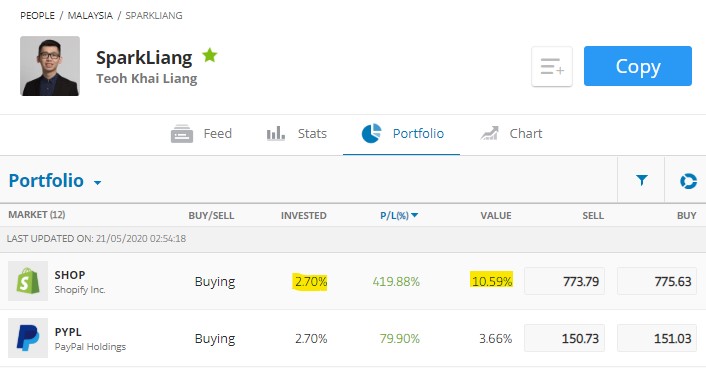

Currently, CopyTrading looks at the invested % of the trader’s portfolio and is ratioed based on that amount. The issue here is when a trader has significant profit in one trade, the value % of that trade is significantly different from the value. As a visual example – Elite Popular Investor SparkLiang is a great trader, producing amazing results. Looking at his top holdings by % you’ll see SHOP at an average of 419% profit – awesome effort. That is now worth just over 10% of their portfolio.

But if you are a potential copier, you are going to join the trade at its current price and that is only 2.7% of the portfolio.

Now here is the fun part. Say you copy SparkLiang and he closes his SHOP trade. That means 10.59% of his portfolio now goes back into his cash holdings. Whilst you only get 2.7%. This could make it difficult down the line if he wanted to use his cash, you would not get the same output.

An eToro idea to change the copytrade feature from Invested % to Value % would help future traders tremendously.

Limit repeat PI promotion exposure

Popular Investors who are doing a great job are in the great position of being promoted by eToro. One thing I have noticed recently is that there are a few traders than continuously get promoted. Not to take away from their good trading but being promoted can give a massive advantage to the trader and they become exposed to traders in the potential millions. Then if they are promoted again in short succession, it would be an unfair advantage to other traders.

Promoting Popular CopyTraders should be limited to once during a 2-3-month timeframe.

Better copier history

As I have mentioned before, I have been trading on eToro since 2016 and have traders copying me for a long time. I like to see how the original copiers are going. This would support my case of long-term copying. What I have found is that now, copier history is only limited to 12 months. Therefore, I am unable to view how the current long-term copier is going. The only way I would be able to monitor this is to add the copier to a watchlist and view them manually each time.

Extending the copier trading history to 24 months or more would be of great benefit to the CopyTraders.

Not punishing copier when Popular Investors are reprimanded

There was a recent update from the Popular Investors team where 2 Popular Investors we reprimanded for their actions. That is fine as these Popular Investors went against the terms and conditions of the program. What I felt is that this could be better communicated to the copiers of these Popular Investors.

As these Popular Investors were essentially frozen (no more new copiers or making new trades), the copiers were also impacted. Their copiers would no longer get any new trades from these copytrades and would either must wait and see when the copier can trade again or cut their losses and stop copying these traders.

If this information were provided to traders in an earlier circumstance, I feel that they could be better prepared in what to do next.

Market information

Before/aftermarket close figures

If eToro were to display the aftermarket or before market changes, that would be a game-changer. Currently, they only display the current/last price of a holding. The exceptions are cryptocurrencies, which never closes, and indices, which present the futures price changes.

eToro currently uses XIGNITE to get their data for market prices, so I would assume it would be easy to achieve this through one of their packages/APIs. The key reason here is to keep eToro customers on the site and not have to go anywhere else for their information. An all in one shop so that traders can find movements outside of regular trading hours.

eToro ideas on Trading

Better virtual copying statistics

I am not going to go into detail here because it is quite well known amongst various groups. Whilst the intention is great, the reality is that there are areas of improvement.

I have experienced this during my Top CopyTraders competition – it is difficult to maintain a competition when the results are skewed. Certain trades will not execute within the copytrade, providing the wrong CopyTrading stats.

Whilst these variances happen in copyportfolios and copytrades, I have yet to experience it with stocks.

Trading Indices using future prices

This is a personal recommendation I have recently discussed. The indices available on eToro provide the price based on the time. It is either whilst the market is open or when it is closed, and it will show the futures price (or the last price if closed over the weekend).

One thing I would like clarification on is why would a position opened during market hours, have the chance to be impacted by the after-market price. As an example, say I purchased $SPX500 for $3000 during market hours and it finishes at $3030. I have my stop loss set at $2900 and during the after-market hours, there is a quick dump of the stock, it falls 3.5% but then it climbs back up to $3000 just before the market opens. Theoretically, by the time it opens, I should be back at 0% but my position was influenced by after hour movements. I would like some clarification around how we purchase a position during market hours but can hit our SL after hours.

To put this in another light – say I purchase $NVDA and I am sitting on 0% P/L with a SL of 10%. The market closed and I am still on 0% P/L. News about $NVDA failing to create a new processor that all the computers need comes out and the stock price drops 15%… that should have hit my SL. But a few hours it seems the report was wrong and there was a typo. Now the stock rockets 20% on the news by market open. So, when the market opens, I am in the green. If this were an Index, my SL would have been touched and I would have lost that profit.

Edit trade order

As I’ve progressed in my trading, I’m finding it easier to set pivot levels where I think a trade (if going below or above a certain level) will continue in the direction. As a result of this, I create a lot of trade orders. one thing I’ve noticed that if my pivot levels change, I need to amend the order. At the moment, you cant amend an order, so you have to create a new one, then cancel the old one. It would be infinity helpful if I was able to edit existing orders that haven’t been executed.

Reinvest Dividends

A key update that would please many traders is the availability of a Dividend Reinvestment Program (DRIP). Majority of the big brokerages have this open and adding it to eToro’s platform would certainly entice many new users and help retain current traders. DRIP is when you can automatically reinvest those dividend payments back into the stock. This would have to have a few caveats to succeed.

- It is not a default feature, if you want to participate, you will need to provide this endorsement.

- The dividend payment would need to be large enough to purchase the minimum amount for the stock in your country of origin

- Positions with leverage would not benefit from this enhancement, only x1 leverage for US stocks.

If the dividend payment were not enough to purchase the minimum amount of that stock, then the dividend payment could

- Go back to the available equity (as it currently does)

- Held until the next dividend payment comes through and is larger than the min stock purchase price.

If someone had their dividend payment in b) and they sell the stock, they would just have the remaining dividend amount applied to their available equity.

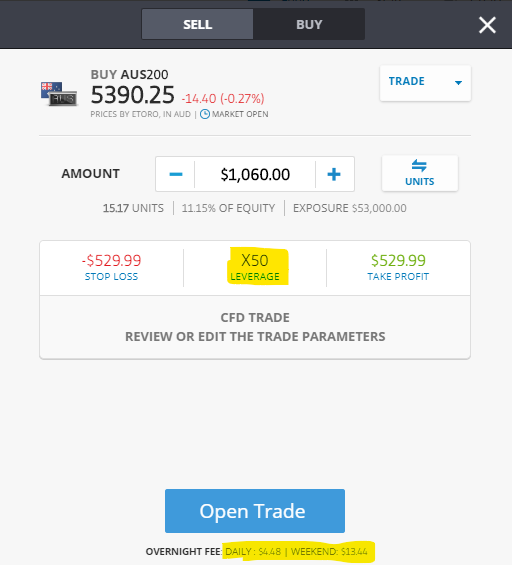

Default leverage on trade

This has caught me off guard several times. When I go to execute a new trade, I can forget to change the default leverage setting. Adjusting the default leverage to x1 for all instruments would help immensely but this is just a personal preference.

If a trader can set their preferences (say x1 stocks x5 indices x10 forex) that would be a welcomed enhancement.

Increase exposure to international markets

This one is purely just for my selfish reasons. Being from Australia, I would love to see Australian markets on the platform. One of the main reasons is because I would love to trade stocks during the day but due to the time difference, US stocks are out of the question. The market is currently open from 11:30 pm – 6 am where I live. Not quite the best timeframe for me.

Hong Kong stocks are more in line with our time zone, then UK stocks, then the US stock market. There are cryptocurrency/Forex/commodities/indices that operate during my daytime, ETFs and stocks are my bread and butter.

Show fee calculation/% when opening a trade

There are the figures shown with executing a trade but for many people, being able to see what that figure is as a % would be a great eToro idea. Alongside the fee %, showing the spread % would also be a useful inclusion.

eToro idea – Scheduled Buy

This one is a bit of a stretch. I was looking into dollar-cost averaging (DCA) and thought how great it would be if you could schedule a purchase based on date, not on price. Say I wanted to buy $500 worth of $SPY every month, I could schedule it for the 1st of every month and it would execute at the next available market open, for whatever the price happened to be. I have not come across this feature in any other platform to date. If you have seen it let me know! This would certainly set eToro apart from its competitors.

Weekly/monthly/yearly performance of stocks

Being able to see x timeframe performance of a market would be great in conducting research. Whilst we get a visual clue via the chart, having these in number format should be on the list of eToro ideas.

eToro ideas to the Portfolio

Risk score explained in simple terms

This is one of the most misunderstood components of the eToro application. I do not believe there is anyone now that can understand and explain all the components of the risk feature. As the risk levels play a significant part of the Popular Investors program, having this explained in simple English would be a must include in the next eToro ideas.

Better dividend information/clarity

One aspect that causes a lot of frustration with traders is dividend payments – particularly the information around how much, when and which stock paid out a dividend.

In your portfolio, you can see ‘fees’ against a particular stock. This is where your dividend payment shows up but does not tell you how much or when. In your account history statement, you can see when and how much, but not against what.

If there was a way to consolidate this information to an easy to understand format, this would go a long way in pleasing users of the platform. as such, I would welcome as one of the eToro ideas.

Better filtering on manual trades.

When I look within my portfolio at my manual trades (shows all holdings and what positions I have within). I only have the option to see all of them and can only sort by column. When I look at my portfolio, I have the option to view by market) crypto/ETFs/indices etc). If we were able to filter in the manual trades section, that would improve the user experience.

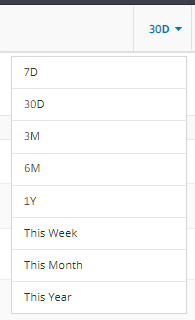

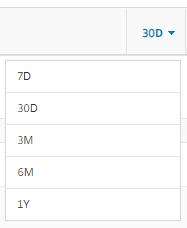

Better filtering on history timeframes.

When looking at the trading history page, you have different timeframes, depending on which page you are one. When looking at your won profile, you are provided with the following options.

But if you look at another traders trading history page, you get these filters.

Then if you look at the chart history, you get this

As you can see, there is quite a bit of difference between them all. I would love to see a consistent choice between them to help with research.

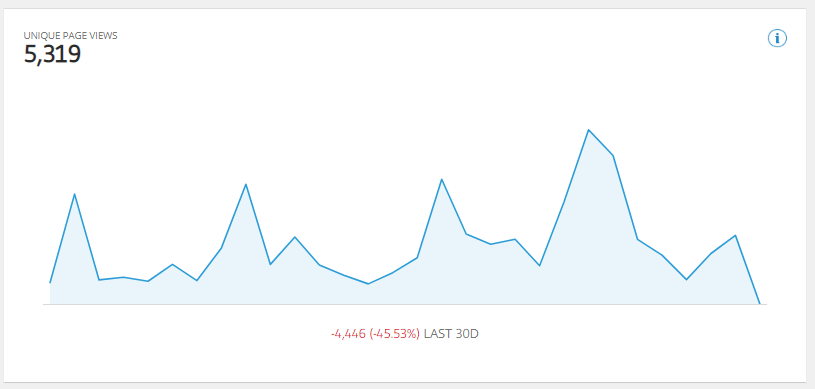

How people are finding our page (either posts/links etc)

In the Popular Investor dashboard, Popular Investors can see how many pageviews they have been receiving recently. Whilst this data is useful, it does not state where this information is coming from. Are they coming from a recent post or an external source? Being able to identify where users are finding the page would assist Popular Investor to increase their social presence through known methods.

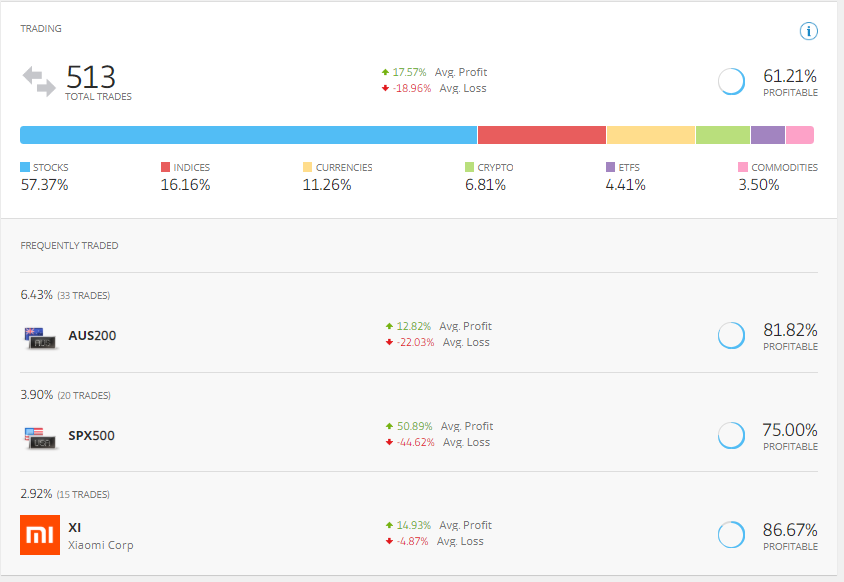

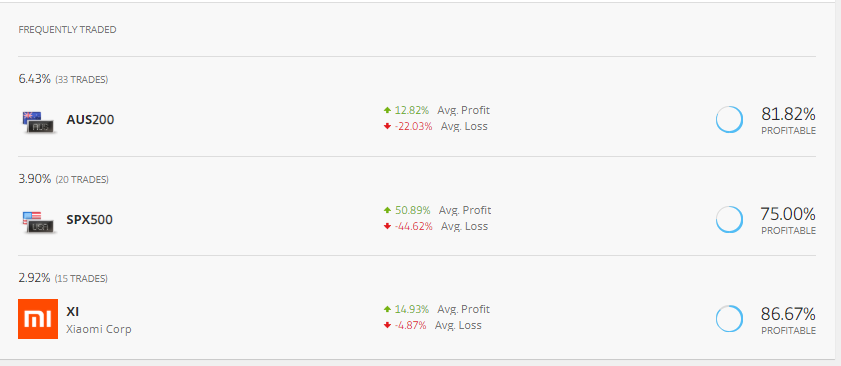

eToro ideas – Trader’s stats section

This section provides information on total trades, average profit/loss per trade and the breakdown of the trades (which market they belong to). Whilst this information is indeed useful, it can be misrepresented when viewing someone’s profile.

The 12 months of data can include more than 12 months. Say we are in May 2020, then I would assume that it would be all the trades within the last 12 months. The data includes trades from May 2019 – May 2020. If we are at the end of the month, it is including data from the start of May 2019 – more than 12 months ago. This does seem to be more of an issue towards the end of the month, rather than the beginning. A potential fix could just be today’s date – 365days when formulating the data.

These stats also include both open and closed positions in their statistics. This can throw off the stats because a trader might have an outlier (say +300% trade they have in their portfolio) or a -95% trade they closed 11 months. To take this to the next level, I would recommend having stats for open trades and another for closed trades. That way, traders can easily see the difference between the two.

Individual Savings Account (ISA) status

This eToro idea was submitted via the eToro Investors Community group on Facebook – this group is a fantastic source for all things eToro, and I would highly recommend checking them out!

It is tailored towards the UK but as they are one of the biggest cohorts on eToro I thought obliged to add it. As I don’t know too much on this I’ll let our friend Wikipedia do the honours.

An individual savings account is a class of retail investment arrangement available to residents of the United Kingdom. The accounts have favourable tax status. Payments into the account are made from after-tax income, then the account is exempt from income tax and capital gains tax on the investment returns, and no tax is payable on money withdrawn from the scheme. Cash and a broad range of investments can be held within the arrangement, and there is no restriction on when or how much money can be withdrawn. Since 2017, there are four types of account: cash ISA, stocks & shares ISA, an innovative finance ISA (IFISA) and lifetime ISA. Each taxpayer has an annual investment limit (£20,000 as of 2019–20) which can be split among the four types as desired. Additionally, children under 18 may hold a junior ISA, with a different annual limit.

The main component here that could be included in the next eToro idea is the Stocks/shares ISA.

Investors’ money is invested in ‘qualifying investments’, which are:

- cash

- UCITS authorised funds like unit trusts and open-ended investment companies

- investment trusts that satisfy various conditions

- stock market company shares listed on one of the many recognised stock exchanges. Merely being traded is insufficient, it must be a full listing, and this excludes PLUS-quoted and PLUS-traded market segments, but PLUS itself is acceptable; shares in unquoted companies; warrants; futures and options. Since 5 August 2013, AIM shares are allowed in ISAs.

- public debt securities such as government, corporate bonds, debentures, and Eurobonds

- from 1 July 2014, some core capital deferred shares issued by building societies, some types of insurance policy and other investments that were previously deemed too low in risk.

Money held in a stocks and shares ISA must be made available on request within 30 days, but it is permitted to have a loss-of-interest penalty for this.

So basically, having money in a Share ISA account rather than a Share Account means any profit is completely tax-free. If that eToro update is not incentive enough, I do not know what is.

eToro ideas to Frequently traded stats

This section also includes both open and closed positions over the last 12 months. As above, I would recommend distinguishing between the two.

In conclusion

Hopefully, these articles get traders thinking about their eToro user experience and which eToro ideas might be useful for them.

As the numbers of traders grow, so does the task of keeping users on the eToro platform. I am going to keep a log of how these suggestions are considered. Let us hope we can get some of them included in future eToro ideas!

Implemented eToro Ideas

Here I’m going to track and see if any of these eToro ideas have been implemented.

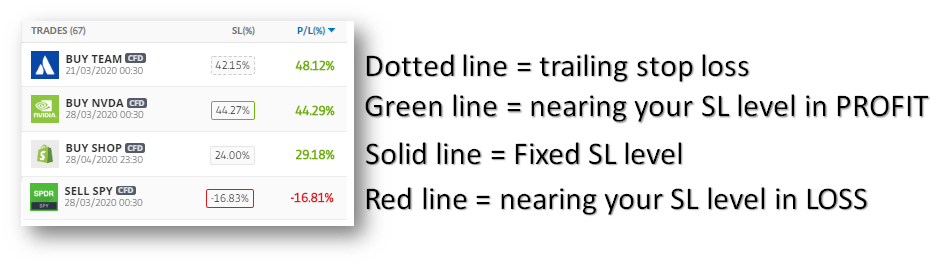

IMPLEMENTED! Trailing Stop Loss icon

An icon displayed next to the trades you have set a trailing stop loss. This will identify these stocks and help with traders monitor their stocks.

This feature has been implemented. You’ll see a dotted outline next to a particular holding if that position has one set or not.

Training Videos

Looks like eToro has stepped up their game and added a number of new videos for traders – good on them!

https://www.etoro.com/trading/academy/videos/

Limit popular investor allocation to a single holding

eToro has come down on Popular Investors recently and proposed a max. 20% allocation to anyone holding. This is good to see that they are taking the copytrading experience seriously.

Popular Investor probation period

Recent Popular Investor updates ensure that some PIs don’t rise to the top of the ranks too fast. They have included time periods, minimum amounts in their accounts and for the higher levels, certifications. All these add to the validity of the PI program.

Minimum trading history for PIs – Now Updated via the PI website

New rules have come inf or the PIs, which is refreshing. Here is my old suggestion below

This is a somewhat controversial one but there is merit behind it. There are looking at implementing this at the new elite pro level for the upcoming changes to the Popular Investor program. There will soon be 4 levels of Popular Investor – Cadet, Champion, Elite and Elite Pro. Introducing time-based criteria for each level would certainly add some rigour to the program. I am not referring to anything drastic but as an example, you can progress to the next level once you have traded continuously on eToro for:

- Cadet (3 months)

- Champion (6 months)

- Elite (12 months)

- Elite Pro (3 years)

This could help facilitate certain Popular investors who rush through the rankings. Minimising the risk to traders and copiers. Now, I believe if the Popular investor meets the general criteria, they must have been at that level for at least 2 months, before being promoted. That means that someone who has just joined eToro and has no trading experience could go from cadet to Elite in 6 months. Introducing terms like the above could restrict these types of an explosion in CopyTraders rises and subsequent falls.

Do you have any updates you would like to see implemented? Let me know in the comments below.