This post will clarify the difference between shorting, closing and selling trades on eToro. Due to inconsistent terminology across the platform, there have been many instances where trades have been on the wrong end of a trade and ended up losing a profit. So, this guide and video will help you determine which action you would like to take and how to go about it.

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

Closing vs shorting vs Selling Trades on eToro video

I’ve put together a quick video to give you examples of what each of these terms mean.

How to sell a trade on eToro

In eToro, selling trades is the same as shorting a trade. This means that when you enter into this trade, you expect that particular holding to lose price value. As the price drops, your profits go up. So if you open a sell trade on stock X and the stock price goes down 5%, you would profit 5%.

To sell or short a trade on eToro.

To short or sell trades on eToro, you need to perform an order. There are two easy ways to get to the order section. So, you can either navigate to the particular market you want to trade, and you’ll sell this trade button on the right-hand side.

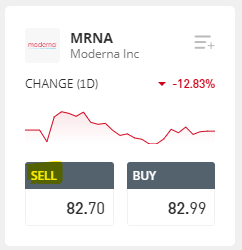

Or you can use the SELL / BUY section from the Trade Market page.

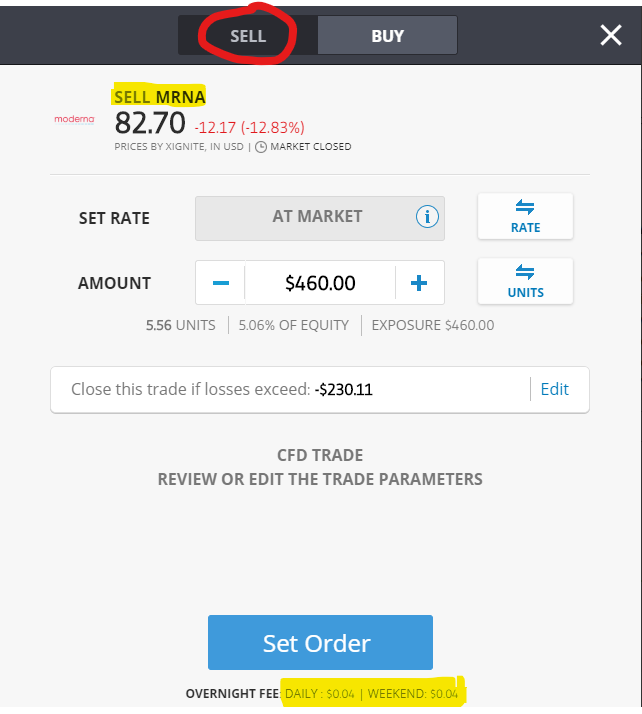

When you select SELL / BUY options, this pop up will show. This is the order page.

Here you want to ensure that ‘SELL’ is selected at the top. You’ll know that it is selected when it says SELL XYZ at the top. This is highlighted in yellow. Once you’ve set your amounts and other figures, click on Set Order. The order will then execute at the next available opportunity.

Do note that all short positions have fees. These fees are highlighted at the bottom of the trade pop up.

How to short a trade on eToro

Shorting a trade is the same as selling a trade on eToro. Both terms mean that you want the price to go down in value, giving you a profit.

How to close a trade on eToro

Closing a trade on eToro is closing an open trade you currently hold. For example, you bought/sold a position in stock X. After a week, you’ve made some profit and want to close off this trade. You’ll need to go into your portfolio, find the relative stock x and select close (generally marked by the red X at the end of the stock line item). A pop-up with the trade data will show a big red “close trade” button. Click this button, and your trade will close.

Please don’t confuse ‘closing’ a trade with ‘selling’ a trade.

Want further reading? Check out these posts about the Copytrader Walkthrough, the eToro Ideas Lab and my comparison of Stake vs eToro.