This eToro Copytrader walkthrough will be the only page you need to know about the information on eToro CopyTrader. I will walk through what eToro Copy Trader is, what to look out for and how to use it to your advantage. It’s going to be a long post, but it’ll be worth it.

There are some recent changes to the Popular Investor program – check them out here

** If you don’t have an eToro account – you can set one up here! **

** Already have an eToro account? Check out my profile! **

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note that this does not apply to US Users and eToro USA LLC does not offer CFDs.

If you think that two heads are better than one, how about 20 million heads thinking together?

I am going to break eToro copy trader down into a number of categories so you can follow along and see what works for you!

What is eToro Copy Trader?

eToro Copy Trader is mimicking another trader and the investments they make. You allocate a portion of your funds to copy what another trader is doing. If the trader buys $GOOG stock, then the relative portion of your copy funds will buy $GOOG stock. You trust the trader enough to copy their trades automatically.

It is important to note that none of your money actually goes to the trader, but their trades are replicated within your eToro copy trader funds.

They are essentially acting like a Funds Manager – and in the real world, when they get to a certain level, the Funds manager will get a kickback from eToro based on the Assets Under Management (AUM) – via the Popular Investor Program. Again, this doesn’t cost you anything.

There are many options for copying another trader, which I will explain further in this post, but there are some essential caveats with copy trader.

Requirements to be an eToro Copy trader/ copied

- The minimum amount to invest in a trader is $500.

- The maximum amount of traders you can copy simultaneously is 100.

- The maximum amount you can invest in one trader is $500,000.

- The minimum amount for a copied trade is $2, so your copy will not open trades valued below $2.

- The min amount to copy an investor and the min trade copied size was recently changed to $500 and $2. This can change back soon but keep this in mind.

If you close a copied trade manually, the funds from this position will be credited back to your copy balance (the amount allocated to copy that person that is not invested in open positions).

Who can you copy?

Nearly everyone! That is the good thing about it.

You cannot copy those with a risk rating of 9 or 10 (or if they have reached their limit within the Popular Investor Program, but these are very rare!)

Just find the trader you want to copy and select the copy button on their profile! You will find this button on the right-hand side of their profile page.

However, before you copy anyone, you will want to do your research! An even better way is to use your virtual account before using your real money.

Picking someone to copy

Choosing a trader depends on several factors, and luckily, I have posted about my own personal filters to find that perfect trader. Picking someone is purely up to the person choosing – use the information available to you to make the best selection you can.

What kind of eToro copy trader are you?

(short/medium/long) and do you want to copy someone who is the same? You may want someone opposite to your style, so you balance out.

What level of risk is acceptable for you?

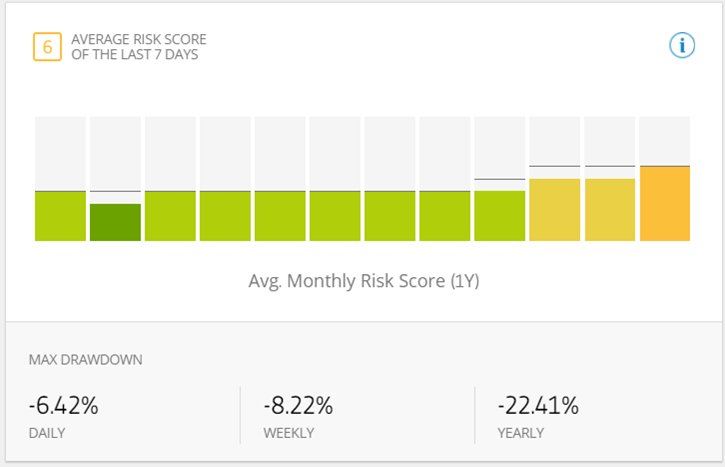

A trader with a risk of 5/6 tends to take riskier trades now and then. This could be a result of trading volatile stocks/cryptos etc. Currencies and indexes normally have low volatility (if you are trading with low leverage). They normally only change 0.5% day-to-day. The higher the volatility, the higher the risk but also the potential for bigger rewards and losses. The lower the risk score, the more stable the traders’ portfolio is – but normally, the returns are a lot lower. Max drawdown is another factor with volatility. In simple terms, it is the biggest loss the portfolio has experienced over the period (day/weekly/yearly). Below is an example from a portfolio.

The traders trading record/stats.

Have a look at the stats tab within the traders’ profile, as there are a number of important items to look for.

When to copy someone

Their performance over the last few months/year

How have they been performing? Is it a consistent return, or did they get lucky for a few months, or on the other hand, did they have a terrible month, which skewed their stats? They could have 120% for the last 12 months but have only traded for the last 2 months.

How long they have been trading for?

They may have only been trading for a month and get massive gains in their portfolio. If I saw a trader who consistently achieved 4% per month over two years, they would pique my interest over a trader who has only traded for 3 months and gained 70%. So someone who has been on the platform longer may have a better understanding. But note that this is not always the case.

Are their results constant or fluctuate wildly?

Please have a look at what their stats have been since joining eToro. A lot of investors got lucky during the crypto boom and saw massive gains in 2017. Then a lot of traders lost a lot of money when it crumbled in early 2018. Same thing in 2020 – we saw massive numbers in the second half of 2020. So, see how they have been performing. Have their results been constant or fluctuated? A good indication is to compare them to the S&P 500 growth rate.

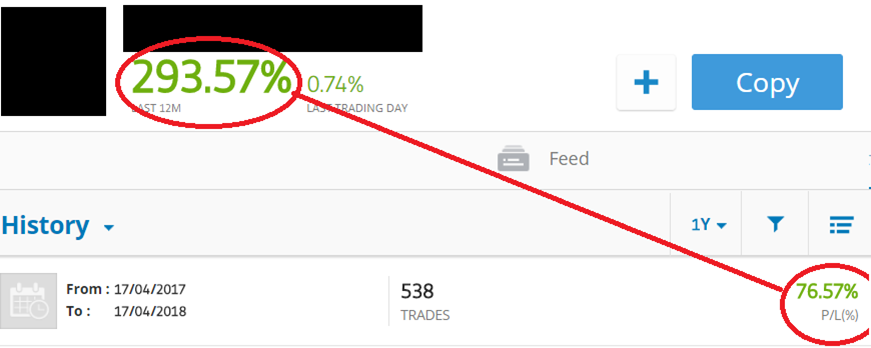

Portfolio % performance vs actual trade performance.

Did you know that the last 12months performance / Portfolio Growth is different from the historical performance? So the 12-month performance tracks how the portfolio fluctuates over the year. Those % increases only show how your portfolio has changed, not how your equity has changed. We only make/lose money when we close a trade. We can have someone with over 1000% increase for 12months. But if they haven’t closed any trades, they haven’t made any money (yet).

Below is a screenshot of a trader who was nearly 300% for the year! This is awesome, but when you actually look into their closed trades, they’re only at 76% for the year – still a fantastic year of trading! If the market collapsed and lost their whole portfolio, you would have only been 76% up. So be wary of traders with massive gains – check their history to see their actual portfolio gains.

Current market conditions

How is the market performing currently? Is it a bear market, or is it bullish? Depending on your trading strategy, you don’t want to jump in on a downtrend because you’ll be behind. Look at how the trader’s portfolio is fairing to the market – are they following the same pattern? If their portfolio is down for the month, is there room for it to grow the following month? The timing of when to copy is paramount to ensure that you’re getting the best results possible! Is earnings season coming up? Earnings Season is volatile, and as a result, it can spell disaster if it goes the wrong way.

Alright, I’ve found someone – how much do I allocate?

CAUTION: eToro has recently changed the minimum copy amount from $500 to $200 – this seems to be a temporary thing, but please check out the eToro pages to confirm.

The absolute minimum to copy someone is $200. How much you want to copy them with is up to you. As expected, the more you copy with, the bigger the return (or the loss!) You can minimise your loss with a stop loss.

For example – copying with $200 vs $800 > If you make it through the year and their return is 45% for the year. If you invested $200, you would get a $90 profit, so now you’re playing with $290! When you invest $800, you would get a $360 profit – then you’ll have $1160 to play with.

If you’re not sure how much to allocate – the minimum is $200, the maximum is $2,000,000, so anywhere between those two figures. Copy with what amount you are comfortable with investing. Most Popular investors will let you know how much you should invest to cover all trades.

To make things easier, I’ve created a Copy trader Calculator to help you find the minimum amount needed to copy all trades.

What about copying your profile?

My average copy amount (September 2021) is $1,000 per trader for my profile, but to cover all trades, I recommend at least $600.

How are the funds split across the trades?

The amount you copy the trader with is ratioed into their trades and split accordingly. So, if the trader has 50 open trades of equal value, each trade will represent 2% (or $4) of your copy. As a result, anything under $1 is not copied.

Each position will open in a proportional amount. For example, if the copied trader has a trade using 10% of his realised equity, your trade will be opened using 10% of your copy amount.

Before you copy a trader, you can see in their account how much funds he recommends allocating to copy them successfully. Sometimes this is inflated, so they seem to be handling more AUM than what is required.

You can calculate the minimum copy amount using the following technique. Find out what the smallest holding is and what the value of the portfolio it represents. This represents the smalled % that $2 (min open trade) can cover.

To explain this in simple terms

The trader has 300 open positions, and the smallest of those represents 0.17% of their portfolio value. That means, if you want to copy all open trades, then $2 needs to represent at least 0.17% of the portfolio. Please note that nothing under $2 is opened.

So to copy all of the open trades, you’ll need to copy with $590. 0.17% of $590 is $2 – the minimum required for all trades to be opened.

So, remember that the decision of how much to allocate is yours and yours alone.

Copy open trades or not?

The eToro Copy Trader system gives copiers the option to copy all of the copied trader’s currently open trades or to only copy new trades. Copiers choosing this method will copy all open trades at the market rate. If the market is closed, at the rate once the market opens)

This can be both beneficial and detrimental. Your copy will essentially start in the negative due to the spread. It doesn’t matter what the trader has in regards to the profit/loss for that stock. You’ll start as you had just bought it. They could be 500% up on $XRP, but you’ll start at 0. That is not including the spread, so you’ll be in the negative. The only time you get the same rate as when the Trader opens a new trade.

Something to note on eToro Copy Trader

The trades will all open in your account at the same time. You will see them at a slight loss, reflecting the spread between the Buy and Sell rates, to show you a real-time representation of the funds you will receive if you close the trade. New trades will open at the same rates as the copied trader opens them and use the Realised equity (balance + invested funds) as the basis for the proportions of copied trades. For example, a trade opened with 10% of the Copied Trader’s realised equity will open a trade in your copy account with 10% of the realised equity in the copy relationship.

Many traders will tell you to copy open trades, but it depends on their trading style – if they trade several times per week, then I would copy only new trades. If they buy and hold, then I would copy open trades. That way, there’ll be time for the stock to grow before taking a profit.

eToro Copy Trader Tips and Tricks

Want to add money to your copy fund?

Well, it depends on how much money you are adding. If you are adding a significant amount (say 60%+ of the current value), I would suggest to stop copying the trader, then recopy them with the new total amount. Add the new funds to the copy trade without stopping. It’ll just add it to the realised equity pile, so when they make their next trade, that new trade will have a significantly higher % allocation compared to the rest – that’s why I suggest you stop copying and add it all together (so you have a similar % of the allocation to the stocks.)

Please note: The proportion can change when the Copied Trader changes their available balance. This can occur when the copied trader makes a deposit or withdrawal or closes an old trade that they opened before you started copying them (if you chose not to copy the already opened trades). When any of these events occur, you might get trades that have a different proportion than before.

Reopen manually closed trades

A relatively unknown feature when copying someone is that you can manually close trades within your copy. What’s even more unknown is that you can recopy all the open trades and those manually closed trades if you add funds in the future! As an example

- I copy JMilazzo with $1000, covering 10 positions at $100 each

- After a month I manually close 2 positions (Stock 1 and Stock 2)

- The next month, I decided to add another $2000 to the copy fund

Next Steps

Now you can either add funds without copying open positions OR copy open positions. This means the $2000 you’re about to add will be distributed across the 10 positions JMilazzo has open, including the 2 you manually closed.

- So the original $1,000 is across stocks 2-10

- The new $2,000 is now across stocks 1-10

- So now your eToro copy trader covers all of the copiers open trades!

Copy only certain trades

Similar to the reopening of manually closed trades, you can pick (to a certain degree) which trades you want to copy.

The main trick here is to copy the trades when that particular market (stocks, commodities, forex etc.) is closed. All of the markets close at some stage during the week, except for cryptocurrencies. So that could stuff your plans around a bit if you’re planning on copying someone with a lot of cryptos. The best is on the weekend as the majority of markets are closed.

Copy certain trades example

Here’s how you do it, and we’ll use my portfolio as an example – JMilazzo on eToro.

- Please find my portfolio on eToro (or any copytrader you want to copy).

- Look at their current holdings and determine what positions you want and what you don’t.

- Find a suitable time when the market is closed and copy the trader. Again, the weekend is the best in my opinion.

- Make sure you select ‘copy open trades’

- All the trades where the market is open will be executed; all the other trades will have ‘pending.’

- I said the timing is important as you the trades you don’t want to be ‘pending’ as the market can’t execute the trade yet.

- Now go to your portfolio and find the copy.

- Open the copy, and you’ll see a list of all the trades. Some will be executed (crypto), but most should have ‘pending’ against them.

- Open each of the ‘pending’ trades you don’t want and manually cancel the order.

- Repeat until you’re happy.

- The funds allocated to those trades you cancelled will be put back into the equity within your trade amount, waiting for the next purchase by the Copy Trader.

- At a high level, that means if you copy someone with $500 and you cancel $200 worth of orders, that money will be allocated to future trades and not used upon opening.

Using a Copy Stop Loss in your copy trades

Copy Stop Loss (CSL) is a feature that gives you the ability to manage your trades effectively by providing risk management in each “copy relationship” based on real-time Profit/Loss values. It is essentially an automated risk control system that allows you to set controls for the entire copy relationship at a dollar value. The CSL amount represents the copy equity that needs to be reached for the entire copy to automatically close, NOT the amount you are willing to lose.

Copy Stop Loss example:

Trader B copiers Trader A with $100 and a CSL set at $60 – meaning Trader B does not want the copy relationship to lose more than $40 before CSL triggers. Trader A has 2 positions: one that has gained $10, another that just dropped to -$50. At that point, CSL triggers and both positions – the losing position and the gaining position are closed, and the copy relationship with that trader is disconnected.

The default CSL is set at 60%* of your copy equity so that once you’ve lost 40% of your investment, the copy will close. You will be able to edit your CSL upon copying a trader and at any point thereafter; however, it is important to note that every time you edit your CSL, the new value will reflect as a percentage of your copy equity at the time of the edit and not the original allocated amount.

*The default CSL in a CopyPortfolio is set at 5% of your invested amount so that once the value has dropped below 95% of your investment, the CopyPortfolio will close.

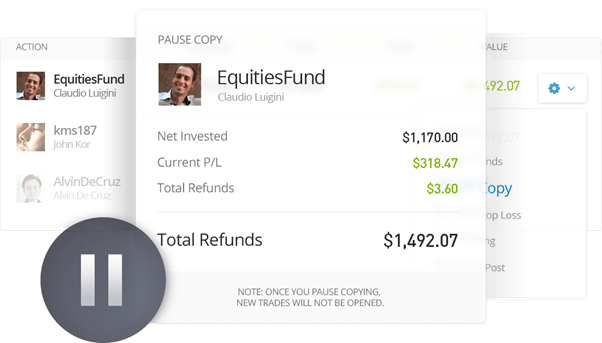

Pause Copy

When you pause a Copy Trader, no new trades will be executed. The current trades within your copyportfolio will still adhere to the TP and SL. So, essentially, you’ve paused any new trades and continuing with the original ones.

“Pause copy” can be activated from the portfolio page on eToro by clicking on the settings button and “Pause Copy.”

When “Pause copy” is activated, no new trades will be opened under that copy relationship. However, all the currently opened trades will still be copying the SL/TP and close actions from the Copied Trader.

eToro Copy Trader fees

It doesn’t cost money to use the eToro Copy Trader feature – although there is a caveat. So, if the trader you are copying uses leverage for their trades, the fees associated with that trade will come out of the equity you have with them and affect your profit/loss. For example, the trader you are copying has a profit of $100, but there are $7 in fees, then your profit is only $93. These are typically associated with leverage fees.

If they only use x1 leverage, as I do in my portfolio, then there is nothing to worry about.

There are no additional charges for copy trading. eToro is a social trading platform that allows you to copy other traders of your choice so that any trades they open will automatically open in your account with a proportional percentage of your allocated funds.

How does eToro make money?

eToro’s commission comes from the SELL/BUY spread of the trades you place, and the good news is that spreads remain the same regardless of whether you are copying someone or trading manually.

Better yet, if you’re a successful trader and want to gain a loyal following, you can join the excellent Popular Investor Program and get paid for being copied.

eToro Copy Trader filters

These are my filters I would choose if I was to copy someone:

- Time Period = Last 12 Months

- Status = Verified

- Country = Anywhere

- Name + Picture = Profile Picture

- Copiers = n/a

- Copiers change = n/a

- Copy AUM = n/a

- Return = > 10%

- Profitable Months = >50%

- Profitable trades = n/a

- Risk Score = 1-6

- Daily Drawdown = <5%

- Weekly drawdown = <10%

- Allocation = Crypto <25%

- Average Trade Size = <4%

I go into more detail here about why these should be the parameters for selecting someone to copy.

Responsible trading – what does it mean?

Responsible trading is in place to protect your portfolio and those who are copying you. Therefore, you are passively managing the funds of other people, and eToro wants to ensure that you will not go all-in on a high leverage trade.

All eToro users can see your daily, weekly and monthly risk score. Your risk score serves as an indicator of how much their portfolio is at risk by copying you.

Risk

The higher the risk, the less likely someone will copy you. So, if you start creeping above risk level 8, you could lose the privilege of being copied until you have it under control. If you’re a popular investor, then you need to be under 6.

It would help if you also watched your leveraged trades to ensure that you’re not going above the required limit. If you have open positions at the time of a Popular Investor application, you may be rejected.

Europe and UK

For retail clients of eToro (Europe) Ltd (CySEC regulated) and eToro (UK) Ltd (FCA regulated):

- x30 for major currency pairs (such as EUR/USD)

- x20 for non-major currency pairs (such as EUR/NZD), Gold and major indices

- x10 for commodities other than Gold and non-major equity indices

- x5 for CFD stocks and ETFs

- x2 for crypto crosses

- x1 for cryptocurrencies.

For Professional clients and clients of eToro Australia Capital Ltd (ASIC regulated):

- x50 for currency pairs

- x25 for commodities and indices

- x5 for CFD stocks and ETFs

- x2 for crypto crosses

- x1 for cryptocurrencies.

If you are a Popular Investor whose risk reached 7 that month or have open positions exceeding the leverages above, eToro will warn you. If your scenario doesn’t change, you will not receive your payment that month or be blocked from being copied.

How does eToro choose the top-ranked traders?

eToro sets various filters to find out who the top-ranked traders are for a determined timeframe. They are primarily based on total gain or winning ratio (i.e. 80% for 12 months or 95% winning trade ratio).

Some of the filters include, but are not limited to, the following and may differ for the various periods selected:

- Minimum number of positions opened or closed over a specific period

- The minimal winning ratio for a specific period

- Number of days/weeks in which the investor was active (had at least one open position)

- Minimal average position duration

- The maximum ratio of high leveraged trades

- Maximum leverage amount placed in a single trade

- Minimal total investment for the period

My eToro copy trader has invested in cryptocurrencies, what type of position do I have?

When you copy someone or a copyportfolio, you’ll have the same position if they have a cryptocurrency position. Whether it is a CFD or a real asset depends on where you are located. Primarily for Chinese residents and those who fall under the Australian regulation, the actual trades will be CFDs. Recent changes to ASIC means that Australian traders are now purchasing actually crypto.

Why are my trades not the same as the trader?

You copy someone only to notice that not all their trades have been copied. What happened? Why can’t I copy all of the trader’s positions? Well, there are a few things to remember. You may not have selected “Copy Open Trades” when copying them. This means every tradeable trade the Copy Trader has in their portfolio will be executed at the market open (if the market is closed).

1. To copy all the trader’s currently opened positions. This is the default option.

Each position will open in a proportional amount. As an example: If the copied trader has a trade using 10% of his realised equity, a trade will be opened for you, using 10% of the amount you allocated for copying that trader.

2. Deselect ‘Copy open trades’ – This means you’ll only open new trades from that point forward.

Remember that the minimum proportional amount for a copied position to open is $2. Trades below that amount will not open for you.

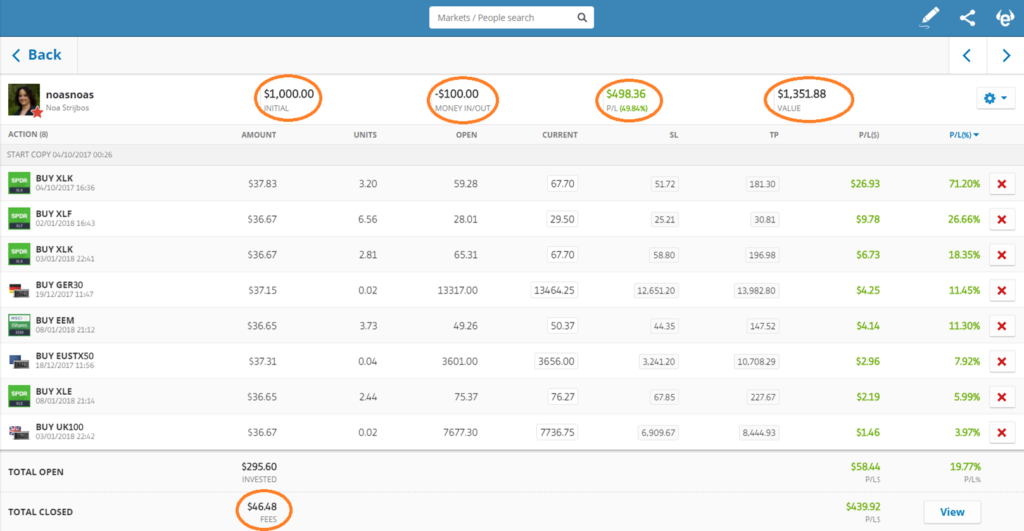

What is the value of my copy?

When copying a trader, you will see the current value of the copy in your portfolio. This figure shows the exact amount of money you would get back in your account balance if you were to stop copying the trader. It considers the initial invested amount, funds added to/removed from the copy, profits/losses, and any fees or dividends credited/debited on the copied positions.

The value of your copy balance is calculated as follows: INITIAL + MONEY IN/OUT + P/L – FEES = VALUE

In the example below: $1,000.00 initial investment – $100.00 money out + $498.36 profits – $46.48 fees = $1,351.88 value

What are Copy Dividends?

If the trader you are copying withdraws funds, the proportional amount will be removed from your copy allocation and sent back to your account balance. This amount is called the Copy Dividend. Copy Dividends mean that you get to enjoy the profits of the traders you are copying while you are copying them (not only once the copy relationship has ended). But it does rely on the trader withdrawing money out of their account.

For example, Trader X has $10,000 in his account. You allocate $1,000 to this trader, and after a few weeks, he makes a profit of $2,000. If Trader X decides to withdraw the profit, the proportional amount for you – $200 – will be removed from your copy allocation and sent back to your account balance so that you too can enjoy the profits without having to wait for the copy to close. Additionally, if the trader you are copying adds funds to his or her account, you will receive a notification so that you can decide whether you wish to add more funds to the copy allocation.

Do I get dividends from my etoro copy trading?

Yes – if you’re copying a trader and that trader receives a dividend for one of their positions, you will get it as well. It will be funded to the unallocated portion of your copy trade. This means that if you are copying with $1,000, with $950 allocated, if you received $5 in dividends, you would have a copy total of $1,005 but $950 still allocated.

It is worth noting that if you are copying with a small amount ($200), your dividend payments may be small (i.e. 2c) depending on what % allocated to the dividend-paying stock makes up the portfolio.

Can I get my traders’ details?

Due to privacy regulations, eToro does not permit to disclose of such information. You may be able to find the trader on social media, or you can ask them. I’m more than happy to answer any questions people might have. You can find me on Twitter, Instagram or write on my eToro wall.

Why can’t I copy other traders?

Copy Trading Services will be provided following an assessment of the information you provided in the “complete your profile” questionnaire due to regulatory requirements. That means that if your objectives or financial situation do not match the risk, you are taking in the Copy Trading Services, eToro may choose to prevent your account from opening new Copy positions. However, this will not affect open positions.

If your objectives or financial situation have changed, we encourage you to update your profile.

Why is the eToro Copy Trader blocked from being copied?

The majority of the time, it is because they have broken one of the rules of being a Popular Investor. The most common reason is that the trader has reached a risk level of 7 (or above) or violated another rule (scalping, for example). The trader should provide an update on their page as to why traders can no longer copy them. In the background, eToro works with the trader to bring them back to copying status again.

That’s it for now – I’ll continue to update this page as I tweak my copy trader reviews and add some tips and tricks I learn along the way.

Good luck in your trading and if there are any hints you’d like me to look at, let me know!

Cheers

[…] (Virtual Account) first to get a feel for how the platform is used. Use my formula to find the best copiers to trade and keep up to date with my monthly reviews to see what stocks I’ve added to my portfolio and […]

Thank you for every other informative website. The place else may just I am getting that type of info written in such an ideal method? I have a undertaking that I’m simply now working on, and I’ve been at the glance out for such info.

Great post. I am facing a couple of these problems.

Thank you for that detailed post. I have a question regarding the profits. Will the copy trader reinvest my portion of the when he opens new postions?

Yes – when the copytrader takes profits, it will go back into their available equity. THe copy amount you have on the trader also replicates their available equity, so their next trade would reinvest the same ratio as you have invested (i.e. if they buy a trade with 2% of their equity, it will be 2% of your invested amount)

You have no idea how long I’ve been googling for this answer. Thank you, Joe.

Glad I could help 🙂

Hi, appreciate this post!

Just one question about the trader depositing money.

Suppose a trader’s total equity is $10000 and I copy him for $1000.

Then the trader deposit another $5000 to his account. and I also add funds of $500. (with copy open trades)

Does it mean that my $500 will copy all of his $15000 but my original $1000 would loss the track of his new $5000, i.e. only 2/3 of his all positions would be copied?

If yes, shall I just stop and re-copy?

Thanks very much!

Hey – Yep, you are spot on with your thinking (although it does depend if they have open trades or not when they add money). I’m answering based on 100% allocated funds in a portfolio. If you add the 500 and copy open trades, that will copy all of his portfolio. If you add 500 and don’t copy all trades, that 500 will go to the unallocated portion of the copy and just be added towards new trades. So if the copytrader makes a trade between the time they add money and you add money, that trade won’t be reflected in your copy. As an example, they add money 1st July, make a trade 2nd July, you add money 3rd July – the trade on the 2nd won’t show. The original 1k should replicate their original 10k, so it wouldn’t come across as a true ratio. If you want to copy all of their trades for the correct ratio, i would stop copy, then recopy with the original amount + the new amount (so 1000 + 500 = 1500) to get the best ratio.

Really good articulate article. I have been running a virtual copy and am considering doing for real just unsure as to whether to copy Open Trades or not. The trader is trading about 10 times/week so am considering copying for only new trades as the market is so volatile. What are your thoughts on 10 trades/week vs copying Open Trades?

Do they have many trades open at the moment? It sounds like they open/close them quite frequently. If it was me, I wouldn’t copy open trades and just get in on future trades.

Also note that virtual can be buggy with opening copied trades – just double check the trade frequency on the copiers stats page

30 Open Trades at the moment and I think you may be right about not copying!

How do I copy open trades when i already started copied someone?

Hey Rasmus, I assume you copied with ‘copying open trades’? What you can do, is withdraw unallocated funds from the copytrade, then ‘add funds’ back to the copier, clicking on ‘copy open trades’. So as an example, you copied trader x with $1000 but didn’t copy open trades, the $1000 would be allocated to all future trades and sit there unallocated until the next trade(s). If the trader has only opened a few trades in the interim (say $100 worth of trades) there would be $900 unallocated. You can remove these funds from the copytrade (they will go back into your account as available funds), then go back to the trader and select ‘add funds’ When you do that, add the $900 and click ‘copy open trades’. it may throw off your % ratios slightly but over time they will start to reflect the traders allocations more closely.

Hi Joe, I have a question related to your answer. For example if a trader has $10,000 total. And he already invested $5000. Left available is $5000.

Then I came into the picture, copying the trader without “copy open trades” with $10,000.

Next, if the trader spend $1000 for his next trade, which is

which percentage will be taken out from my investment for the same trade?

Thank you very much for your clarification! Much appreciated

So think of it like % like for like. If you don’t copy open trades, you’ll have 100% unallocated until they make a new trade. If they open a new trade that is 10% of their equity, you’ll match that with your copy funds. So doesn’t matter the % of the unallocated amount, it’s the % allocation of their total amount that you match

Oh no, then that is bad. So if I understand you correctly, for the situation I described above, the amount that will be traded in my account is $1000, right? Because $1000 is 10% of the total equity of the copied trader.

Why I said that is bad, imagine this, the trader has $10,000 of equity. But $9000 already invested in long term which he will not sell in near future. Only left that he could invest is $1000.

Then I joined, copied him without “copy open trades” with $50,000 of my own money. So the trader then spent the last $1000 he has to trade. He now has no money balance left to trade, and will wait months for high green. But for me, out of my $50,000, only $5000 (10%) is invested, the rest of my money ($45,000) just sits there in idle, correct?

And there is no way I could know that the trader has already invested all of his money, I might assume he is waiting for the right time to buy more when the time is right, when in fact, he already invested all his money. While my $45,000 sits in idle generating zero income.

Unfortunately yes. If the trader is a long term buy hold trader, it would take awhile for your copy to sync theirs. You can look at 2 factors, how many they have unallocated and how often they trade. Unallocated amount shows up in the bottom right hand side when you go into their portfolio and scroll all the way down. Number of trades is in the statistics part of their profile. If they have a low unallocated % and a low trade frequency, then yes, copying open trades might be better. Have you thought amount using the remove copy funds option, then adding those funds back to the copy, selecting copy open trades? That way your removing the 90% and reinvesting it but you can copy open trades this time

Thanks for clarifying Joe. And thanks for the recommendation of pulling out 90% of the stock, I didn’t know that we can check the %unallocated of the copied trader, awesome input again! Thank you!

I can see my current copied trader has only 0.48% unallocated left, but i still have half of my money sitting in idle copying him. I guess I’ll be pulling that out soon to invest somewhere else, most probably to copy other traders.

Thank you for your time and so grateful to have someone to guide me with all this questions I had. I wish you all the best in your investment!

My pleasure, hope my answers made sense! Good luck with your trading and hope the copytrade works out for you

What advise can you give to someone who is just willing to trade $200 to start? Is it better to copy trades or focus on 1 stock?

It can depend on your situation. If you’re not experienced in researching and trading, then copying someone or trading an ETF might be better. You’ll get better exposure using these two as you can hold multiple smaller positions, rather than picking a stock. On the other hand if you love a stock and are satisfied with their numbers, you could buy that instead.

Hi Joe, thanks for your article. I have been looking for this all over in google.

I have one question though, hope you could help to kindly clarify.

Let’s say I already copied a trader without “copy open trades”. After a few days, I see the copied trader already made 30+ trades, all currently active. I then clicked on Stop Copying. After like 5 mins, I changed my mind and started to copy the trader again without “copy open trades”. Lets say the trader DID NOT make any changes to his trades in those 5 minutes I stopped copying him, when I copied him back, will the system continue to sync with all 30+ trades that I copied him before. Meaning if the trader for example close 5 trades out of the 30+ after I copied him for the 2nd time, will that action sync with my trades? Or it will not sync since I already stop copying him for 5 minutes, so my account is already detached from his, and all I can do now is manually monitor & close all the 30+ trades that’s currently active?

Appreciate your clarification. Thank you!

Hey Ezwan,

Thanks for the question and it’s a good one! As soon as you press “stop copy” you detach from that trader. Some trades may remain “pending close” until the next market day resumes if markets are closed. So, unfortunately, etoro isn’t intelligent to recognise you’ve previously copied a trader. So when you copy someone again, it’s a brand new copy. I think you should have a look into the “pause copy” feature. It essentially pauses your copy, so no new trades are executed until you unpause but you’ll still have the same trades as the trader when you paused. Hope I’ve answered your question!

Thank you for the answer Joe, and very fast respond as well, much appreciated!

I am very clear now that “stop copying” will totally detached myself from the trader. But I am not sure on the statement

“Some trades may remain “pending close”

From what I understand, I just stopped copying the trader, and I do not want close any trades. Wouldn’t all 30+ trades stays open as it is until I manually close it?

You mean when I stop copying a trader, all the 30+ trades will be closed (sold) as well? No, right?

Hi Ezwan, when you select stop copy, it will close all open trades in your copy. It will show up as pending close if the related market is not open. For example, if one of the trades was tsla, as the US market is closed, it’ll have to wait until Monday to close the trade when market hours resume. So yes, when you stop copying, all trades will be closed.

Wow, this is a very important point, I didn’t know that. I thought it’s only function is to detach from copied trader. So if most trades are currently in red, I better not stop copying then… got it. Thank you!

Yes! Traders can have a bad day/week/month but if you close the trade you can miss out on the upcoming gains! It is up to you, if you feel they aren’t performing then sometimes it is better to cut your losses

Hi Joe,

Really good article this one, but I’m still struggling to decide, copy existing trades versus joining in as they take new positions.

I’ve just brought some funds over to Etoro to copy some traders- probably 4-5 of them. At the moment though the money is sitting uninvested in etoro, and has been for a fortnight while I decide how to play it, which is very frustrating and I feel I need to allocate it soon so I don’t miss out as economies start reopening etc.

My concerns are some of the people I’m thinking of copying have stuff like GME positions that are heavily in profit (for them!) because they bought in when it was back at $10 or similar. Say it drops from the $50ish dollars it is today down to $25ish and they close the position as they believe the GaME is over. I lose out horribly.

Similarly they might have ridden recent crypro gains, and if it falls back a bit might sell out leaving me at a loss.

Does this potential downside effect mean I’m better off finding someone with a higher frequency of trades to copy- even a day trader, and join in as they invest?

Hey Jake, thanks for commenting. One thing that you may not have thought of is only copying certain trades initially with someone. So it’s not well known but if you copy someone outside of market hours for their trades, they won’t execute until market open. This way you can manually cancel that trade order. That means, using your GME example, you can copy that trader (selecting copy open trades) and then manually cancel the GME order so it won’t be replicated in your copy, this saving you the pain of losses of it drops. You can also manually close it post open if you wish, you don’t have to wait until the trader closes it!

One key thing I consider with someone copying another whether to copy open trades or not is if the trader frequently trades or if they are a long term buy and hold. If they frequently trade, say 20+ trades per week, I’ll plan towards not copying open trades. If they buy and hold, perhaps copying open trades is more suitable.

Hope that provides some help!

Hello!

I’m very new to Etoro and investing, and I wanted to ask what difference it makes to invest in copytraders at different times of the day. I invested 500 into someone through my virtual account and the profit was -0.5$. But I invested on the same person at night and my profit was -5$. I’m sorry if this a fairly dumb question but I’m very confused about how to choose the right time to copytrade.

Thanks!

Hey Ady – apologies for the late reply on this. There will be a difference when copying because it will depend on if the market is open at that time or not. On a side note – virtual is not without its faults, it can be buggy from time to time so not all trades open. I would recommend looking at what stocks the trader has in their portfolio and looking at whether the market is open or not. If it isn’t open and you copy all trades for the trader, they will execute as the first possibility when the market opens. So the price could significantly change there. Does my response make sense?

Good article. Question: I copied a trader (ticked copy-open-trade) and for example I funded it by 100 USD. I gained 20 USD which makes my total equity 120 USD.

Should I withdraw my 20 USD gain and recopy using that same 20 USD and tick copy-open-trade ? Or should I withdraw all 120 USD and reinvest/recopy that all 120 USD with ticked copy-open-trades?

Sorry I am confused on how my funds are compounded. Or if being compounded at all.

Your funds are already being compounded when you’re copying, so there’s no need to withdraw and recopy!

Thanks for reply.

Should I let it there or should I untick “copy open trades”?

Hey Joseph, great post keep it up!

I have a question about the CSL and It would be great if you could help me. Do you think it’s better if I keep the default CSL as it is (60%) when I copy other traders ?

It does depend on the trader and their stats. Go to their stats page and take a look at their draw down figures. Then take a look at their history to see if they’ve had any significant drops. 60% should be enough to cover nearly every drop in history! If they have a lower than 4 risk, it should be ok – use your gut feeling. Good luck!

Hi. I just copied a guy since the 1st of may. I am up about 3% with my copy and he is up 29%. I know there’s a difference in spreads and fees, but this seem a bit wild? Do you have any idea what is wrong? thanks

Hi, it could be a couple of things. With a variance that large it sounds like you didn’t copy open trades or the copy amount wasn’t enough to copy the smaller trades